Fertilizer markets tighten as energy costs lift 2026 food inflation

Global commodity markets are sending an increasingly clear signal from an unexpected corner. While attention remains focused on oil, gas and precious metals, fertilizer markets are beginning to tighten again, driven not by speculation but by rising energy costs and renewed geopolitical friction. The implications stretch well beyond agriculture and into the heart of the 2026 inflation outlook.

Fertilizers sit at the foundation of the global food system. Nitrogen based products such as ammonia and urea are directly linked to natural gas prices, while potash and phosphates depend on concentrated and geopolitically sensitive supply chains. When energy prices rise or logistics become constrained, fertilizer costs respond with a delay, but the impact on food production is structural rather than temporary.

This dynamic is re emerging as natural gas volatility returns and geopolitical uncertainty reshapes energy flows across Europe and global LNG markets.

Energy costs return to the center of fertilizer pricing

Natural gas is not just a heating or power generation fuel. It is the primary input for nitrogen fertilizer production. Ammonia synthesis depends directly on gas availability and pricing, making fertilizer markets extremely sensitive to changes in energy costs.

As gas prices stabilized through much of autumn, fertilizer markets remained relatively calm. However, the recent resurgence of volatility in European and global gas benchmarks is altering that balance. Even without a supply shock, higher and more unstable gas prices raise marginal production costs and reduce flexibility for fertilizer producers.

This matters because fertilizer manufacturing does not respond instantly. Production decisions are made months ahead of planting seasons. When energy costs rise late in the cycle, producers often pass the burden downstream rather than absorb it, tightening availability precisely when agricultural demand is preparing to accelerate.

Geopolitics keeps fertilizer supply fragile

Beyond energy inputs, fertilizer markets remain exposed to geopolitical risk. Russia and Belarus are key exporters of potash and nitrogen based fertilizers. While trade flows have adjusted since 2022, the system remains fragile and highly dependent on political stability, payment mechanisms and shipping access.

Renewed tension in energy markets inevitably revives concerns about fertilizer logistics. Even minor disruptions in export routes or financing channels can reduce spot availability and increase price volatility. Unlike grains or oil, fertilizers cannot be easily substituted in the short term without compromising yields.

This fragility explains why fertilizer prices tend to move in phases rather than continuous trends. Long periods of calm are punctuated by sudden repricing events driven by cost pressure rather than demand surges.

Agricultural producers face difficult trade offs

Rising fertilizer costs force farmers into difficult decisions. In some regions, application rates are reduced to control expenses. In others, higher costs are absorbed through tighter margins. Both outcomes carry macro implications.

Lower application rates often translate into reduced yields with a lag, while higher costs passed along the chain raise food prices further downstream. These effects rarely appear immediately in headline inflation data, but they accumulate over time, shaping medium term food inflation dynamics.

This is why fertilizer markets function as a leading indicator rather than a coincident signal. By the time food prices reflect tighter fertilizer availability, the adjustment process is already well advanced.

EcoModities perspective highlights early warning signals

In the EcoModities perspective, Coffee and Cocoa sit at the intersection of climate volatility, land productivity and global trade flows. They offer some of the earliest signals of how weather anomalies translate into price instability, long before the broader CPI indexes capture the shift. This makes soft commodities essential forward looking indicators for 2026 inflation risks.

The same framework applies upstream to fertilizer inputs. Fertilizers act as amplifiers of climate and energy stress. Weather shocks raise demand for yield protection, while higher energy costs constrain supply. Together, these forces quietly rebuild inflation pressure long before it becomes visible in consumer prices.

Natural Gas chart reflects the cost transmission channel

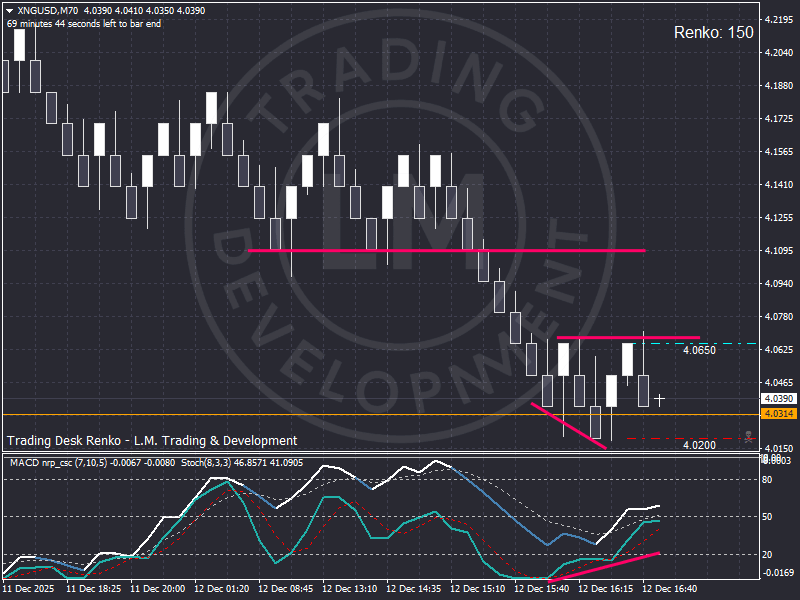

The Renko structure of XNGUSD provides a clean visual representation of this process. The chart shows a well defined bearish sequence followed by stabilization near the 4.02 to 4.04 zone. This area has acted as a technical base, with repeated reactions indicating the presence of responsive demand.

Momentum indicators reinforce the picture. While price has not yet staged a decisive reversal, the oscillator shows improving structure from deeply oversold conditions. This type of divergence suggests that downside pressure is losing intensity, even as volatility remains elevated.

For fertilizer markets, this matters regardless of short term direction. What matters is not a sustained rally, but the return of instability. Volatile gas prices complicate production planning and raise risk premia across the fertilizer complex.

The resistance zone near 4.09 to 4.10 marks the first threshold where renewed upside pressure would signal cost transmission becoming more aggressive. A break above that area would likely translate into higher fertilizer input costs heading into the next agricultural cycle.

Why 2026 inflation risks are being rebuilt quietly

Food inflation rarely erupts suddenly without warning. It is built through layers of cost accumulation, beginning with energy, moving through fertilizers, and finally appearing in agricultural output and consumer prices.

What makes the current phase notable is its subtlety. There is no panic, no visible shortage, and no speculative frenzy. Instead, there is a gradual tightening of input markets under the surface, driven by energy volatility, geopolitical uncertainty and climate variability.

This is precisely the environment where inflation risks are underestimated. Policymakers focus on headline energy prices and core inflation metrics, while cost pressures accumulate upstream. By the time food inflation re accelerates, the structural drivers are already entrenched.

Market implications extend beyond agriculture

The implications of tightening fertilizer markets extend well beyond farming. Food price stability plays a critical role in inflation expectations, especially in emerging markets where food carries a higher CPI weight. Persistent food inflation complicates monetary policy, limits rate cut flexibility and increases social and political pressure.

For investors, fertilizer dynamics also influence positioning across soft commodities, agricultural equities and even sovereign risk in food import dependent economies. These connections reinforce the importance of monitoring input markets rather than reacting only to finished goods prices.

Outlook remains balanced but vulnerable

The current setup does not point to an immediate fertilizer crisis. Supply remains available, and production capacity has expanded since the energy shocks of recent years. However, the margin for error is narrow.

If energy volatility persists or geopolitical tensions intensify, fertilizer markets will tighten further. If weather anomalies increase demand for yield protection, pressure will build quickly. Conversely, a return to stable energy pricing would ease input costs and delay inflationary transmission.

For now, the system remains balanced but vulnerable. That vulnerability is the key signal for 2026.

Conclusion

Fertilizer markets are quietly returning to relevance as energy costs and geopolitics reshape the inflation landscape. Natural gas volatility is once again influencing the cost structure of agricultural inputs, rebuilding pressure that will be felt months rather than weeks ahead.

The Renko structure of XNGUSD captures this dynamic with clarity. It shows not a crisis, but the return of instability. In commodity markets, instability is often the precursor to structural change.

For those looking beyond headlines, fertilizers offer one of the clearest windows into the next phase of food inflation risk. The signals are early, subtle and easy to miss. But history shows that ignoring input markets is rarely cost free.

Author

Luca Mattei

LM Trading & Development

Luca Mattei is a market analyst focusing on FX, metals, and macroeconomic trends. He develops trading tools for retail and professional traders, coding indicators and EAs for MT4/MT5 and strategies in Pine Script for TradingView.