EUR/USD bulls in control but require break above 1.13

The EUR/USD made a bullish breakout above the 21 ema zone after bouncing at the 144 ema support. Can the currency pair confirm the uptrend again?

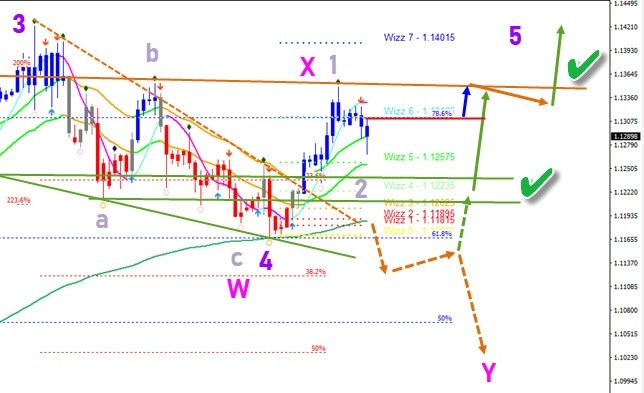

4 hour chart

The EUR/USD is certainly in a good position to confirm its bullish bias. Price action is retesting the 21 ema support zone. There is also strong support around the inverted head and shoulders levels and the 144 ema zone. Only a break below the 144 ema invalidates (red x) the immediate bullish trend. In that case, a larger and more complex bearish WXY correction could take place. But if wave 2 (purple) stays above the bottom of wave 1, then an uptrend has better odds.

An immediate breakout (blue arrow) above the current 4 hour candle high (red line) could already confirm the continuation higher. Also a bull flag pattern would aid the case for the bulls. Plus of course, the breakout above the resistance line (orange) and flag pattern (green arrow).

The analysis has been done with the ecs.SWAT method and ebook.

Author

Chris Svorcik

Elite CurrenSea

Experience Chris Svorcik has co-founded Elite CurrenSea in 2014 together with Nenad Kerkez, aka Tarantula FX. Chris is a technical analyst, wave analyst, trader, writer, educator, webinar speaker, and seminar speaker of the financial markets.