Biden doubles lumber tariffs, aren't home prices high enough already?

The Commerce Department announced it will double the average tariff on Canadian softwood lumber to 17.9% from 8.99%.

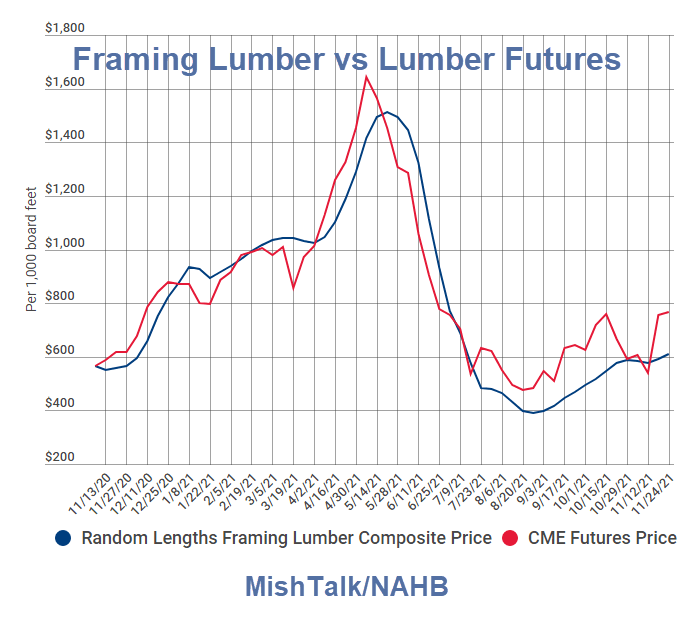

Lumber Futures Synopsis

- For decades the price of lumber futures mostly stayed in a range of $240 to $440.

- In February of 2020, pre-pandemic, lumber futures were about $400.

- In May of 2021, lumber futures approached $1700.

- Futures are now $795, nearly double the pre-pandemic price.

Framing Lumber Prices

The National Association of Home Builders discusses the relationship between lumber futures and Framing Lumber Prices.

Skyrocketing lumber prices in 2020 and early 2021 caused the average price of a new single-family home to increase by nearly $30,000. The latest framing lumber prices are down significantly from their peak in May, but are trending upward yet again. NAHB continues to work with government officials to develop long-term solutions to the broader supply challenges that threaten housing affordability across the nation.

The price tracker above provides an overview of the behaviors within the U.S. framing lumber pricing market. The information is sourced each week using the Random Lengths Framing Lumber Composite which is comprised using prices from the highest volume-producing regions of the U.S. and Canada.

Biden Doubles Tariff On Canadian Lumber

Please note Biden Joins the Lumber Trade Wars.

President Biden says he feels your pain regarding inflation, and he’s made public-relations moves to show it, begging ports to move goods faster and OPEC to produce more oil. Too bad his Administration’s policies reveal different priorities.

The Commerce Department said last week that it will double the average tariff on Canadian softwood lumber to 17.9% from 8.99%. Softwoods like spruce and pine are the backbone of light construction, and a steady supply is key to restraining the rising cost of home building. For decades U.S. sawmills haven’t been able to meet domestic demand, but they’ve leaned on government to protect their market share.

There’s rarely a good time for trade restrictions, but the timing of this one is tragicomical. The same month Commerce revealed its tariff plan, lumber hit a record price of $1,650 per thousand board-feet, more than three times the level before pandemic supply shortages began.

The Biden Administration’s tariff resumes the U.S.-Canada lumber war where President Trump left off. After a 2006 agreement on softwood lumber expired in 2015, Trump Commerce Secretary Wilbur Ross later proposed to raise tariffs on imports.

President Biden campaigned against his predecessor’s tariffs, but his trade policy in office has been nearly as protectionist. The Administration’s priority is pleasing unions and favored businesses, not reducing inflation.

Biden Joins Trump's Lumber War

Apparently an additional $30,000 to the price of an average home is OK with president Biden.

Perhaps the tariffs will save a hundred US lumber jobs. Perhaps not because it will likely stall the construction of thousands of new homes by making them even more unaffordable.

Author

Mike “Mish” Shedlock's

Sitka Pacific Capital Management,Llc