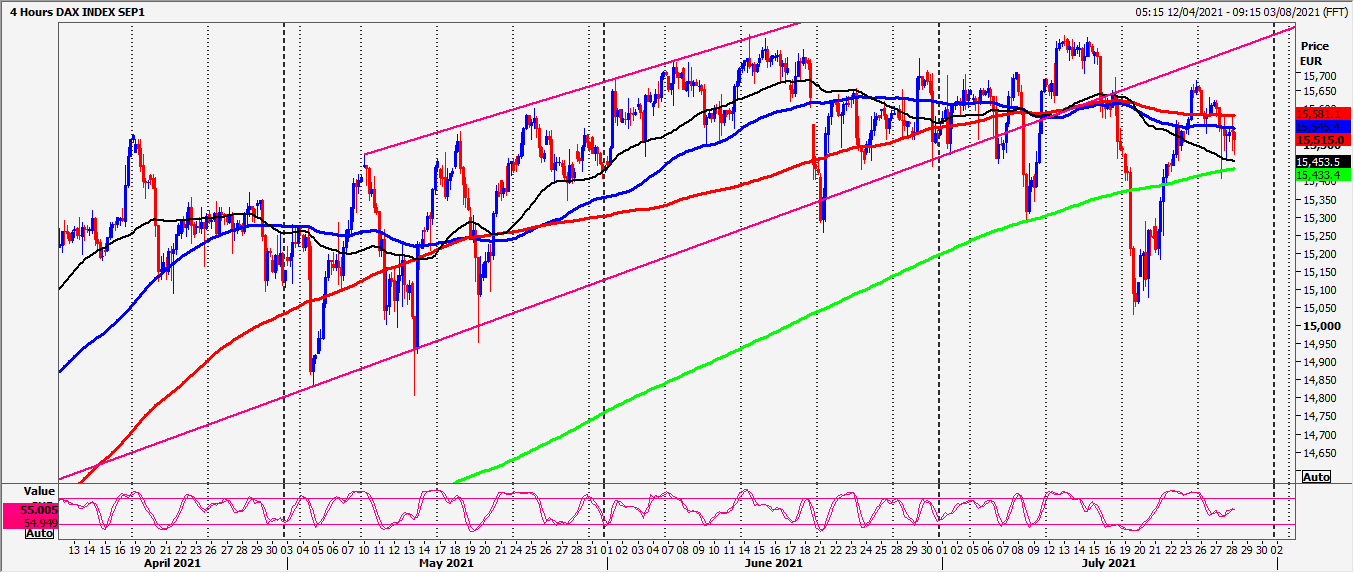

DAX holding resistance at 15550/580

Dax, EuroStoxx, Ftse

Dax 30 September broke strong support at 15550/500 this time but bottomed exactly at the next target of 15420/380.

EuroStoxx 50 September held the next target of 4110/15.

FTSE 100 September sold off from strong resistance at 6945/55 on the open to 6910.

Daily analysis

Dax holding resistance at 15550/580 keeps the pressure on for a retest of first support at 15450/410. Longs need stops below 15390. A break lower is a sell signal targeting the 100-day moving average at 15325/05.

Strong resistance at 15550/580. Shorts need stops above 15610. A break higher is a buy signal targeting 15640 & 15720/740 before a test of very strong resistance at the all-time high at 15770/800. Obviously, a sustained break above 15820 is a buy signal, initially targeting 15920/940.

EuroStoxx September beat key resistance at 4065/75 to top exactly at the next target of 4110/15. A break higher this week targets 4140/50.

First support at 4060/50. Second support at 4030/20. A break below 4010 is a sell signal initially targeting 3980/70.

FTSE September strong resistance at 6980/90. Shorts need stops above 7010. A break higher can target 7040/50, perhaps as far as 7080/90. Minor support at 6930/20 A break below 6910 can target 6870/60. On further losses look for 6820/10.

Chart

Author

Jason Sen

DayTradeIdeas.co.uk