EUR/USD Forecast: Euro to target fresh multi-month highs on a hawkish ECB

- EUR/USD has retreated below 1.0650 following Wednesday's rally.

- ECB is expected to raise its policy rate by 50 basis points.

- The Fed's hawkish dot plot failed to trigger a decisive recovery in the US Dollar.

EUR/USD has lost its traction and retreated below 1.0650 early Thursday after having touched its highest level in over six months near 1.0700. The near-term technical outlook points to a loss of bullish momentum but the pair could target new fresh multi-month highs in case the European Central Bank (ECB) delivers a hawkish message.

On Wednesday, the US Federal Reserve raised its policy rate by 50 basis points (bps) to the range of 4.25-4.5% as expected. Although the dot plot showed that the terminal rate projection in 2023 rose to 5.1% from 4.6% in September, the positive impact of this hawkish outlook on the US Dollar remained short-lived.

Chairman Jerome Powell continued to push back against the market expectation for a rate cut in late 2023 but failed to convince markets. Nevertheless, the US Dollar Index, which dropped to a fresh multi-month low below 103.50 on Wednesday, regained its traction on risk aversion and climbed above 104.00 on Thursday.

The ECB is forecast to hike key rates by 50 bps. The ECB will also publish its quarterly projections. Reuters reported on Wednesday that the ECB will project inflation comfortably above 2% through 2024.

Several policymakers have advocated for one more 75 bps increase in rates following the October policy meeting and a 75 bps hike at this meeting would offer a significant hawkish surprise and trigger a strong rally in EUR/USD. If the ECB opts for a 50 bps increase as anticipated, details surrounding the quantitative tightening could drive the Euro's reaction. In case the ECB unveils a timeline of how it plans to reduce the balance sheet, the Euro is likely to hold its ground against its major rivals.

On the other hand, a 50 bps rate hike alongside a gloomy growth outlook and an uncertain QT could weigh on the Euro and cause EUR/USD to extend its slide.

ECB Preview: Five reasons to expect Lagarde to lift the Euro with a hawkish hike.

EUR/USD Technical Analysis

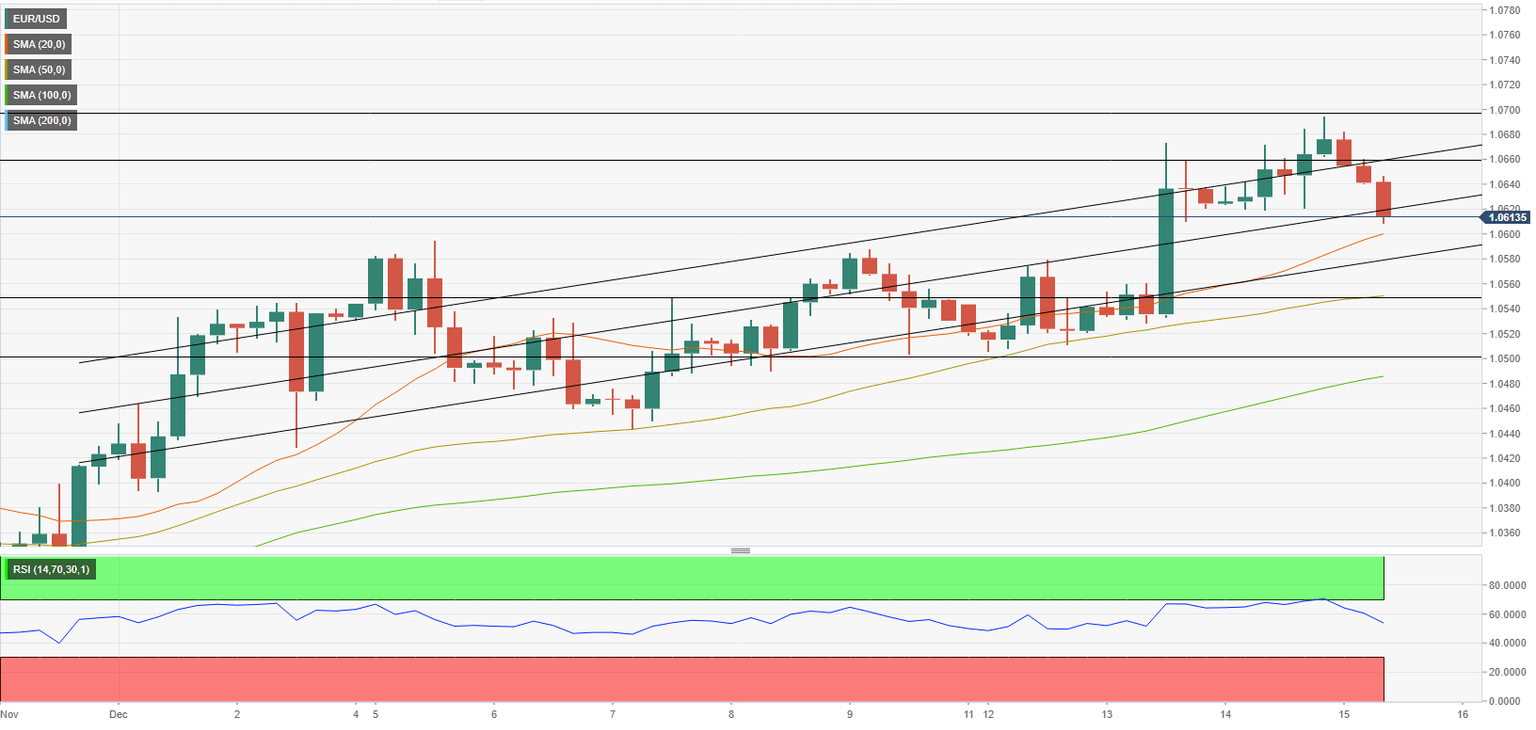

EUR/USD dropped below the mid-point of the ascending regression channel and the Relative Strength ındex (RSI) indicator on the four-hour chart declined toward 50, pointing to a loss of bullish momentum.

On the downside, 1.0600 (20-period Simple Moving Average (SMA) on the four-hour chart, psychological level) aligns as interim support ahead of 1.0580 (lower limit of the ascending channel). In case EUR/USD drops below the latter and fails to reclaim it, it could extend its slide toward 1.0550 (50-period SMA) and 1.0500 (psychological level).

1.0630 (mid-point of the ascending channel) forms initial resistance. If EUR/USD manages to stabilize above that level, it could target 1.0660 (upper limit of the ascending channel) and 1.0700 (psychological level, static level).

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.