Central America: How climate variability impacts human mobility?

Climate-related migration (internal displacements and cross-border flows) have increased significantly in recent years across Central America. Natural disasters and environmental changes (increasing temperatures, changing precipitation patterns, increasing intensity of storms) affect human mobility through their impact on agriculture (soil degradation, crop failure, declining agricultural yields), access to water resources, destruction of infrastructure and land losses (coastal erosion/flooding, landslides).

Central America’s high climate vulnerability stands in large part from the region’s high dependence on subsistence agriculture for employment, GDP, exports and domestic food security. In Guatemala, Honduras, and El Salvador, more than half of the rural poor live in poverty making them particularly vulnerable to climate events (loss of habitat and livelihoods). From 2018 to 2021, the number of people going hungry in Central America nearly quadrupled, reaching close to 8 million.

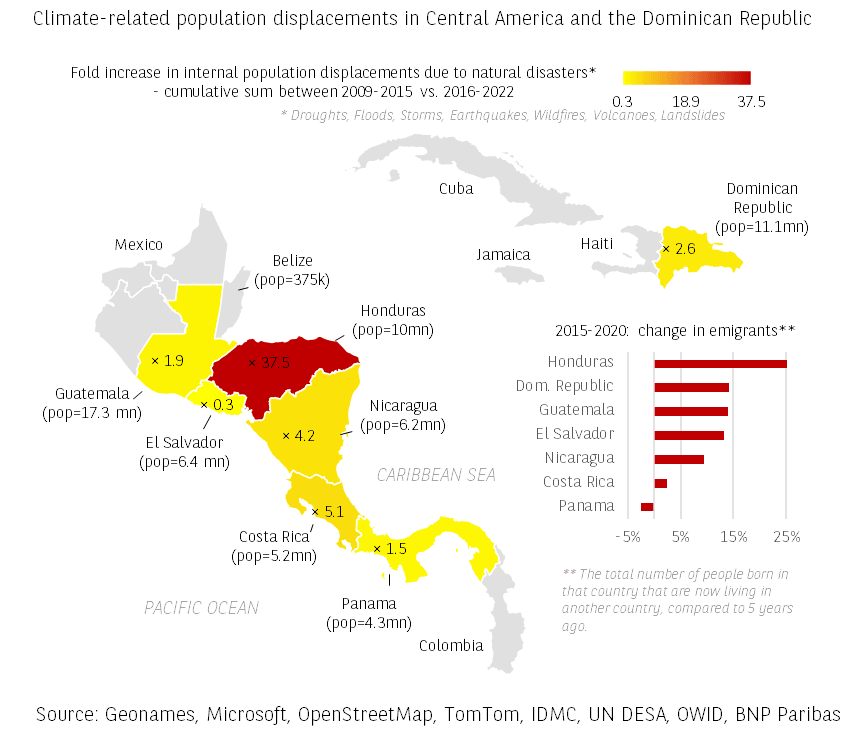

Internal population displacements due to natural disasters have at least doubled in most countries across the region, since 2016. Outmigration from the region is also on the rise and climate-related factors are exacerbating pre-existing migration drivers: family ties, insecurity (criminal violence, conflict), political drivers (human rights violation, backsliding democratic governance, political repression), socio-economic determinants (poverty, inequality – both compounded by the Covid-19 pandemic).

Climate events and change act as risk multipliers. Honduras – a country that has experienced the highest percentage change in emigration in the region since 2015 is also the country that has i/the lowest per capita GDP after Nicaragua, ii/ the highest homicide rate in the region, and iii/ has been the most affected by population displacements associated with natural disasters (the number of internally displaced people over the period 2016-2022 relative to the period 2009-15 has increased almost 40-fold). Climate change can force people to leave their homes (e.g. rural-to-urban migration) and then in turn high levels of violence can force them to leave their country.

Author

BNP Paribas Team

BNP Paribas

BNP Paribas Economic Research Department is a worldwide function, part of Corporate and Investment Banking, at the service of both the Bank and its customers.