Central Europe: Return to pre-COVID GDP levels likely in 2021

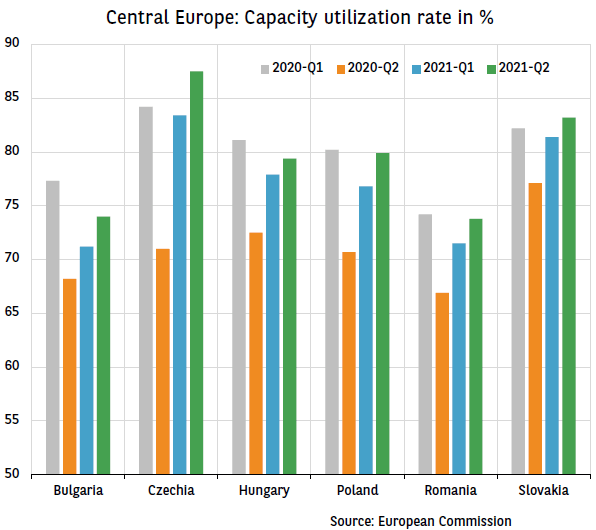

Growth in Central Europe looks set to accelerate in the 2nd quarter of 2021, after already a good performance in the 2nd half of 2020, as indicated by the capacity utilisation rate in the manufacturing sector. This highlights good resilience despite a shortage of chips in the automotive sector and a fairly severe 3rd wave of Covid in the 1st quarter of 2021.

Improving business conditions in the industrial sector stem from the on-going recovery in demand, specifically for exports: this has already allowed economic activity in the Czech Republic and Slovakia to move above pre-Covid levels, whilst the Polish and Romanian economies have returned to around pre-crisis levels.

This performance should allow the region’s GDP to recover its pre-Covid levels before the end of 2021 (growth of 4.2% compared to the 3.8% contraction in 2020), notwithstanding a loss of activity in services that will hold for longer. It is also likely to support inflation (along with the chips shortage and oil prices recovery), which is likely to remain close to 3% on average for the 3rd year in a row.

Author

BNP Paribas Team

BNP Paribas

BNP Paribas Economic Research Department is a worldwide function, part of Corporate and Investment Banking, at the service of both the Bank and its customers.