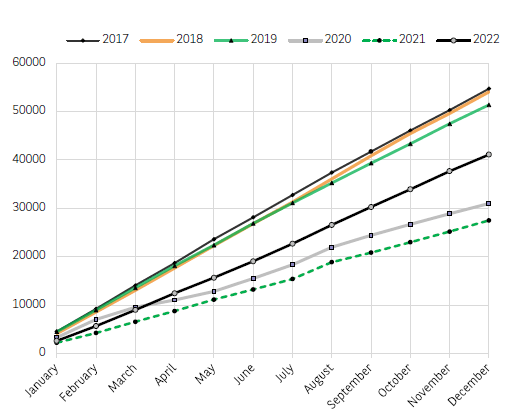

France: Business insolvencies remain below pre-COVID-19 levels

In France, business insolvencies reached 41,020 units in 2022, according to the provisional estimate of the Banque de France. Over the year as a whole, they were up sharply compared to 2021 (+49%) but remained 20% below their 2019 level. However, these figures for the year as a whole conceal two distinct periods: the first half of 2022 which featured a sharp 30% drop compared to the first half of 2019 and the second half of 2022 where the drop in insolvencies was less significant (-10% compared to three years previously). This shift can be explained by the withdrawal of “whatever it costs” subsidies, as well as a deterioration in cash flow mainly attributable to the rise in the cost of energy.

However, the relative stability of payment behaviour – with, for example, the very limited increase in late payments according to the economic survey by INSEE (French National Institute of Statistics and Economic Studies) in the building sector – suggests that defaults could once again remain below their 2019 level in 2023, yet come close.

However, some dynamics already seem to have deteriorated as much, if not more so, than in 2019. All sectors combined, insolvencies affected 29 large companies and medium-sized businesses in 2022 compared with 26 in 2019. The industry already accumulated as many defaults in the second half of 2022 as in the second half of 2019. In addition, although micro-enterprise defaults (and those of unspecified size) were, in 2022, almost 22% lower than in 2019, this factor should be put into perspective, since company write-offs reached almost 365,000 units in 2022 (+31.7% compared to 2019), of which almost a third were in retail trade and transport.

France: Business insolvencies (cumulative number)

Source: Banque de France, BNP Paribas

Author

BNP Paribas Team

BNP Paribas

BNP Paribas Economic Research Department is a worldwide function, part of Corporate and Investment Banking, at the service of both the Bank and its customers.