EUR/USD Forecast: Parity comes back in play following correction

- EUR/USD has lost its traction following Tuesday's recovery attempt.

- Euro struggles to find demand in the risk-averse market atmosphere.

- Investors await June inflation data from the US.

Following a consolidation phase near 1.0050 during the Asian trading hours, EUR/USD has turned south on Wednesday with European stocks opening deep in negative territory. The pair stays within a touching distance of parity and the bearish pressure could ramp up with a drop below that critical level.

The modest improvement witnessed in risk sentiment allowed EUR/USD to hold above 1.0000 on Tuesday. Although US stock index futures are posting modest gains in the early European session, the Euro Stoxx Index is down 0.65%, not allowing the shared currency to find demand.

As China tightens coronavirus-related restrictions, the US Centers for Disease Control and Prevention (CDC) said on Tuesday that the Omicron subraviant BA.5 was responsible for 65% of current COVID-19 cases in the United States. Safe-haven flows continue to dominate the financial markets amid mounting recession fears.

Meanwhile, money markets continue to scale back European Central Bank (ECB) rate hike bets. According to Reuters, the bank is now expected to hike its policy rate by 135 basis points by the end of the year, compared to 145 bps earlier in the week.

Later in the session, the US Bureau of Labor Statistics will release the Consumer Price Index (CPI) data for June. Markets expect annual CPI to climb to a new multi-decade high of 8.8% from 8.6% in May. The US Dollar Index (DXY) is already up more than 1% this week, suggesting that markets may have priced in a hot inflation report. Hence, a "buy the rumor sell the fact" action could be witnessed unless CPI figures surpass analysts' estimates. Weaker-than-forecast CPI prints, however, could trigger a risk rally in the near term and open the door for a rebound in EUR/USD.

US Inflation Preview: Finally signs of peak inflation? Three scenarios for Core CPI and the dollar.

EUR/USD Technical Analysis

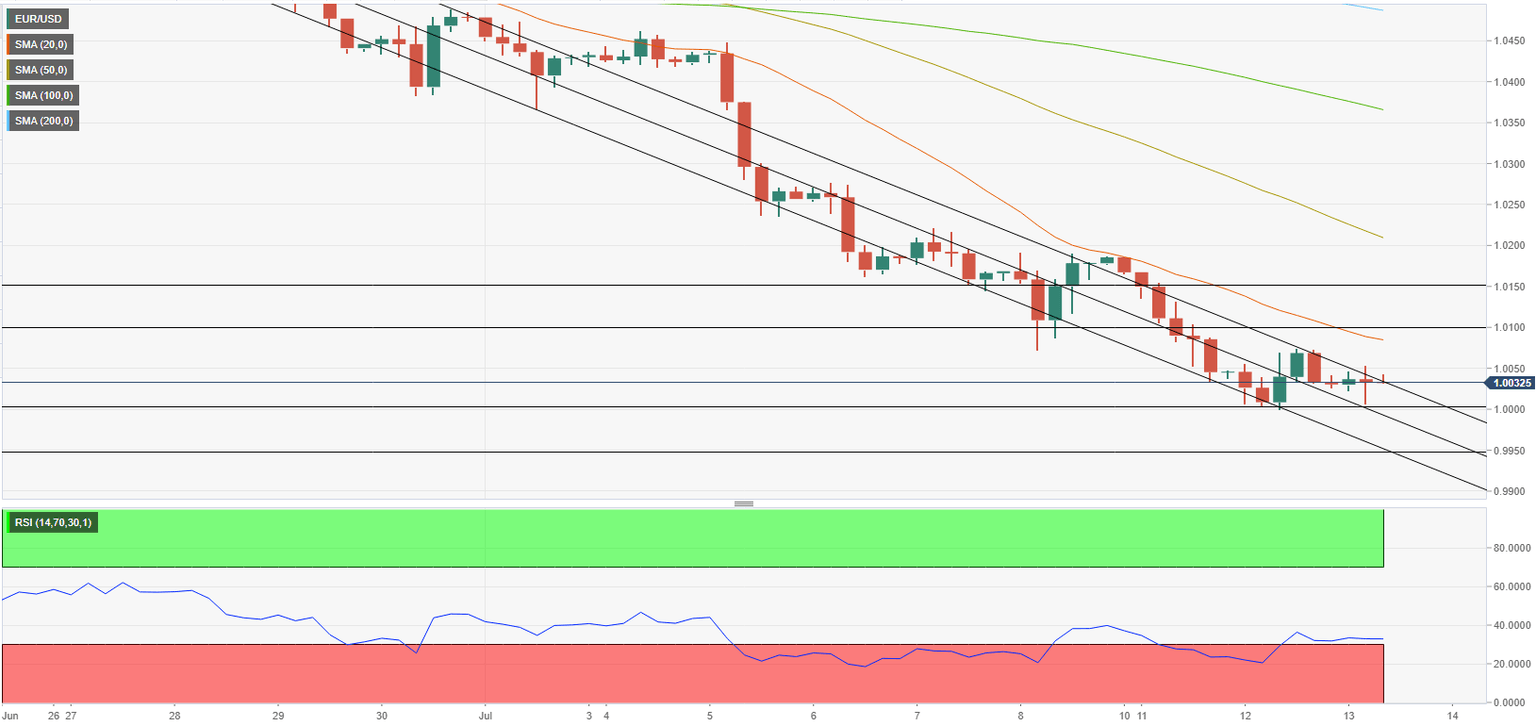

Following Tuesday's recovery, the Relative Strength Index (RSI) indicator on the four-hour chart climbed above 30. Additionally, the pair edged higher toward the upper limit of the descending regression channel coming from late June. Both of these developments point to a technical correction rather than a reversal.

In order to continue to push higher toward 1.0100 (psychological level, 20-pierodSMA) and 1.0150 (static level), the pair needs to clear 1.0050 (static level) and start using that level as support.

On the other hand, EUR/USD could face increasing bearish pressure and fall toward 0.9950 (static level from November 2002) and 0.9900 (psychological level) if buyers fail to defend 1.0000 (psychological level, multi-year lows set on July 12).

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.