- Australian data was mixed these days but still encouraging.

- Wall Street participants have already digested the Fed’s aggressive stance.

- AUD/USD is at an inflexion point with limited bearish potential.

The AUD/USD pair trades around the 0.7400 level, down for a second consecutive week. The aussie has been relatively resilient to the broad greenback’s strength, partially helped by firmer commodity prices and partially due to contained declines in stocks markets. Wall Street has already priced in the US Federal Reserve’s aggressive monetary policy stance, and the latest inflation figures spurred hopes price pressures may be close to a top.

Risk-off having a limited impact

Nevertheless, financial markets remain in risk-off mode. Record inflation around the globe keeps worsening amid a coronavirus outbreak in China, leading to local lockdowns and the Eastern European crisis. Both are exacerbating supply chain issues, one of the main reasons price pressures are soaring.

In the past week, gold prices soared, with the bright metal currently changing hands at around $1,973 a troy ounce, usually a bullish factor for AUD/USD. But in general, commodity prices are on the rise amid shortages related to the Russian invasion of Ukraine. President Vladimir Putin has said that diplomatic talks are at a dead-end, as Kyiv has broken the agreement reached in Turkey. Attacks continue, and western nations keep piling up sanctions on Russia, although

The Australian economy keeps recovering

Australian data was mixed. March NAB’s Business Confidence improved by more than anticipated to 16, while NAB’s Business Conditions were also higher, reaching 18. However, Westpac Consumer Confidence fell to -0.9% in April, while March employment-related figures disappointed. The country added just 17.9K new jobs in March, missing the market’s expectations. In the mentioned period, the country lost 2.7K part-time jobs while adding 20.5K full-time positions. The Unemployment Rate held steady at 4%, missing the 3.9% anticipated by analysts. Finally, the Participation Rate also remained unchanged at 66.4%.

The US published the March Consumer Price Index, up to 8.5% YoY, a fresh multi-decade high. The core figure rose by less than anticipated, reaching 6.5% in the same period. Ahead of the release, the White House warned it could be “elevated,” and the final reading was taken positively, as market participants were anticipating a much worse figure. Still, inflation remains at worrisome levels, although at least the Federal Reserve is working on it.

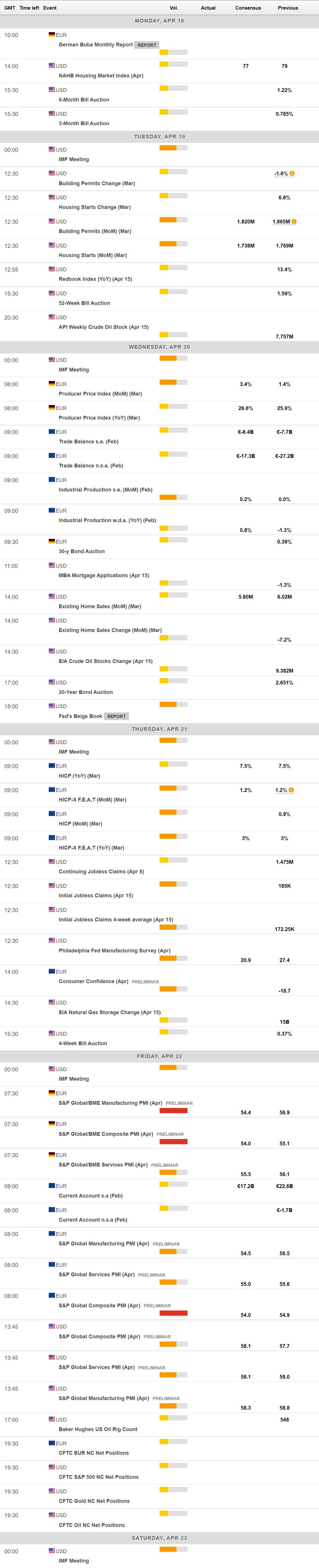

The upcoming week will start with China publishing March Retail Sales and Industrial Production and the Q1 Gross Domestic Product. Asian shares were sharply down on Friday, hinting at a risk-off start to the next week, which could be fueled by discouraging Chinese data.

Later in the week, Australia will release housing-related data and the March Westpac Leading Index. By the end of the week, S&P Global will publish the preliminary estimates of the April PMIs for all major economies.

AUD/USD technical outlook

From a technical perspective, AUD/USD is at an inflexion point. The pair is hovering around the 38.2% retracement of this year’s rally, measured from 0.6966 to 0.7660. The weekly chart shows that technical indicators eased within positive levels but also that their bearish strength is limited. In the same chart, the pair is above all of its moving averages, although the 20 SMA is between the longer ones. Overall, the ongoing decline seems corrective.

According to the daily chart, the chances of a bearish extension are greater. The pair is developing below a now flat 20 SMA, while the longer ones are also directionless, although below the current level. Technical indicators, in the meantime, head firmly lower within negative levels.

Once below 0.7390, the pair could extend its decline towards 0.7310, the next Fibonacci support level, en route to 0.7230. The main resistance level to watch is 0.7500, as once above it, the pair could recover up to the aforementioned yearly high.

AUD/USD sentiment poll

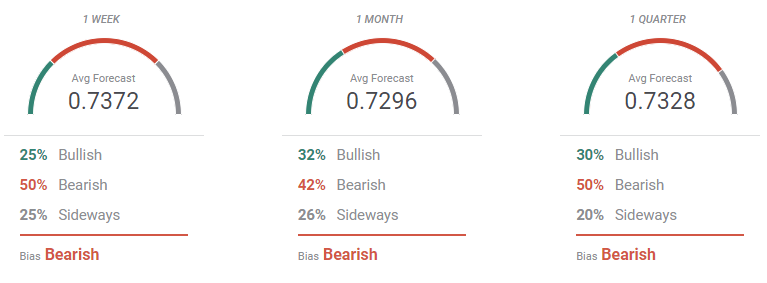

The FXStreet Forecast Poll hints at a bearish extension. The AUD/USD pair is seen bearish in the three time-frame under study, although at the time being, the downside seems limited. The pair is seen on average around the 0.7300 level in all cases. Still, a bearish breakout is not confirmed.

The Overview chart shows that the three moving averages are neutral to mildly bullish, reflecting investors’ reluctance to sell the pair. The monthly and quarterly moving averages aim marginally higher, while the spread of possible targets is quite wide, a sign of directional uncertainty.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD stays below 1.0700 after US data

EUR/USD stays in a consolidation phase below 1.0700 in the early American session on Wednesday. The data from the US showed a strong increase in Durable Goods Orders, supporting the USD and making it difficult for the pair to gain traction.

USD/JPY refreshes 34-year high, attacks 155.00 as intervention risks loom

USD/JPY is renewing a multi-decade high, closing in on 155.00. Traders turn cautious on heightened risks of Japan's FX intervention. Broad US Dollar rebound aids the upside in the major. US Durable Goods data are next on tap.

Gold trades on the back foot, manages to hold above $2,300

Gold struggles to stage a rebound midweek following Monday's sharp decline but manages to hold above $2,300. The benchmark 10-year US Treasury bond yield stays in the green above 4.6% after US data, not allowing the pair to reverse its direction.

Worldcoin looks set for comeback despite Nvidia’s 22% crash Premium

Worldcoin price is in a better position than last week's and shows signs of a potential comeback. This development occurs amid the sharp decline in the valuation of the popular GPU manufacturer Nvidia.

Three fundamentals for the week: US GDP, BoJ and the Fed's favorite inflation gauge stand out Premium

While it is hard to predict when geopolitical news erupts, the level of tension is lower – allowing for key data to have its say. This week's US figures are set to shape the Federal Reserve's decision next week – and the Bank of Japan may struggle to halt the Yen's deterioration.