- The ECB is set to cut interest rates in its all-important September meeting.

- A new bond-buying scheme is also on the cards.

- Significant stimulus is already priced into the euro – which may rise after the decision.

- No less than five scenarios await EUR/USD traders.

Is the upcoming stimulus package already priced into the euro? That is the question on EUR/USD traders' minds. Everybody knows that the European Central Bank is going to cut interest rates – but its size, the commitments to do more, and perhaps QE which are set to make a difference. We lay out five scenarios – each one with a different outcome for the world's most popular currency pair.

Why is the ECB going to cut rates?

The economic situation has been deteriorating in recent months – as seen in a plethora of figures. Gross Domestic Product (GDP) has slowed from an unimpressive 0.4% in the first quarter to a meager 0.2% in the second quarter. While employment and consumption are OK, the manufacturing sector is struggling.

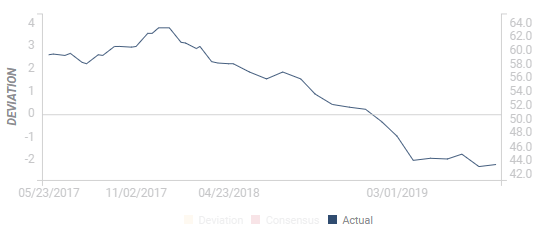

Forward-looking Purchasing Managers' Indexes (PMIs) have been below 50 – the threshold separating expansion from contraction – for several months. The problem has been more acute in Germany – the largest economy – which has seen manufacturing PMIs at the 43 handle for several months. The "locomotive" of the euro-zone has derailed and is now leading the continent down – with a contraction of 0.1% in the second quarter.

German manufacturing PMI:

Source: FXStreet

Germany's export-oriented economy is suffering from the US-Sino trade wars as China imports of German goods have fallen. The German labor market – already experiencing rising unemployment – is also set to suffer from a no-deal Brexit. 100,000 jobs may be lost according to estimates. France and other countries may also struggle in that scenario.

Germany is not only important as the largest economy nor only as of the home to the ECB headquarters in Frankfurt. Cross-border supply chains mean that weakness in the center of Europe spreads to other countries – something the central bank has mentioned.

Weak inflation now and later

The ECB has a "single needle in its compass" – as former president Jean-Claude Trichet said – and that is inflation. The bank has consistently been missing its 2% target. While headline Consumer Price Index (CPI) weakness may be blamed on falling oil prices, weak core CPI already reflects weak fundamentals.

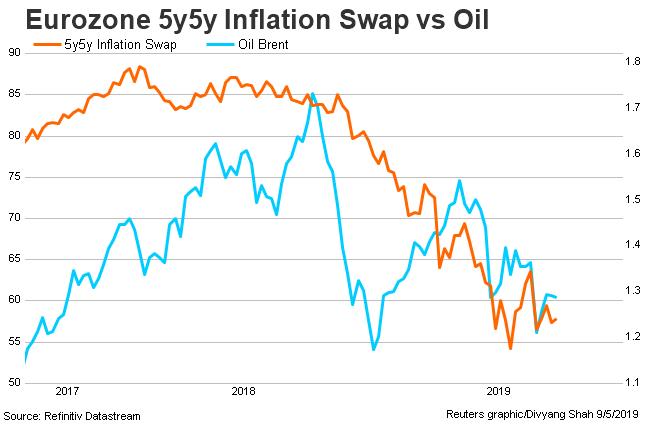

Moreover, the bank sets interest rates for the medium-term and closely monitors the gap between nominal five-year bonds and the inflation-adjusted ones – the 5y/5y swap. And that swap has been projecting lower prices – expressing mistrust in the ECB's ability to achieve its target.

Here is how inflation expectations have fallen (orange line):

Source: Refinitiv Datastream

To conclude, weak growth, depressing growth projections, flashing warning signs for the manufacturing sector, subdued inflation, and lack of confidence about future inflation – have all led to expectations for more stimulus. In the last meeting, ECB President Mario Draghi explicitly said that the bank would act in September. The statement included a thick hint that the bank will be cutting its deposit rate – currently at -40 basis points – and an open the door to doing more.

What exactly is priced in?

EUR/USD has dropped to the lowest levels since 2017 – and expectations for stimulus contributed to it. Bond yields – already negative in many countries – have been falling as well.

Olli Rehn, Governor of the Bank of Finnland further raised expectations in mid-August. He said that the "the bank's package of stimulus measures, which will be announced in September, could overshoot investors' expectations" That statement sent the euro lower.

On the other hand, several ECB hawks such as Jens Weidmann, Sabine Lautenshläger, Klaas Knot, and others have said that market forecasts have gone too far.

The consensus stands at a rate cut of 10 basis points – but a 20bp reduction is also an option. Regarding resuming the Quantitative Easing program, that may wait for October – Draghi's last meeting as ECB President –. 90% expect ECB to pre-announce QE in October. But will they preannounce it now?

Let us examine the possibilities.

5 ECB scenarios and EUR/USD reactions

1) A 10bp cut

In this scenario, the northern hawks on the Governing Council succeed in preventing going beyond the minimum stimulus the bank hinted to. It would also show that Draghi is losing influence in his last couple of months in office and undermine confidence in the ECB's ability to reach its inflation target.

Such an outcome would be positive for EUR/USD. A rate reduction has been a foregone conclusion for long weeks. A cut without a commitment to do more could send the euro surging in reaction.

The probability of this outcome is low.

2) 10bp with a commitment to do more

If hawks succeed in blocking a deeper rate cut, they may still give ground on forward guidance. Draghi may secure a pledge to have one last go at stimulus in his final meeting in October.

A willingness to introduce more stimulus – but unknown its nature – may be insufficient to convince markets that Draghi is doing "whatever it takes." After initial confusion, the common currency may advance – on impatience ahead of the next meeting.

The scenario – a "buy the rumor, sell the fact" one – has a high probability.

3) 20bp cut

A deep cut in interest rates would exceed expectations and indicate that the ECB is serious in tackling low inflation. It would also show that Draghi and his colleagues are unmoved by banks' concerns about profitability. Even if the reduction is accompanied by exemptions to individual banks – a tiering system – the euro has room to fall.

However, EUR/USD slide may be limited as uncertainty about the future – and fears that the ECB is done for now – may confuse.

The scenario has a medium probability.

4) 20bp with a commitment to do more

If the bank provides substantial stimulus now and also commits to doing even more soon, markets will assume that the ECB is preparing the printing presses – more QE.

In this scenario, which has a low probability, EUR/USD may suffer significant losses. Some would interpret the delay in QE as only a temporary measure meant to provide enough time to iron out the details – and not as hesitance.

5) Rate cut + QE

This extreme outcome has a very low probability as the ECB may just be unprepared to lay out the details of the new money-printing scheme. However, it cannot be ruled out as the flow of downbeat data continues at full pace. The severity of the German recession and the lack of appetite for fiscal stimulus in Berlin may push the German hawks into the dovish camp.

An announcement that includes buying bonds may send the euro into a complete free-fall. QE – even at a modest scale of €20 billion – may outweigh the impact of any whichever rate cut the ECB enacts.

Other considerations

As mentioned earlier, the bank may accompany the rate cut with exemptions to specific banks. Banks are already paying to park funds with the ECB. The step is meant to encourage them to lend money to households and businesses – but hurts banks when they are unable to lend it out. A tiering system may take some of the sting out of a rate cut. Nevertheless, the market reaction will likely be focused on the top number rather than the details.

The ECB staff prepares new growth and inflation forecasts that Draghi will read out at the beginning of the press conference. When the ECB refrains from changing its policy, the data tend to move markets. This time, the projections only serve as input for the decisions – and policy speaks louder than forecasts – which are prone to changes.

Conclusion

The ECB is set to announce a rate cut and perhaps additional measures on September 12, at 11:45 GMT. The announcement is accompanied by a press conference by the institution's president Mario Draghi at 12:30 GMT.

The depth of the rate cut, commitments for future policy, and potentially a new bond-buying scheme will all shape the euro's reaction. The most probable scenario is a mild "buy the rumor, sell the fact" in which the ECB cuts rates by only 10bp and provides vague pledges to do more – sending the euro higher. There are four other scenarios that vary significantly, and high volatility is likely.

More US recession: Manufacturing already in contraction – but EUR/USD may still fall

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

AUD/USD keeps the red below 0.6400 as Middle East war fears mount

AUD/USD is keeping heavy losses below 0.6400, as risk-aversion persists following the news that Israel retaliated with missile strikes on a site in Iran. Fears of the Israel-Iran strife translating into a wider regional conflict are weighing on the higher-yielding Aussie Dollar.

USD/JPY recovers above 154.00 despite Israel-Iran escalation

USD/JPY is recovering ground above 154.00 after falling hard on confirmation of reports of an Israeli missile strike on Iran, implying that an open conflict is underway and could only spread into a wider Middle East war. Safe-haven Japanese Yen jumped, helped by BoJ Governor Ueda's comments.

Gold price pares gains below $2,400, geopolitical risks lend support

Gold price is paring gains to trade back below $2,400 early Friday, Iran's downplaying of Israel's attack has paused the Gold price rally but the upside remains supported amid mounting fears over a potential wider Middle East regional conflict.

WTI surges to $85.00 amid Israel-Iran tensions

Western Texas Intermediate, the US crude oil benchmark, is trading around $85.00 on Friday. The black gold gains traction on the day amid the escalating tension between Israel and Iran after a US official confirmed that Israeli missiles had hit a site in Iran.

Dogwifhat price pumps 5% ahead of possible Coinbase effect

Dogwifhat price recorded an uptick on Thursday, going as far as to outperform its peers in the meme coins space. Second only to Bonk Inu, WIF token’s show of strength was not just influenced by Bitcoin price reclaiming above $63,000.