Euro edges higher, ECB eyes June cut

Euro recovers after dip

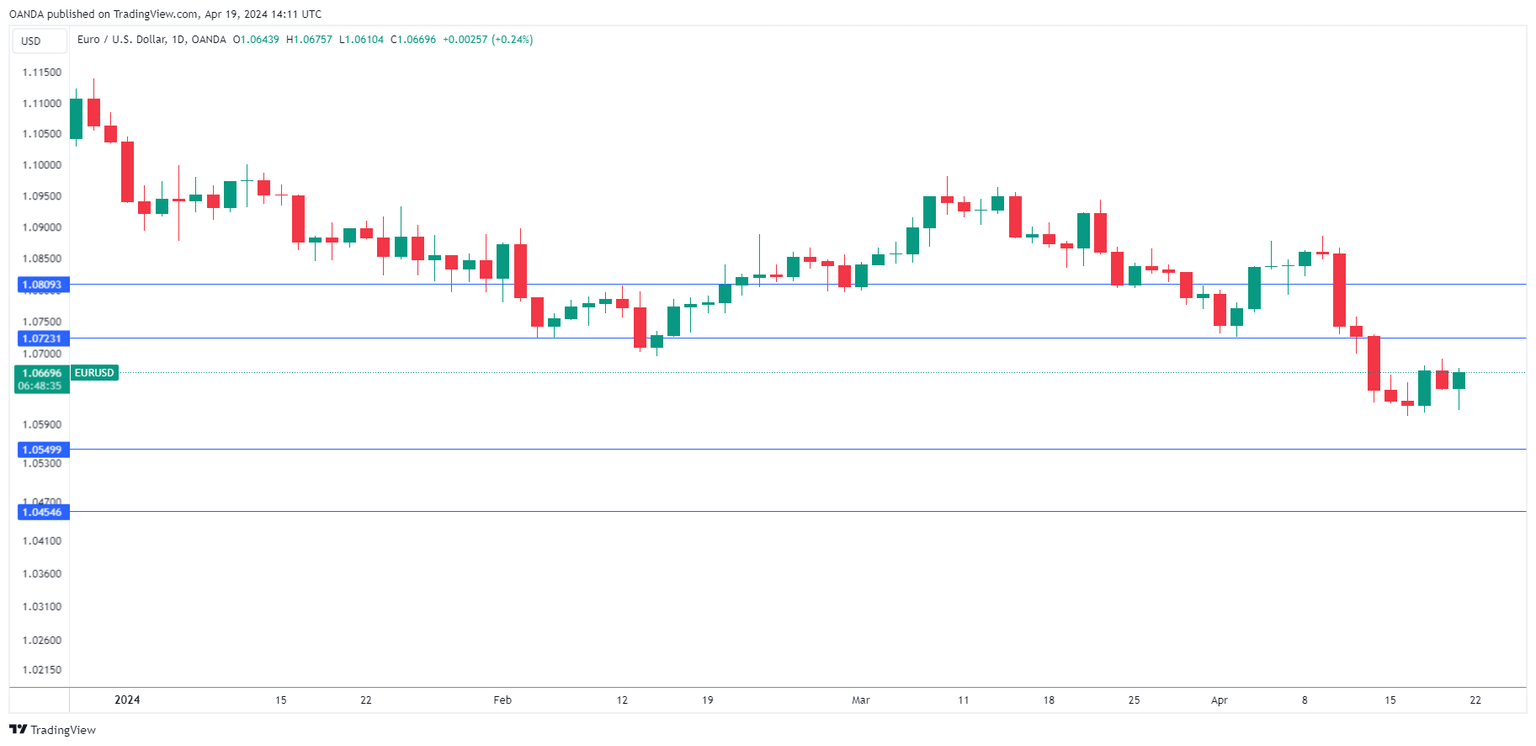

The euro fell as much as 0.30% earlier but has recovered and edged higher. In the North American session, EUR/USD is trading at 1.0666, up 0.21%. The euro remains under pressure from the strong US dollar. Last week, EUR/USD fell 1.8% and dropped as low as 1.0601 this week, its lowest level since early November.

The data cupboard is bare today, with no US releases and only one event in the eurozone. German PPI dropped 2.9% y/y in March, marking a ninth straight month of producer deflation.

ECB poised to lower rates in June

With consumer inflation falling in the eurozone, European Central Bank policy makers have been signaling that a rate cut could be coming in June. The ECB doubled down on that message on Thursday. ECB Vice President Luis de Guindos and Governing Council member Francois Villeroy stated clearly that the central bank was poised to cut rates at the June meeting.

What is less certain is whether the ECB will lower rates in July as well. The markets have priced in cuts in June, September and December. The ECB has kept the deposit rate unchanged at 4.5% for five consecutive times, including at last week’s meeting. The rate statement said that a rate cut would be “appropriate” provided that the ECB remained confident that inflation was falling back to the 2% target.

The ECB has been cautious about committing to a rate cut, concerned that lowering rates too soon might allow inflation to rebound and force the central bank to zig-zag and raise rates. Inflation has been moving lower, although there are new worries that the fighting between Israel and Iran could cause a jump in oil prices which would lead to higher inflation.

EUR/USD technical

Taking a look at the weekly support and resistance lines, EUR/USD remained rangebound this week:

-

There is resistance at 1.0716 and 1.0810

-

1.0548 and 1.0454 are providing support.

Author

Kenny Fisher

MarketPulse

A highly experienced financial market analyst with a focus on fundamental analysis, Kenneth Fisher’s daily commentary covers a broad range of markets including forex, equities and commodities.