- Cryptocurrencies are consolidating their gains after the robust weekend gains.

- All three top digital coins face hurdles ahead of the next leg higher.

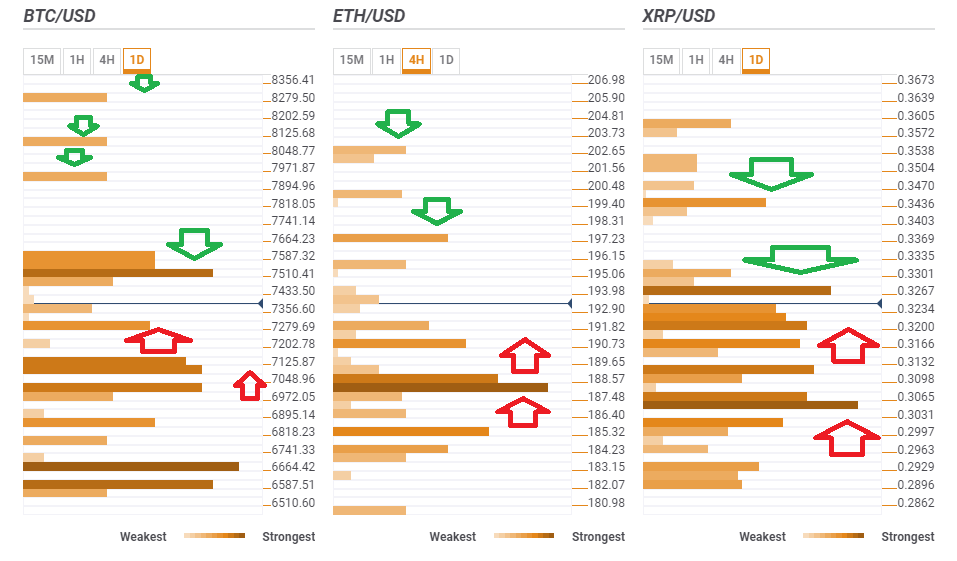

- Here are the levels to watch according to the Confluence Detector.

Cryptocurrencies have not moved higher today but at least they are not crashing like stock markets, amid an escalation in the US-Sino trade war. What's next for digital coins?

Every bullish trend has its corrections as well. Bitcoin, Ethereum, and Ripple each need to break above clear resistance clusters in order to run higher once again.

This is what the Crypto Confluence Detector shows in its latest update:

BTC/USD eyes $7,510

Bitcoin, the grandaddy of cryptocurrencies that led the recent run, faces resistance at $7,510 which is the convergence of the Pivot Point one-month Resistance 3, the Bollinger Band 15min-Upper, the PP one-day Resistance 1, the PP 1s-R3, and more.

If it breaks higher, it has three equal upside targets: $7,930 (PP one-day R2), $8,079 (Fibonacci 161.8% one-day), and $8,279 (PP 1d-R3).

BTC/USD has initial downside support at $7,279 which is the confluence of the previous 1h-low, the BB 1h-Upper, and the Fibonacci 61.8% one-day.

Further down, at $7,188 we see a dense cluster including the Simple Moving Average 5-4h, the SMA 100-15m, the BB 1h-Middle, the Fibonacci 38.2% one-day, and the SMA 50-1h.

ETH/USD eyes $197

Ethereum needs to break above $197 where the Pivot Point one-week R2 awaits.

Further up, $202 is the meeting point of the previous daily high and the BB 4h-Upper.

ETH/USD enjoys support at $190 which is the convergence of the SMA 10-1h, the Fibonacci 38.2% one-day, and the SMA 10-4h.

Vitalik Buterin's brainchild has substantial support at $188 which is a minefield including the previous monthly high, the BB 15min-Lower, and the Fibonacci 23.6% one-day.

XRP/USD looks at $0.3267

Ripple managed to cross several hurdles but now faces another one at $0.3267 which is a cluster including the PP 1d-R1, the BB 1h-Upper, the PP 1w-R3, the Fibonacci 161.8% one-week, the previous 4h-high, and more.

The next target is $0.3436 which is where the PP 1d-R2 and the Fibonacci 38.2% one-month converge.

XRP/USD has immediate support at the round number of $0.3200 which is the confluence of the SMA 200-15m, the SMA 50-1h, the previous 1h-low, the SMA 50-1d, the SMA 5-1h, and more.

The next substantial cushion is at $0.3045 where the Fibonacci 61.8% one-week, the BB 1d-Middle, and the previous daily low all meet up.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Why crypto may see a recovery right before or shortly after Bitcoin halving

Cryptocurrency market is bleeding, with Bitcoin price leading altcoins south in a broader market crash. The elevated risk levels have bulls sitting on their hands, but analysts from Santiment say this bleed may only be cauterized right before or shortly after the halving.

Manta Network price braces for volatility as $44 million worth of MANTA is due to flood markets

Manta Network (MANTA) price was not spared from the broader market crash instigated by a weakness in the Bitcoin (BTC) market. While analysts call a bottoming out in the BTC price, the Web3 modular ecosystem token could suffer further impact.

Bitcoin price uptrend to continue post-halving, Bernstein report says as traders remain in disarray

Bitcoin is dropping amid elevated risk levels in the market. It comes as traders count hours to the much-anticipated halving event. Amid the market lull, experts say we may not see a rally until after the halving.

OMNI post nearly 50% loss after airdrop and exchange listing

Omni network (OMNI) lost nearly 50% of its value on Wednesday after investors dumped the token following its listing on top crypto exchanges. A potential reason for the crash may be due to the wider crypto market slump.

Bitcoin: BTC’s rangebound movement leaves traders confused

Bitcoin (BTC) price has been hovering around the $70,000 psychological level for a few weeks, resulting in a rangebound movement. This development could lead to a massive liquidation on either side before a directional move is established.