EU leaders reached a deal – EUR mixed

EU leaders reach agreement on recovery fund, 7-year budget. After the second longest summit on record EU leaders managed to find a complex compromise on the EUR 750 bln pandemic recovery fund and the next seven year budget, which together amount to an unprecedented EUR 1.82 trillion. That these discussions would not be easy was clear from the outset, and after marathon talks the compromise is a complex system that aims to accommodate all sides.

The portion of grants in the pandemic recovery fund was scaled back to EUR 390 bln from EUR 500 bln in the original proposal. There is also a new system that allows states to stop handouts by qualified majority over rule-of law violations, a move that finally appeased Dutch Premier Rutte, who had voiced concern over some legislation in Poland and Hungary. The Netherlands and Austria were also among the countries securing larger budget rebates in exchange for agreeing to cash handouts, rather than conditional loans that require budget oversights in the recovery fund. The European Commission will also be tasked with coming up with proposals on protecting the EU budget and recovering spending more effectively.

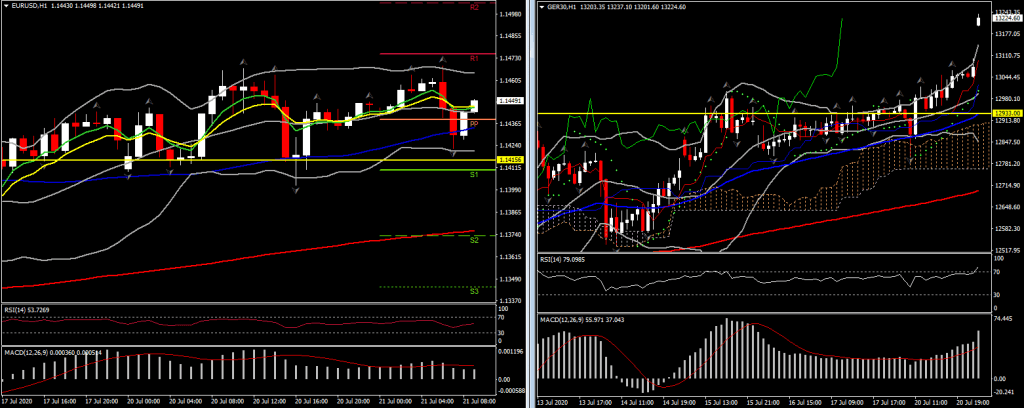

All in all a complex deal – typical for the EU and while a deal is on the table, the EUR is heading south in what looks like a buy the rumour sell the fact move that likely also reflects some disappointment over the lower portion of grants in the recovery fund. EURUSD is currently trading at 1.1447 (above PP), while the Pound is little changed from yesterday against the Dollar and higher against the EUR.

GER30 and UK100 futures are up 0.5% and 0.4% respectively and U.S. futures are also making headway, with the USA100 outperforming again.

BTPs already rallied yesterday, there may be some consolidation today, especially as the final portion of grants was lower than in the original proposal at EUR 390 bln out of a EUR 750 bln total.

Author

Having completed her five-year-long studies in the UK, Andria Pichidi has been awarded a BSc in Mathematics and Physics from the University of Bath and a MSc degree in Mathematics, while she holds a postgraduate diploma (PGdip) in