S&P 500

The S&P index is consolidating under new 10-week high (4095) hit earlier today, in extension of Wednesday’s 3.3% rally, powered by comments from Fed Chair Powell about easing the pace of tightening in coming months.

The index remains at the front foot following the second consecutive month of gains (up nearly 14% in Oct-Nov), but recovery of the fall in first nine months of 2022, when risk sentiment was battered strong increase of interest rates, is unlikely to see stronger extension, as looming recession would sour the sentiment.

Although inflation in the US eased in past two months, supporting the view that strong price pressures have peaked, economists remain pessimistic, expecting that the recent Fed actions in form of sharp rate hikes, to fight soaring inflation, have slowed economic activity to the point when the economy will slide into recession.

The notion is supported by persisting concerns about elevated inflation for services and tight labor sector, as the latest data showed opening of 1.7 jobs for each unemployed person.

Investors focus on November job report on Friday, which is expected to give more details about the situation in the sector, as well as US inflation report for November (due on Dec) which would also provide fresh signals.

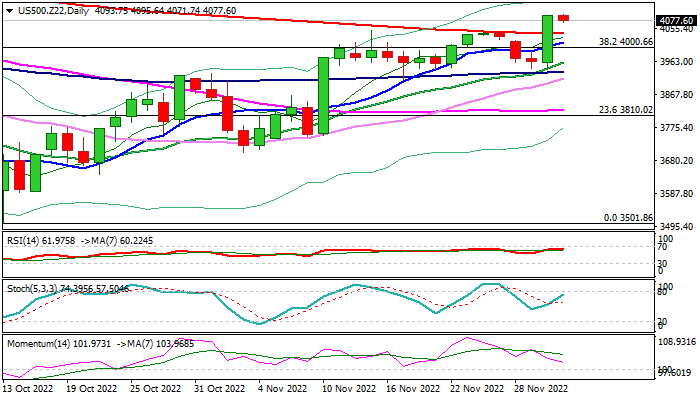

Technical studies remain in bullish setup on daily chart, with additional positive signal generated on Thursday’s break and close above 200DMA (index is trading above this indicator for the first time since early April), though fading bullish momentum warns that near-term action might be running out of steam.

Weekly studies are mixed and lack clearer signals, while bearish tone still prevails on monthly chart.

Near-term action needs to register repeated close above 200DMA (4040) to firm the structure and keep focus at the upside, for attack at next target at 4154 (50% retracement of 4807/3501).

Next strong supports lay at 4000 zone (10DMA / broken Fibo 38.2%), guarding lower breakpoint at 3940 zone (100DMA / Nov 29,30 lows), loss of which would generate initial signal of stall of a multi-week recovery..

Res: 4095; 4154; 4196; 4232.

Sup: 4040; 4000; 3959; 3940.

The information contained in this document was obtained from sources believed to be reliable, but its accuracy or completeness cannot be guaranteed. Any opinions expressed herein are in good faith, but are subject to change without notice. No liability accepted whatsoever for any direct or consequential loss arising from the use of this document.

Recommended content

Editors’ Picks

AUD/USD tumbles toward 0.6350 as Middle East war fears mount

AUD/USD has come under intense selling pressure and slides toward 0.6350, as risk-aversion intensifies following the news that Israel retaliated with missile strikes on a site in Iran. Fears of the Israel-Iran strife translating into a wider regional conflict are weighing on the higher-yielding Aussie Dollar.

USD/JPY breaches 154.00 as sell-off intensifies on Israel-Iran escalation

USD/JPY is trading below 154.00 after falling hard on confirmation of reports of an Israeli missile strike on Iran, implying that an open conflict is underway and could only spread into a wider Middle East war. Safe-haven Japanese Yen jumped, helped by BoJ Governor Ueda's comments.

Gold price jumps above $2,400 as MidEast escalation sparks flight to safety

Gold price has caught a fresh bid wave, jumping beyond $2,400 after Israel's retaliatory strikes on Iran sparked a global flight to safety mode and rushed flows into the ultimate safe-haven Gold. Risk assets are taking a big hit, as risk-aversion creeps into Asian trading on Friday.

WTI surges to $85.00 amid Israel-Iran tensions

Western Texas Intermediate, the US crude oil benchmark, is trading around $85.00 on Friday. The black gold gains traction on the day amid the escalating tension between Israel and Iran after a US official confirmed that Israeli missiles had hit a site in Iran.

Dogwifhat price pumps 5% ahead of possible Coinbase effect

Dogwifhat price recorded an uptick on Thursday, going as far as to outperform its peers in the meme coins space. Second only to Bonk Inu, WIF token’s show of strength was not just influenced by Bitcoin price reclaiming above $63,000.