GBP/USD Forecast: A decisive recovery seems unlikely

- GBP/USD has staged a modest rebound early Monday.

- Brexit-related political jitters are likely to limit the pound's upside.

- US markets will be closed in observance of Independence Day holiday.

GBP/USD has managed to reclaim 1.2100 early Monday after having declined to its lowest level since mid-June below 1.2000. Despite the recent rebound, the technical outlook doesn't yet point to a buildup of bullish momentum and Brexit-related political jitters could make it difficult for the British pound to find demand.

Over the weekend, foreign ministers of Germany and Ireland said in a joint statement that the UK was breaking an international agreement. Ministers noted that there was no legal or political justification for the UK to unilaterally change the terms of the Northern Ireland Protocol and argued that the British government chose not to act in good faith.

Meanwhile, the US Dollar Index, which tracks the dollar's performance against its major rivals, consolidates last week's gains in a tight range above 105.00 on Monday.

The disappointing ISM Manufacturing PMI data from the US triggered a sharp decline in the US Treasury bond yields, suggesting that markets are reevaluating the Fed's policy outlook. Although the CME Group FedWatch Tool shows that markets are pricing a more-than-80% probability of a 75 bps hike in July, growing signs of a slowdown in the US could cause participants to refrain from betting on future policy actions.

Nevertheless, the British pound could have a hard time capitalizing on the lack of dollar strength amid political jitters and the risk-averse market mood. Stock and bond markets in the US will be closed in observance of the Independence Day holiday and the pair is likely to extend its sideways grind ahead of the key events and data releases later in the week.

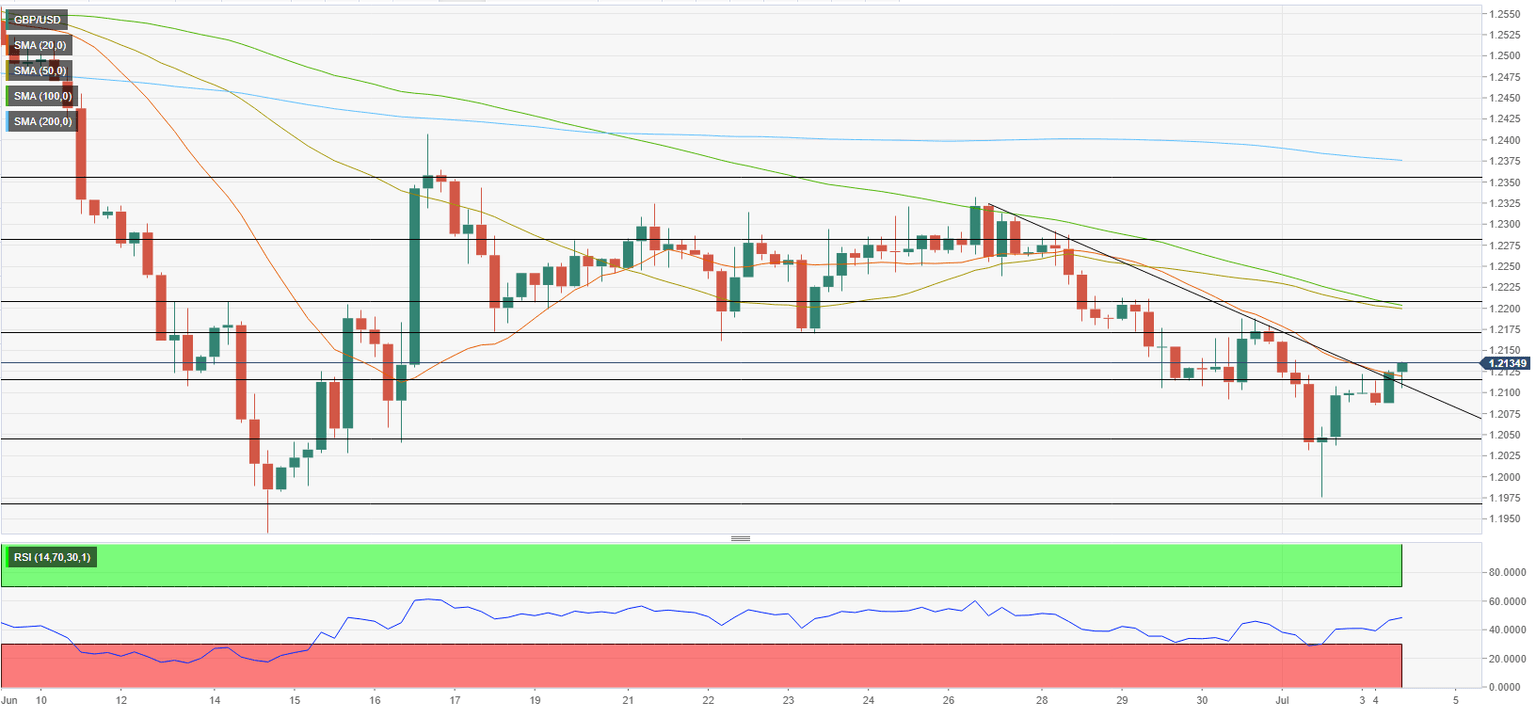

GBP/USD Technical Analysis

1.2120 (Fibonacci 23.6% retracement of the latest downtrend) aligns as immediate support for GBP/USD. With a four-hour close above that level, the pair could rebound toward 1.2170 (static level) and 1.2200 (Fibonacci 38.2% retracement, 50-period SMA, 100-period SMA).

On the downside, 1.2100 (psychological level) could be seen as the next support before 1.2050 (static level) and 1.2000 (psychological level).

In the meantime, the Relative Strength Index (RSI) indicator on the four-hour chart stays below 50, suggesting that buyers remain on the sidelines for the time being.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.