Canadian October Jobs Preview: Labor market upturn in the doldrums

- Canada’s Net Change in Employment is foreseen at 10K in October.

- BOC surprises with a 50 bps rate hike, as recession fears mount.

- CAD bears are here to stay on Canadian jobs data but US NFP will hold the key.

USD/CAD is set to extend its bullish momentum, as the October Canada’s labor market report is unlikely to rescue the Canadian Dollar (CAD) out of the woods.

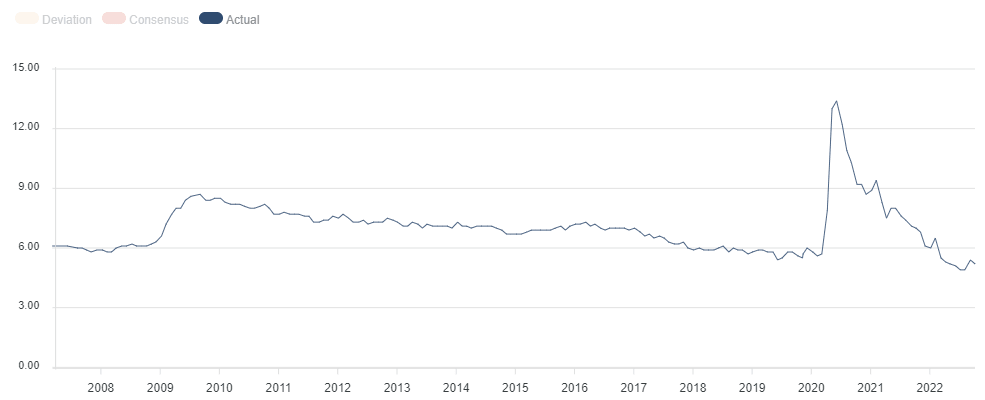

The upturn in the Canadian employment sector is expected to be in the doldrums again in October, having witnessed jobs growth in September for the first time in four months. It’s worth noting that September’s sudden uptick happened not because new jobs were created but because over 20,000 people left the labor force in the past month and they are not looking at coming back to work. From June through August, the economy lost roughly about 110,000 jobs.

The country’s employment data for October will be reported by Statistics Canada on Friday at 1230GMT. The North American economy is estimated to have created 10K jobs in October as against a massive jobs growth of 21.1K reported in September. The Unemployment Rate, however, is seen higher at 5.3% last month from September’s 5.2% while the Participation Rate is likely to hold steady at 64.7% in the reported period.

Source: FXStreet

At the time of the Canadian employment data release, the United States (US) is also scheduled to publish its monthly labor market report. The headline Nonfarm Payrolls from the American economy is seen rising to 200K in October vs. 263K booked previously. The Unemployment Rate is likely to tick higher from 3.5% to 3.6% in the reported month. An upside surprise to the payrolls figure could be in the offing after the US ADP Employment Change jumped to 239K in October vs. 195K expected and 192K prior.

The market reaction to the US employment data is likely to overshadow the outcome of the Canadian jobs report on the USD/CAD pair, especially after the US dollar is holding the upper hand on hawkish remarks from Fed Chair Jerome Powell at Wednesday’s post-policy press conference. The Fed hiked the policy rates by 75 bps, as widely expected but Powell said that ‘there are ways to go’ before they could slow down its tightening pace, as inflation has shown no signs of softening and the labor market remains in a healthy condition.

On the other hand, the Bank of Canada (BOC) surprised markets last week after announcing a smaller-than-expected 50 bps rate hike. The central bank noted that it was getting closer to the end of its historic tightening campaign as it forecast the economy would stall over the next three quarters.

USD/CAD Probable Scenarios

A potential slowdown in the Canadian employment sector combined with a positive surprise in the US jobs data could extend the bearish undertone in the Canadian dollar against its American counterpart. Even if the US payrolls fail to impress traders, the Fed-BOC divergence is likely to keep the CAD undermined in the near term.

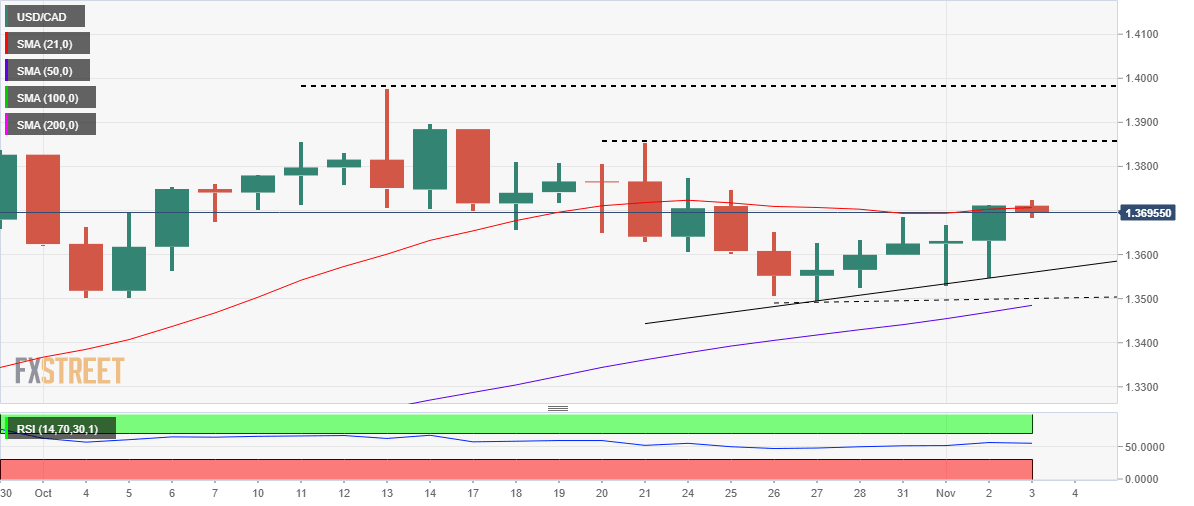

USD/CAD’s daily technical setup remains in favor of bullish traders, implying a likely extension of the US dollar rally on the NFP beat or disappointing Canadian jobs data.

USD/CAD: Daily chart

USD/CAD closed Wednesday above the critical short-term 21-Daily Moving Average (DMA) at 1.3706. The 14-day Relative Strength Index (RSI) holds the fort above the midline, supporting the case for potential upside. On below-forecast Canadian employment data, the pair could initiate a fresh advance towards the 1.3800 round level, above which the October 21 high at 1.3854 and the October 13 high at 1.3977 will be on buyers’ radars.

CAD bulls could be offered some reprieve should the Canadian jobs data beat expectations or the US NFP disappoints the Fed hawks, which would check the upside in the American Dollar. In that case, the spot could fall back towards the rising trendline support at 1.3555, below which the confluence of the bullish 50DMA and the October 27 low at around 1.3490 will offer strong support.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.