EUR/USD Forecast: Bulls ready to restart the rally, investors have reasons to ditch the dollar

- EUR/USD is holding onto most gains as markets cheer coronavirus vaccine promises.

- The Fed's dovish shift and eurozone inflation figures are set to move the pair as August draws to an end.

- Monday's four-hour chart is pointing to further gains.

Clinging to the holiday tranquility on the last day of August – that is how EUR/USD is kicking off a busy week. A bank holiday in the UK and consolidation of previous gains are behind the calm – yet a storm may already be brewing.

US Non-Farm Payrolls await traders at the other end of the week and positioning may already begin now. Bulls have several reasons to be cheerful and expect the rally to resume.

First and foremost, the Federal Reserve's dovish shift continues weighing on the dollar. The world's most powerful central bank will allow inflation to overheat and employment gains to materialize before raising rates. After an initial choppy reaction to the announcement, the narrative of a weaker dollar took hold and is unlikely to change anytime soon.

Will European Central Bank President Christine Lagarde follow the footsteps of her American colleague Jerome Powell? Even if the inflation hawks at the German hawks sign off a shift to allow higher consumer prices – highly unlikely – inflation remains depressed.

Preliminary Consumer Price Index figures for August are due out throughout the European morning and are set to show that inflation is going nowhere fast i staying far from the ECB's 2% target.

Overall, the Fed's dovish shift is set to pressure the dollar while the prospects of lower rates for longer are already baked into the euro's price. Federal Reserve Vice-Chair Richard Clarida will speak later in the day and will likely repeat Powell's message from last week's virtual Jackson Hole Symposium. Clarida has been one of the architects of the policy review.

Another reason to shy away from the greenback stems from hopes for developing a coronavirus vaccine. The US Food and Drugs Administration (FDA) said it is ready to fast-track such immunization if benefits outweigh the risks. China's Sinovac has already received authorization for a COVID-19 vaccine that will be administered to high-risk patients.

Optimism about a solution is pushing stocks higher and diminishing demand for the safe-haven dollar.

Coronavirus cases continue rising in the old continent, with French officials sounding more concerned than beforehand and Spain's situation worrying investors as well. For now, the deterioration still seems under control and does not hurt the euro. That may change, but probably not anytime soon.

US COVID-19 cases have topped six million, but are on a downtrend. Mortalities are still high, with nearly 1,000 Americans losing their lives on average every day, but as long as there is no deterioration, investors seem calm.

Overall, there are risks to EUR/USD's advance, but the broad trend is to the upside.

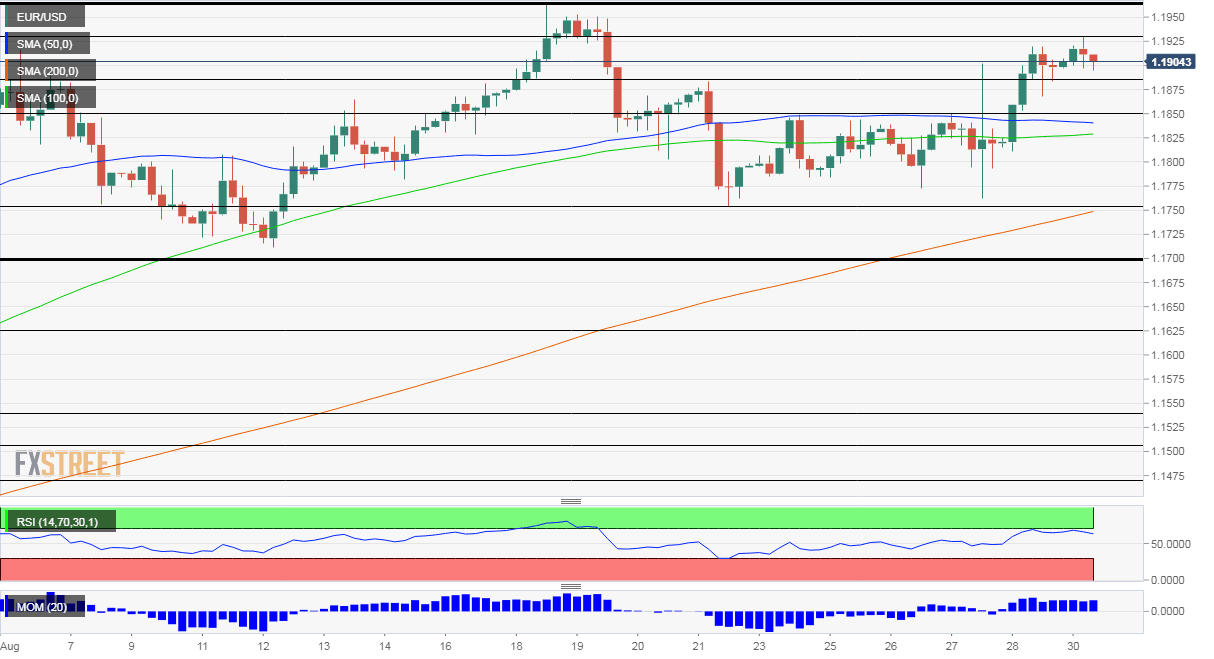

EUR/USD Technical Analysis

Euro/dollar is trading above the 50, 100, and 200 Simple Moving Averages on the four-hour chart and benefits from upside momentum. The Relative Strength Index is below 70, thus outside overbought conditions.

All in all, bulls are in control.

Resistance awaits at 1.1930, the daily high, followed by 1.1965 – the two-year high recorded in mid-August. Further above, the psychologically significant 1.20 level is looming.

Support is at 1.1880, a swing high from last week, followed by 1.1850, which was a stubborn cap before the rally. The next levels to watch are 1.1750 and 1.17.

More Markets are Fed-dependent as ever, reaction to elections could surprise – Interview with Lior Cohen

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.