AUD/USD: Watch for a high for the day if tested

AUD/USD, NZD/USD, AUD/JPY

AUDUSD up one day, down the next day in the sideways trend (exactly like the 3week period from end of March to the beginning of April). We retest the best support 7715/05.

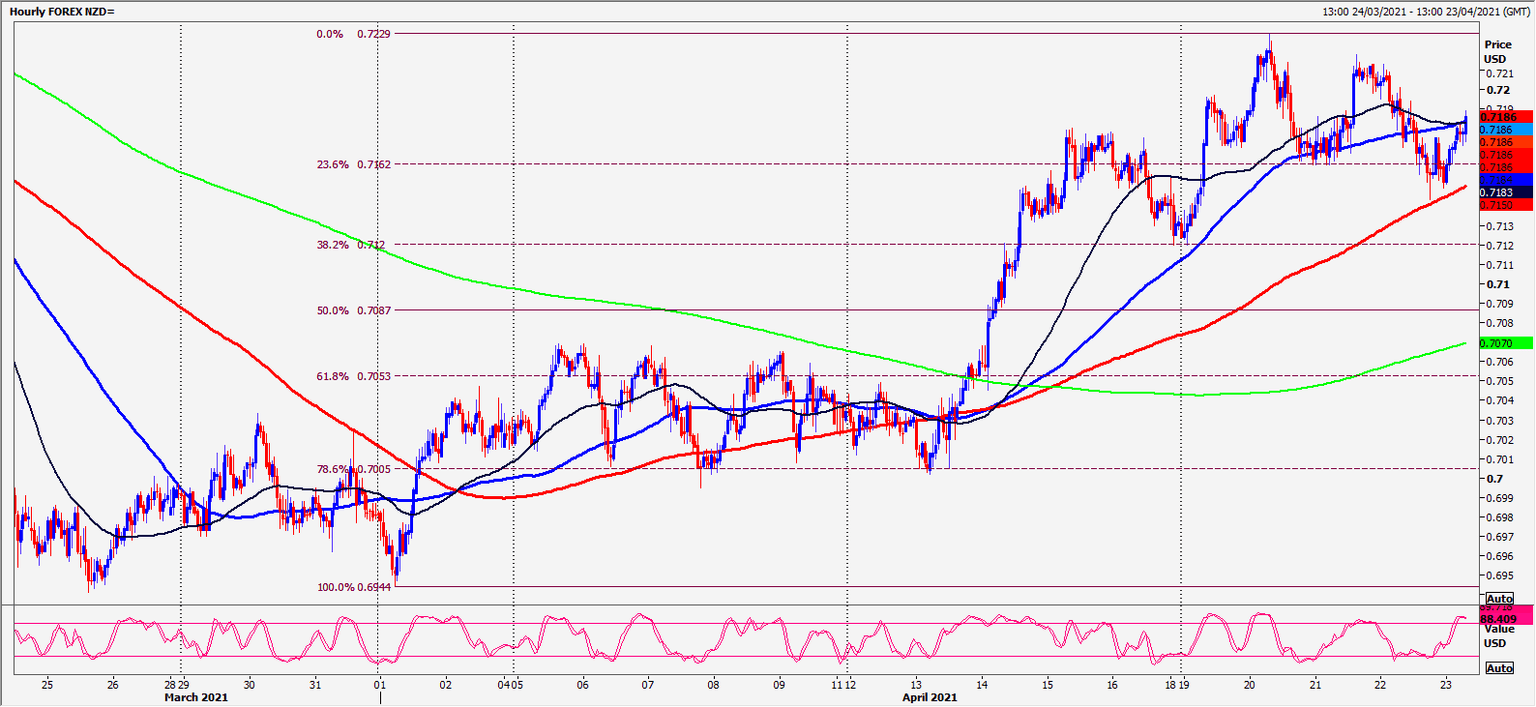

NZDUSD also in an ”up one day, down the next day” trend as we retest first support 7170/60, but overran to 7143.

AUDJPY remains in a 2 month sideways trend. Holding below the 500 weeks moving average at 8440/50 should be negative but the pair do not want to move significantly in any direction at this stage.

Daily analysis

AUDUSD retests best support at 7715/05 (we bottomed exactly at) with another bounce to test minor resistance at 7745/55. Above 7765 look for 7785/90 before resistance at 7815/25. Watch for a high for the day if tested.

Best support again at 7715/05 today. Longs need stops below 7685. A break lower targets 7675 & minor support at 7660/50.

NZDUSD first support at 7160/50. A bounce targets 7190 with strong resistance against 7210/20. Shorts need stops above 7230. A break higher targets 7245/50 &7260/70 with resistance at 7285/90.

First support at 7160/40 but below 7140 targets 7125/15. Further losses target 7090/7080.

AUDJPY bottomed exactly at first support at 8320/00 for the second day. The pair remains in an erratic sideways trend. A break lower risks a slide to support at8240/30. Longs need stops below 8215.

We topped exactly at first resistance at 8380/90 again yesterday. Above 8400 allows further recovery to 8435/45.

Chart

Author

Jason Sen

DayTradeIdeas.co.uk