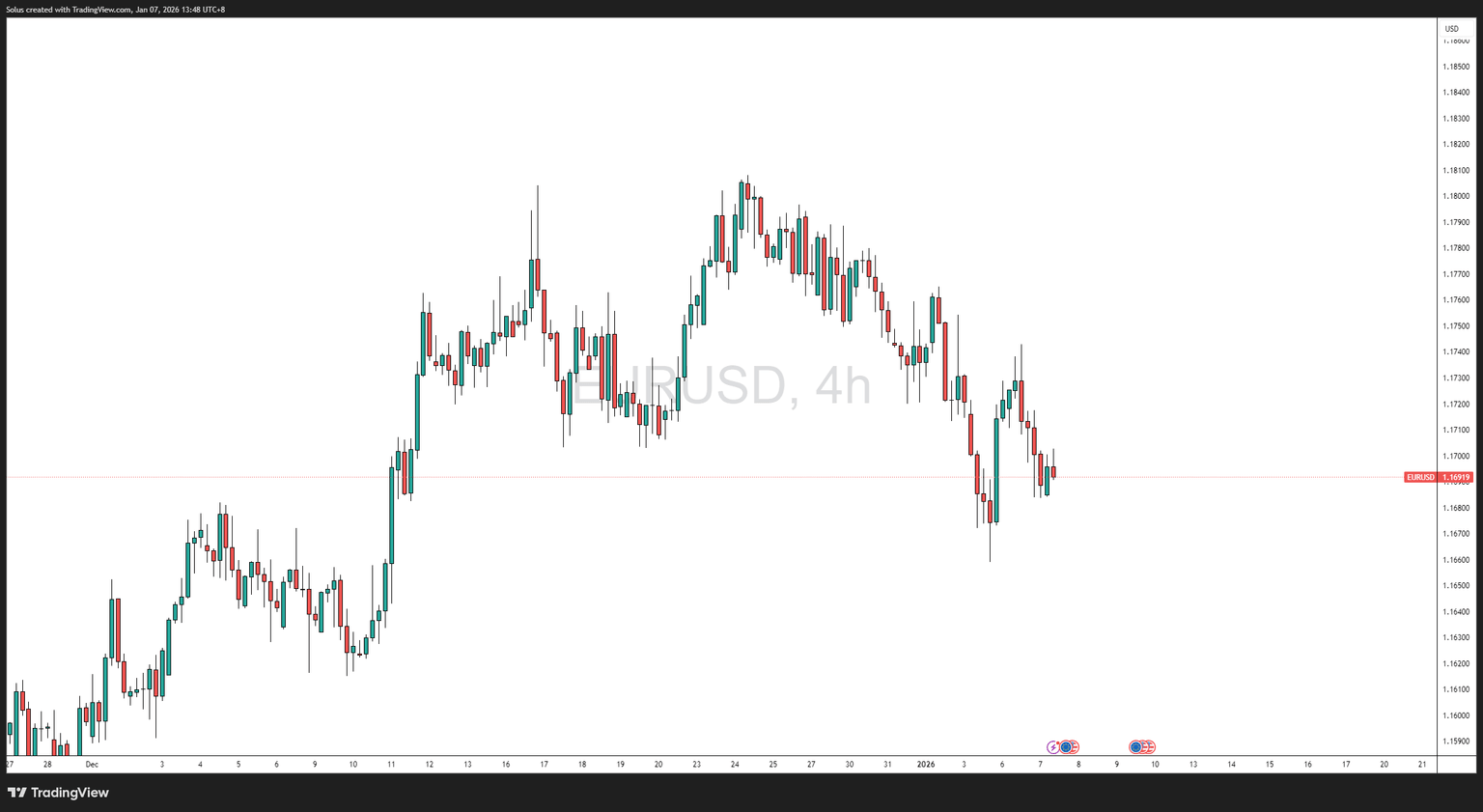

EUR/USD market analysis: Euro vs US Dollar outlook and forecast

- EUR/USD trades under pressure as U.S. dollar strength offsets euro recovery attempts.

- Weak Eurozone data and policy divergence keep the pair capped despite short-term rebounds.

- EUR/USD remains vulnerable below key resistance, with downside risk toward major support if 1.1650 fails.

EUR/USD fundamental market narrative

EUR/USD has entered the new trading year struggling to extend its prior upside momentum, as renewed U.S. dollar strength and soft Eurozone macro data reinforce a cautious outlook for the euro. While the pair attempted to stabilize above mid-range levels, fundamental divergence between the Federal Reserve and the European Central Bank continues to shape price action.

Recent Eurozone data releases have highlighted ongoing economic fragility. Inflation prints across major economies have moderated further, while PMI data point to slowing services activity and subdued demand. These developments strengthen expectations that the ECB will maintain a dovish stance for longer, limiting yield support for the euro.

In contrast, the U.S. dollar has regained traction after a weak finish last year. Although markets still anticipate eventual Federal Reserve easing, U.S. economic indicators remain relatively resilient, particularly in labor markets and consumption trends. This resilience reduces urgency for aggressive rate cuts, supporting the dollar and pressuring EUR/USD.

Risk sentiment also plays a role. Periodic shifts toward risk-off positioning continue to favor the U.S. dollar as a defensive currency, preventing sustained EUR/USD upside despite temporary pullbacks in USD strength.

Red folder events

Key upcoming and recent high-impact events influencing EUR/USD include:

- U.S. ISM PMI & Non-Farm Payrolls: Strong readings reinforce dollar demand and downside pressure on EUR/USD.

- Eurozone CPI & PMI Releases: Softer-than-expected data increases expectations of prolonged ECB accommodation.

- ECB and Federal Reserve Policy Commentary: Any shift in forward guidance remains a major volatility catalyst for the pair.

These red-folder events continue to dictate short-term volatility and directional conviction.

EUR/USD technical outlook

EUR/USD remains technically fragile despite recent consolidation. Price action suggests a corrective structure rather than a renewed bullish trend.

Technical price action narrative

- The pair continues to trade below key resistance near the 1.1740–1.1750 zone.

- Momentum indicators reflect waning bullish strength, with lower highs forming on intraday and daily timeframes.

- Support remains layered near 1.1690 and more critically at 1.1650.

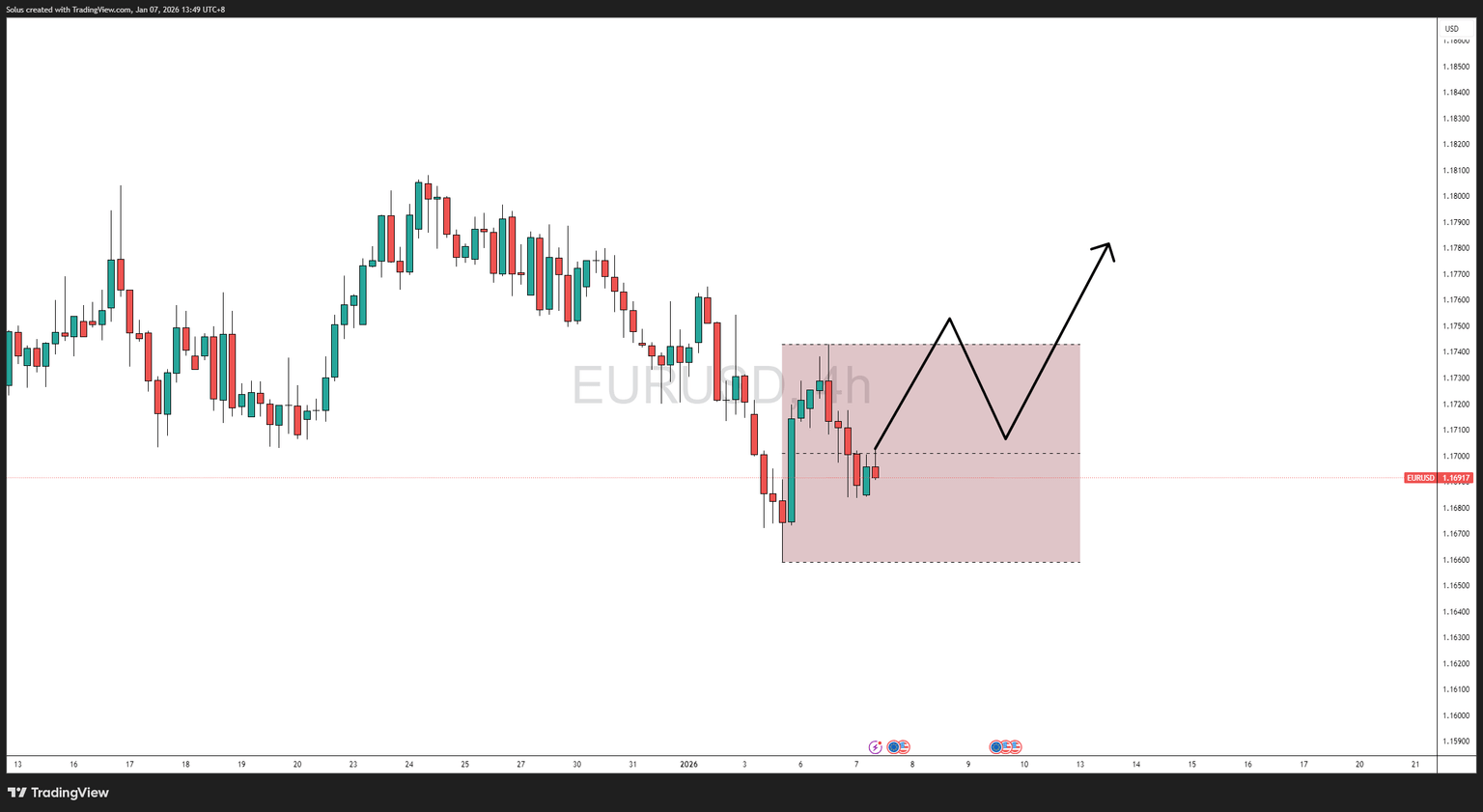

Bullish scenario: Reclaim and hold above resistance

A bullish continuation scenario requires clear structural confirmation:

- A sustained break and daily close above 1.1750.

- Improving Eurozone macro data or hawkish ECB repricing.

- Broad-based U.S. dollar weakness driven by dovish Fed expectations.

Upside targets:

- 1.1800

- 1.1850

Without these conditions, upside attempts remain corrective in nature.

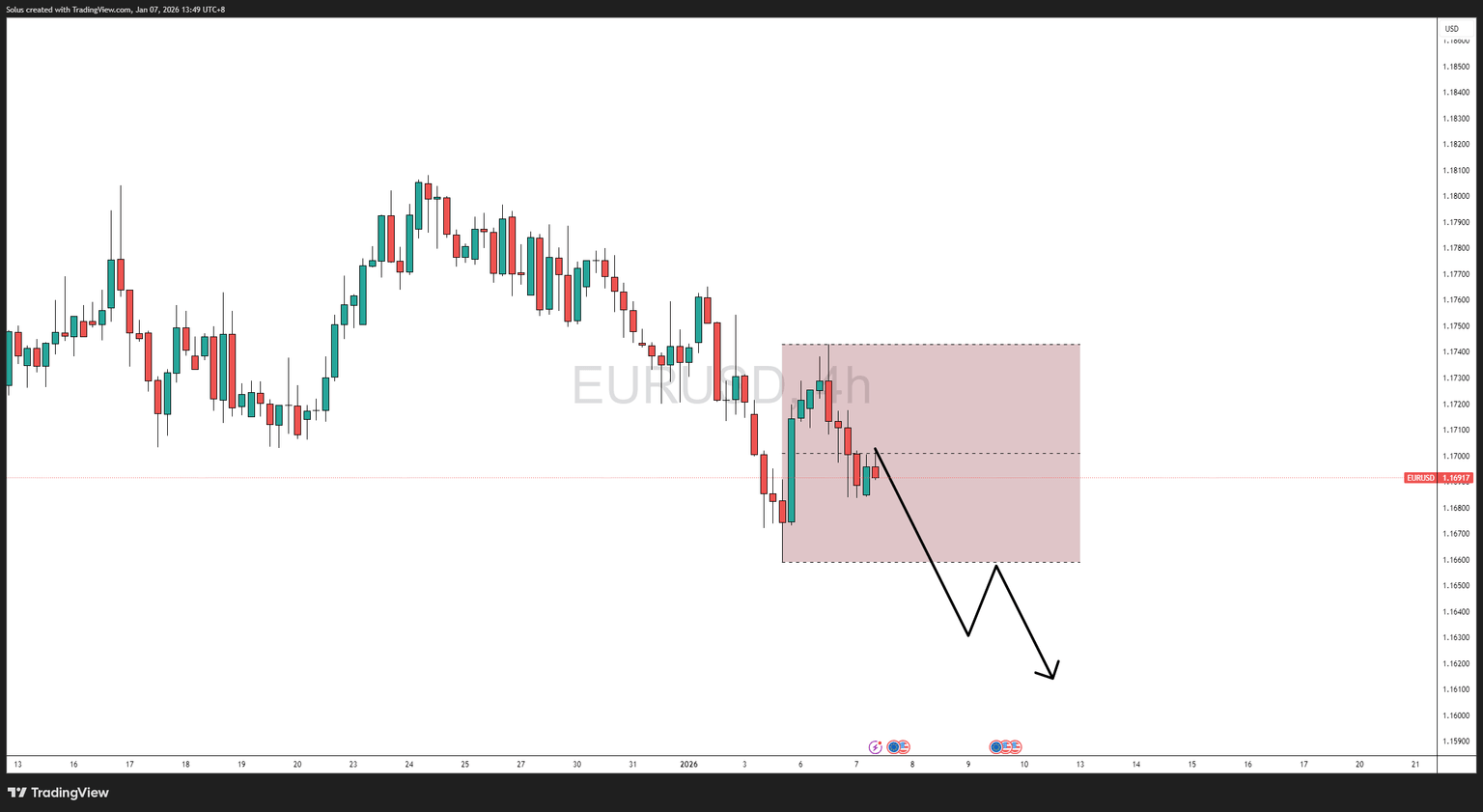

Bearish scenario: Breakdown through key support

Downside risk remains dominant if current supports fail:

- A decisive break below 1.1650 opens downside continuation.

- Strong U.S. labor or inflation data strengthens USD demand.

- Risk-off flows favor dollar positioning.

Downside targets:

- 1.1600

- 1.1550–1.1500 liquidity zone

Outlook summary

EUR/USD remains driven by macro divergence rather than technical strength. As long as the U.S. economy shows relative resilience and the ECB maintains a cautious stance, rallies are likely to face selling pressure at premium levels. Traders should remain selective, focusing on high-impact data catalysts and confirmation around key technical zones.

Author

Jasper Osita

ACY Securities

Jasper has been in the markets since 2019 trading currencies, indices and commodities like Gold. His approach in the market is heavily accompanied by technical analysis, trading Smart Money Concepts (SMC) with fundamentals in mind.