BoE set to hold rates – Can GBP/USD recover from its slide?

- The Bank of England is expected to hold the Bank Rate at 4.00%, signaling policy caution as inflation eases but growth stays weak.

- GBP/USD trades near 1.3040, struggling to gain momentum as the U.S. dollar extends its recovery ahead of key U.S. data.

- Unless price reclaims 1.3100–1.3140, the pair risks further downside toward 1.2940–1.2880.

Central bank narrative: BoE expected to hold as economy softens

The Bank of England (BoE) is widely expected to hold rates at 4.00% in its upcoming policy meeting. After a gradual series of rate cuts earlier this year, policymakers have adopted a “wait-and-see” stance — cautious not to overstimulate a fragile economy while inflationary pressures remain uneven.

Although headline CPI has dropped closer to the 2% target, wage growth and services inflation continue to hover above comfort levels, keeping policymakers hesitant to signal an easing cycle. Governor Andrew Bailey emphasized that while progress has been made, “inflation is not fully conquered yet,” hinting that a prolonged holding phase may be necessary before the next move.

- BoE stance: Expected to hold the Bank Rate at 4.00% with a balanced tone.

- UK backdrop: Weak growth and soft consumer demand contrast with lingering cost pressures.

- Market implication: The Pound could stay under pressure if the BoE emphasizes economic risks over inflation control.

US Dollar narrative: Strength from policy divergence

The US Dollar (USD) remains firm across major pairs, extending gains amid stronger labor data, resilient inflation, and a still-hawkish Federal Reserve stance. Recent Fed commentary suggests policymakers are not in a rush to cut rates, reinforcing the idea of “higher for longer” U.S. monetary policy.

While the BoE and ECB are tilting toward dovish neutrality, the Fed’s tone has sustained dollar demand as global capital flows chase yield and safety. The DXY (U.S. Dollar Index) continues to hold above 104.00, reflecting a robust base driven by resilient U.S. macro data and steady Treasury yields.

- Fed outlook: Holding above 4.25–4.50% terminal rate through early 2026.

- US economy: Outperforming its G7 peers, especially in services and jobs growth.

- Investor behavior: Ongoing demand for USD as both a yield and safe-haven play.

Impact on GBP/USD

This divergence places the Pound in a difficult position:

- The BoE’s cautious hold contrasts with the Fed’s hawkish patience, amplifying downside pressure on GBP/USD.

- Every bout of U.S. economic strength — whether CPI, retail sales, or NFP — tends to extend GBP weakness.

- Unless U.S. data softens or the Fed signals policy easing, GBP/USD rallies may remain corrective rather than sustained.

In essence, the strong USD narrative adds another layer of resistance for the Pound, making any BoE-driven rebound harder to sustain.

Current price action: GBP/USD struggles to find relief

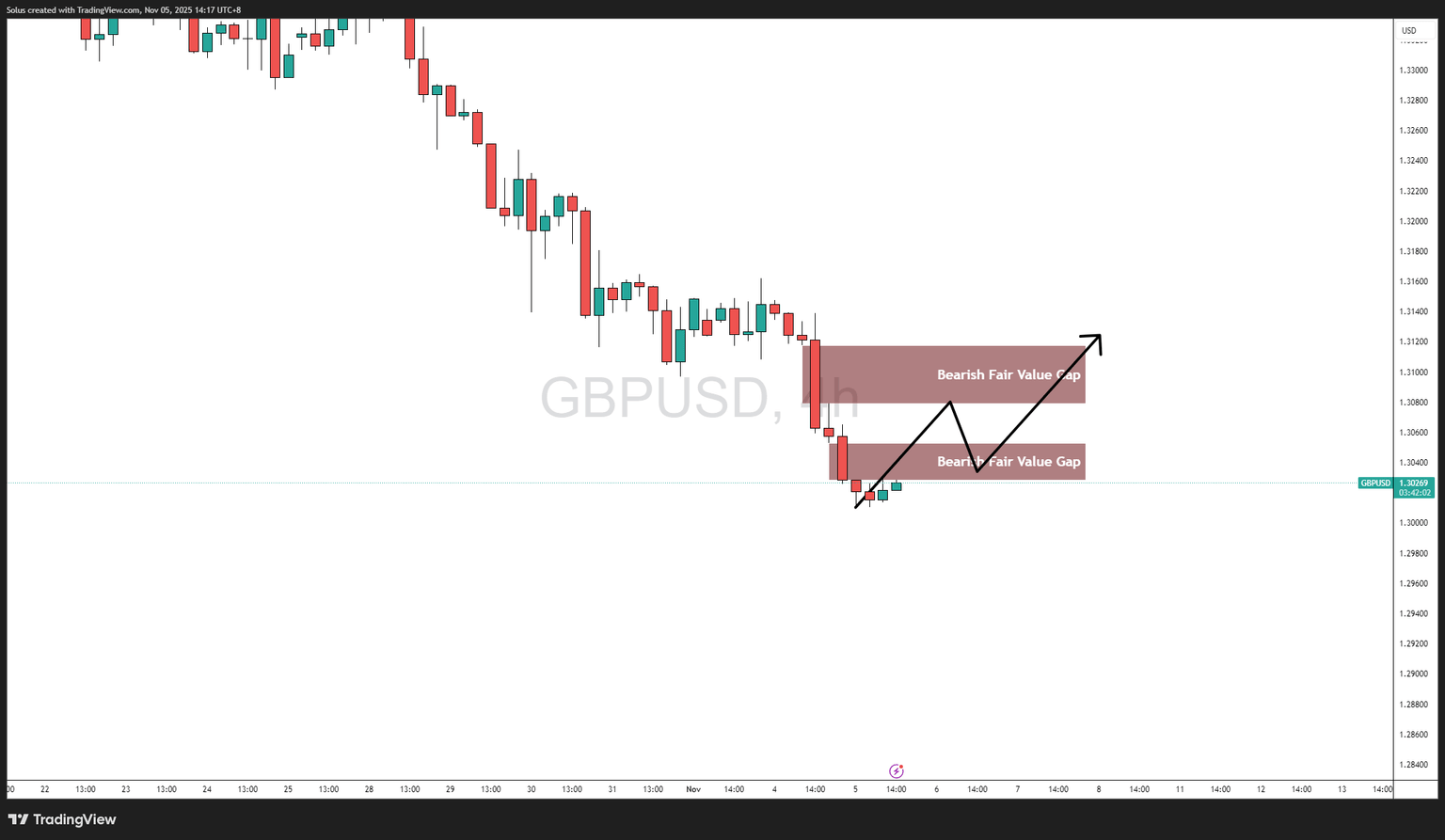

On the 1-hour chart, GBP/USD remains locked in a mild consolidation within a clear short-term downtrend. Price continues to print lower highs and lower lows, hovering just above the 1.3000 handle, a level that now acts as both psychological and structural support.

Two major bearish Fair Value Gaps (FVGs) define the resistance zones:

- 1st FVG: 1.3040 – 1.3070.

- 2nd FVG: 1.3080 – 1.3120.

The pair is currently attempting a shallow retracement into these inefficiencies, but the broader bias remains bearish, especially with USD strength dominating sentiment ahead of both the BoE meeting and U.S. data releases.

Technical outlook

Bullish scenario: Relief rally if FVGs reclaimed

A corrective rally may unfold if GBP/USD reclaims short-term inefficiencies:

- A break above 1.3080–1.3120 indicates intraday strength and potential structure shift.

- Price could extend toward 1.3180–1.3240, aligning with H4 imbalance fills.

- This setup would require softer U.S. data or a dovish market interpretation of BoE remarks.

- Invalidation: Failure to hold above 1.3040 negates the recovery bias.

This remains a retracement scenario within a dominant bearish framework.

Bearish scenario: Rejection from FVGs and continuation lower

The dominant structure favors downside continuation:

- Rejection from 1.3040–1.3080 (lower FVG) could trigger renewed bearish momentum.

- A clean break below 1.3000 exposes 1.2940 → 1.2880 → 1.2840.

- Macro alignment: BoE’s cautious tone + Fed’s hawkish bias = sustained USD advantage.

- Any upside attempt is likely to serve as liquidity grabs before further decline.

This scenario remains the base case while the dollar stays strong and the BoE maintains its hold stance.

Market summary: Caution vs. conviction

The BoE’s expected rate hold underscores its cautious balancing act between cooling inflation and fragile growth, while the U.S. dollar enjoys tailwinds from stronger economic data and persistent policy divergence.

Technically, GBP/USD remains vulnerable beneath two key Fair Value Gaps, with bearish continuation favored unless structural reversal signs appear above 1.3140.

For traders, the narrative is clear:

- Macro: USD dominance and BoE hesitation keep the Pound capped.

- Technical: FVGs act as resistance zones until decisively cleared.

- Bias: Sell rallies into inefficiencies unless macro tone shifts.

Author

Jasper Osita

Independent Analyst

Jasper has been in the markets since 2019 trading currencies, indices and commodities like Gold. His approach in the market is heavily accompanied by technical analysis, trading Smart Money Concepts (SMC) with fundamentals in mind.