EUR/USD Elliott Wave update aiming for 1.191 in wave five extension

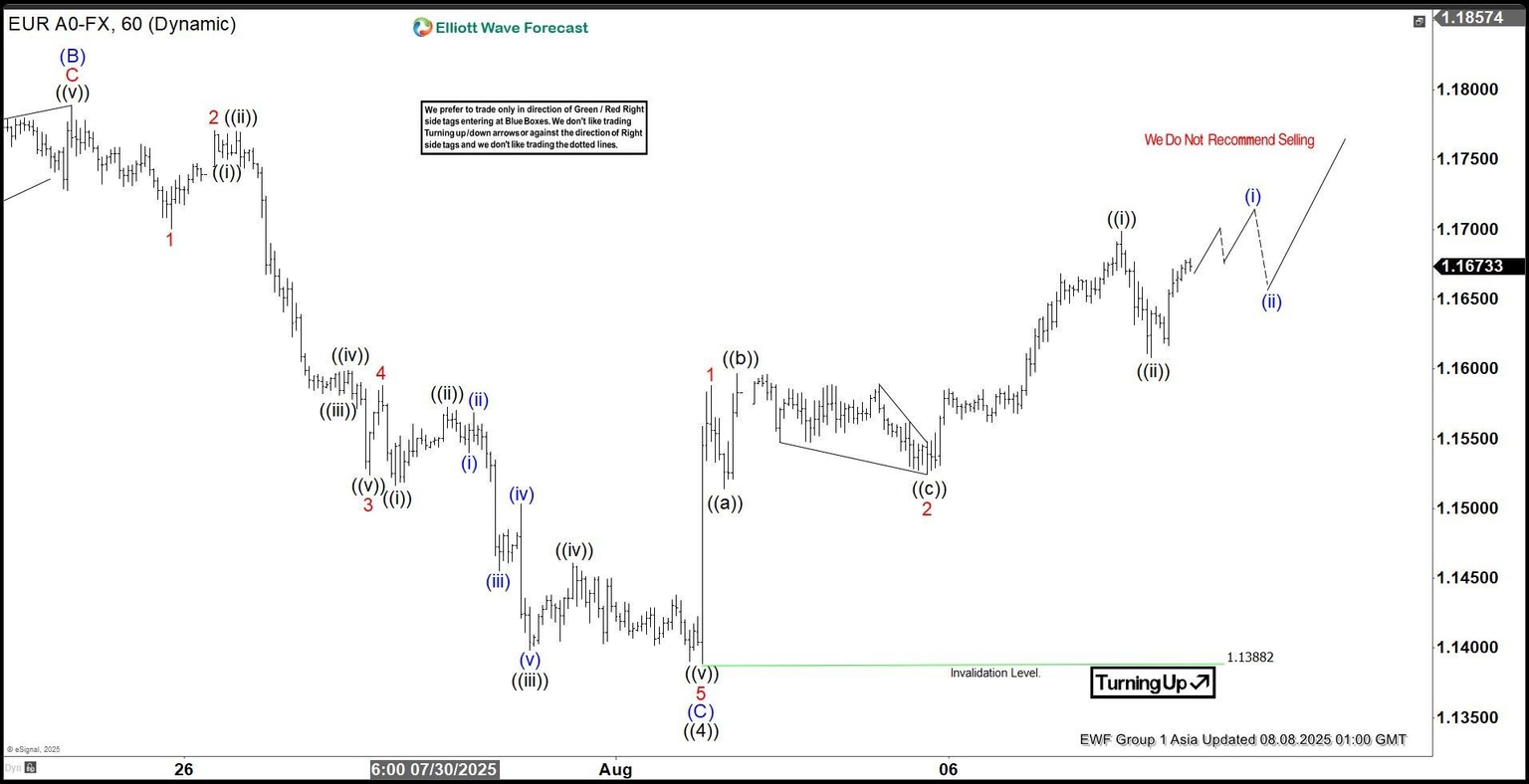

The EURUSD pair exhibits an incomplete bullish sequence originating from the September 2022 low, targeting 1.191. The rally from this low unfolds as an impulse Elliott Wave structure. Wave ((1)) concluded at 1.1275, followed by a pullback in wave ((2)) that ended at 1.0177. The pair has since resumed its upward trajectory in wave ((3)), reaching 1.183. Subsequent pullback in wave ((4)) completed at 1.139, as illustrated in the 1-hour chart. The internal structure of wave ((4)) formed a zigzag pattern. From the peak of wave ((3)), wave (A) declined to 1.1554. Wave (B) rallied to 1.1788, and wave (C) descended to 1.1388, finalizing wave ((4)).

The pair has now turned higher in wave ((5)), but it must break above the wave ((3)) high at 1.183 to eliminate the possibility of a double correction. From the wave ((4)) low, wave 1 peaked at 1.1588, and wave 2 retraced to 1.1524. The pair is nesting higher in wave 2 with wave ((i)) ended at 1.1699 and pullback in wave ((ii)) ended at 1.1608. As long as the pivot low at 1.1388 holds, dips should attract buyers in 3, 7, or 11 swing sequences, supporting further upside potential.

EUR/USD – 60 minute Elliott Wave technical chart

Author

Elliott Wave Forecast Team

ElliottWave-Forecast.com