Brent Crude under pressure amid supply expansion concerns

Brent crude oil prices have experienced significant selling pressure recently, dipping to 77.21 USD per barrel on Tuesday. Although there has been a slight recovery from earlier lows, the overall market sentiment remains bearish.

Investors are reacting to recent data from OPEC, which indicates that 8 OPEC+ members plan to increase their production by 180,000 barrels per day. This anticipated rise in supply casts a shadow over the oil market, particularly as it coincides with weakening demand indicators from major economies.

A report from the Department of Energy in the US highlighted a drop in oil consumption in June to levels not seen since the summer of 2020, considering seasonal adjustments. This downturn in demand is mirrored by troubling economic data from China, where factory activity has reportedly reached a six-month low. Moreover, the decline in selling prices and a reduction in new orders from Chinese manufacturing sectors add to the pessimism surrounding future demand.

However, some support for oil prices stems from production issues in Libya, where the largest local oilfield has halted production due to state-imposed force majeure. This disruption could pose supply challenges for major oil consumers and as highlighted in commodities analysis, temporarily cushion the impact of broader negative trends.

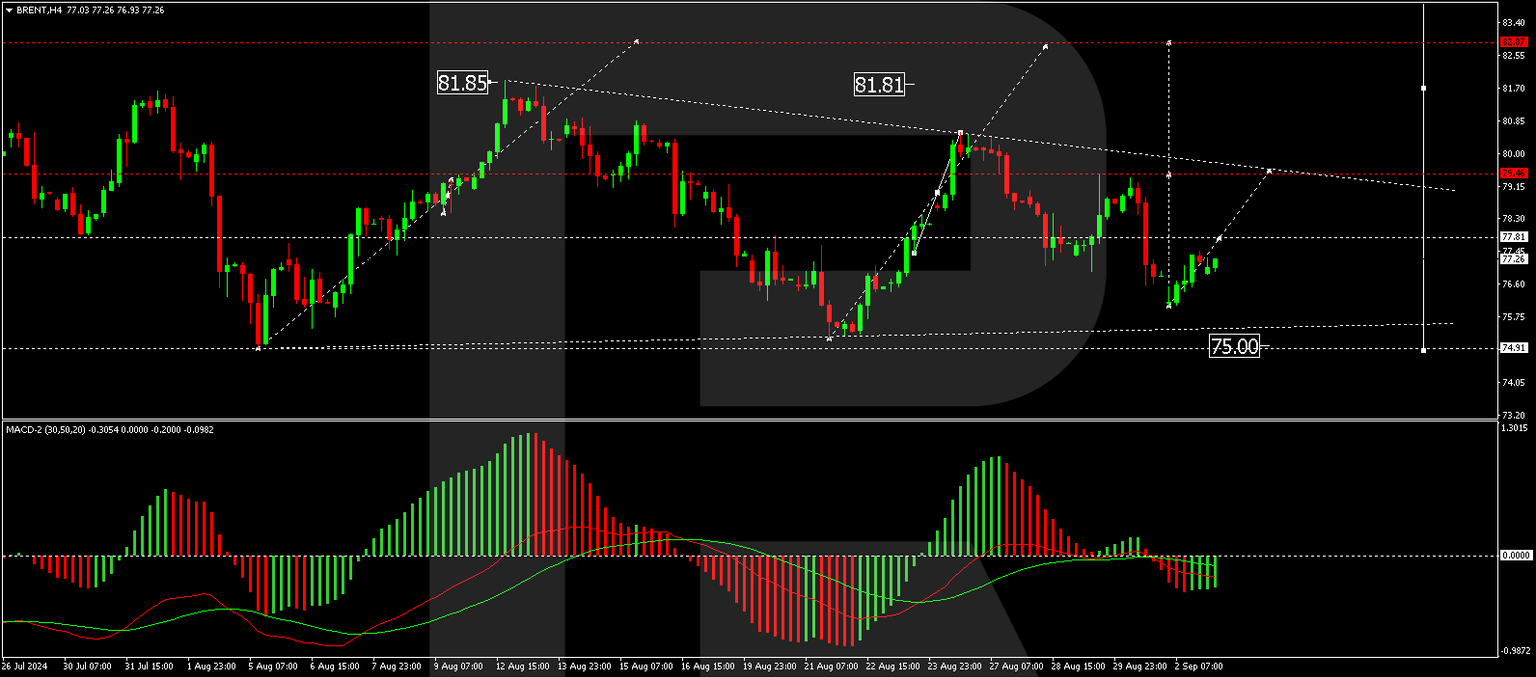

Brent technical analysis

The H4 chart shows a previous growth impulse peaking at 81.85, followed by a correction down to 75.20, forming a broad consolidation range at this lower level. There is an expectation for a growth move towards 79.00 today. If this level is breached upward, it may signal the continuation of the growth wave to 82.87. This bullish scenario is tentatively supported by the MACD indicator, whose signal line is below zero but shows signs of an upward trajectory.

On the H1 chart, Brent has formed a corrective structure down to 76.02 and is currently developing a growth structure towards 77.55. A successful breach of this level could open the way for further growth to 79.00, potentially continuing to 82.87. The Stochastic oscillator supports this outlook, with its signal line positioned around 50 and pointing upwards, indicating potential for further price increases.

Overall, while the short-term technical indicators suggest a possible recovery in Brent prices, the broader market context remains challenging due to increased supply forecasts and weak demand signals from vital global markets.

Author

Andrey Goilov

RoboForex

Higher economic education. Andrey Goilov has been working on the Forex market since 2005. A financial analyst and successful trader. Preference in trading is highly volatile instruments.