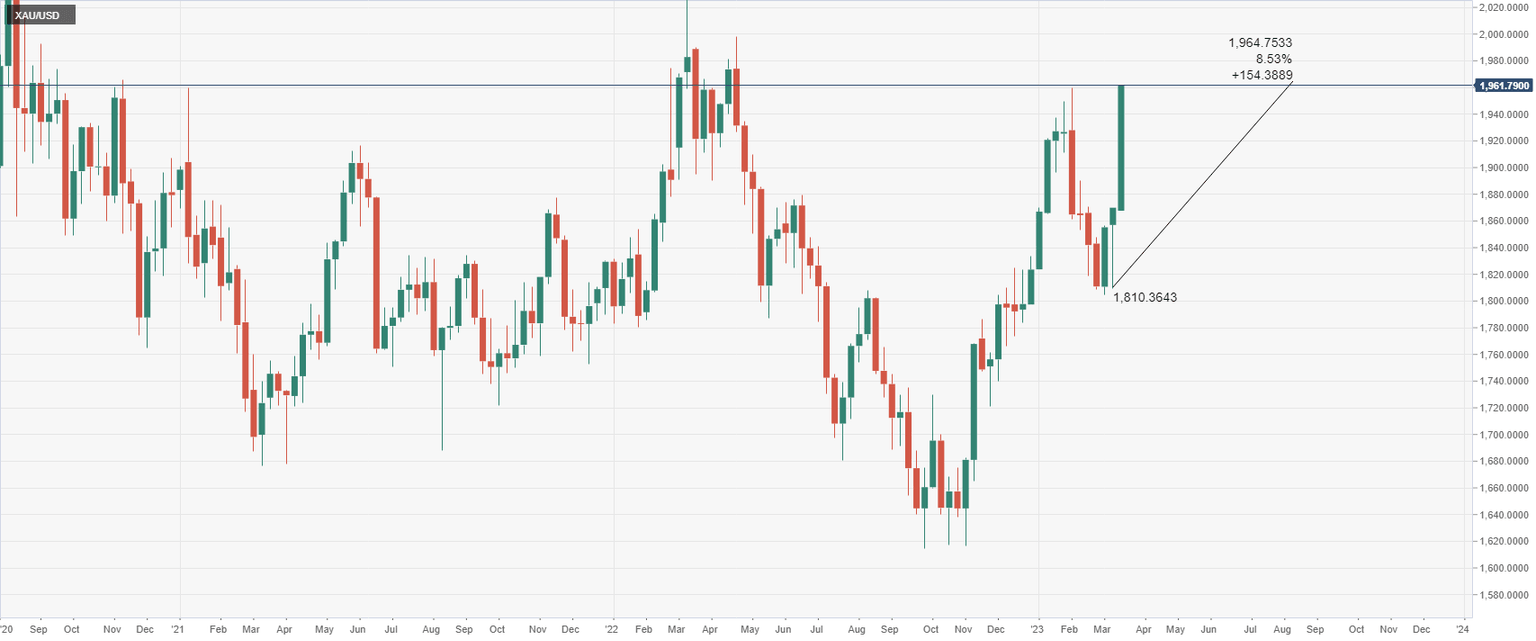

Breaking: Gold rises above $1,960 for the first time since April 2022

Gold price rose further on Friday reaching the highest level in eleven months, rising above $1,960/oz. XAU/USD is rising by more than $40, adding to weekly gains.

Risk aversion amid the banking crisis and lower US Treasury bond yields continue to boost the demand for the yellow metal. Since March 9, XAU/USD has risen more than $150 or 8%.

The rally gained speed last Friday, following the Nonfarm Payroll report and then accelerated following the collapse of Silicon Valley Bank (SVB). The ongoing turmoil softened central banks tightening expectations, pushing government bond yields lower.

Gold at $2,000 now looks like an achievable goal in the short term. Prior to the mark, a strong resistance area is seen around the $1,980 zone.

Author

FXStreet Team

FXStreet