EUR/USD outlook: Key data ahead as 1.1600 support snaps — Is 1.1400 next?

The euro has slipped decisively below the 1.1600 handle, a level that’s acted as a crucial technical pivot for months. The move follows a week of broad dollar resilience and renewed repricing in Fed rate expectations — and it comes just days before a heavy run of U.S. economic data that could dictate the next major swing.

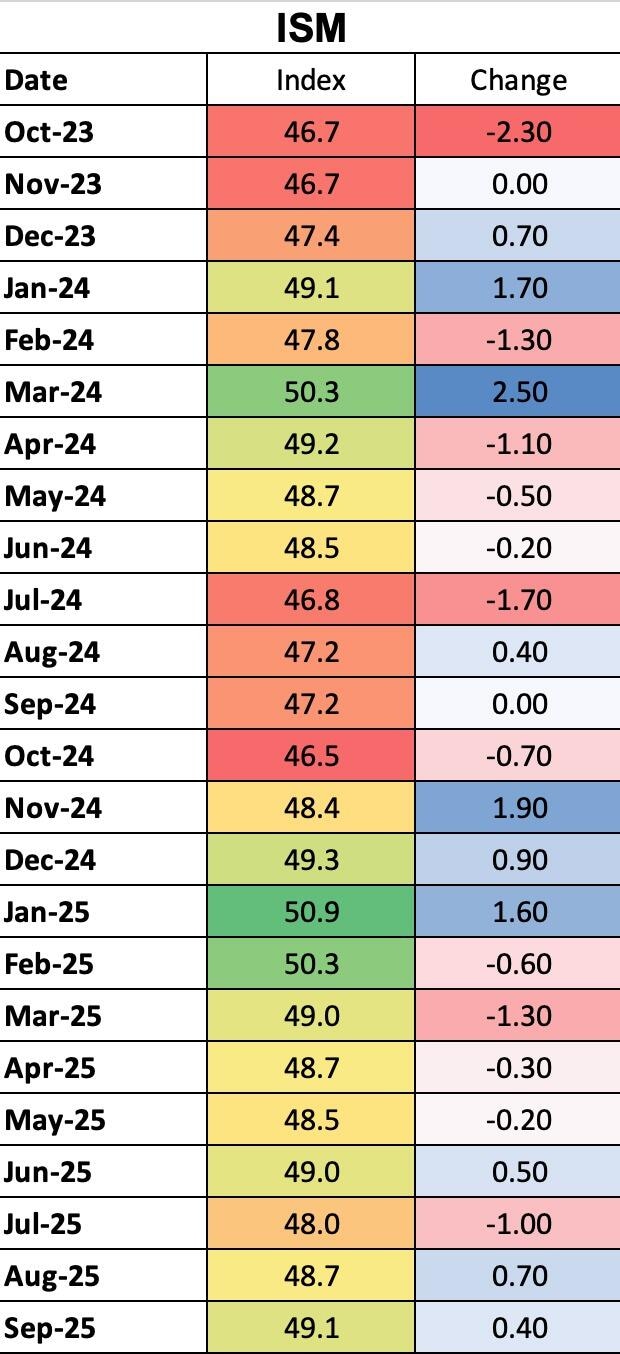

The macro setup: All eyes on ISM and Michigan sentiment

Next week’s U.S. calendar is packed with data that could reshape near-term dollar sentiment:

- Monday, Nov 3: ISM Manufacturing PMI (Oct) — expected near 49.0, signaling continued contraction.

- Wednesday, Nov 5: ISM Services PMI — seen improving slightly to 51.0 from 50.0.

- Friday, Nov 7: University of Michigan Consumer Sentiment (prelim, Nov) — forecast to tick up toward 54–56 from 53.6.

These reports are key because markets have recently scaled back expectations of early 2026 Fed rate cuts. Strong U.S. data would reinforce that view and push the dollar higher, while any signs of cooling activity could offer the euro a temporary reprieve.

Technical breakdown: Bears in control below 1.1600

From a chart perspective, EUR/USD has broken beneath 1.1600, confirming a downside continuation within a short-term descending channel. Price action shows a sequence of lower highs and lower lows, reinforcing a bearish structure.

The pair briefly consolidated near the 1.1600 zone, but sellers regained control as dollar demand strengthened. If this level now acts as resistance, the next major downside target emerges at 1.1450–1.1400, an area of historical demand visible on the weekly timeframe.

That zone could attract buyers, but unless macro fundamentals shift, momentum favours the bears.

What to watch inside the data

- In the ISM Manufacturing, keep an eye on New Orders and Prices Paid — any surge here would signal sticky inflation.

- In the ISM Services, Employment and Business Activity will show whether domestic demand remains firm.

- The Michigan survey’s inflation expectations could easily swing Fed rhetoric — and the USD — for the rest of November.

Outlook summary

EUR/USD sits at a critical juncture just as the data calendar heats up.

If the U.S. economy continues to show resilience, the recent break below 1.1600 may evolve into a broader downtrend, with 1.1400 the next logical destination.

Only a dovish shift from the Fed or clear evidence of U.S. slowdown would be enough to turn this tide — for now, the path of least resistance remains lower.

Author

Zorrays Junaid

Alchemy Markets

Zorrays Junaid has extensive combined experience in the financial markets as a portfolio manager and trading coach. More recently, he is an Analyst with Alchemy Markets, and has contributed to DailyFX and Elliott Wave Forecast in the past.