I think the best analogy to describe to someone who doesn’t trade or hasn’t got any experience with financial markets, what is affecting price action, why do prices move up and down, is to offer an example from the world of physics and the nature of an electron.

An electron, is a particle and a wave of energy at the same time, it has got a dual nature. As a particle, more or less we can predict its trajectory but as a cloud of energy, it is becoming impossible. Therefore, if we try to predict where an electron will be the next second, we can guess that it will be roughly in a specific area, rather than an exact point.

Exactly the same principle applies for asset prices in financial markets. Everything depends on fundamentals, it is actual economic indicators that drive prices and tell us exactly the fair price of an asset but, at the same we also have sentiment involved, behavioral factors and expectations about the future which can cause serious abnormality, since we know humans often overreact!

This year 2017, has been more difficult to trade, especially for FX, because it has been driven mostly by expectations and sentiment and less on fundamentals, to put it in another way the carry trade wasn’t a major driver of prices, as it has been in previous years.

However, we can still uncover opportunities and high probability set ups if we combine our fundamental outlook together with technical.

In the previous week, the EUR has been weakening against other major currencies.

Possible future ECB policy, leaving the door open for an extension of the current QE and dovish rhetoric from Mario Draghi and other ECB members has caused the German yields to move slightly lower, despite tapering of the QE next year.

Take a look at the 2y German yields.

The 2y yields technically are right on the trend-line, finding support and we will be eagerly looking for developments over the next few weeks and evaluate the reaction of buyers vs sellers in this area.

But the yields themselves in absolute terms doesn’t mean anything, please take a look at the German differential against the US 2y yields.

We can clearly see that the yield differential is strongly in favor of the US and has been rising further the last week. What do you think is more likely to have happened to the EURUSD pair?

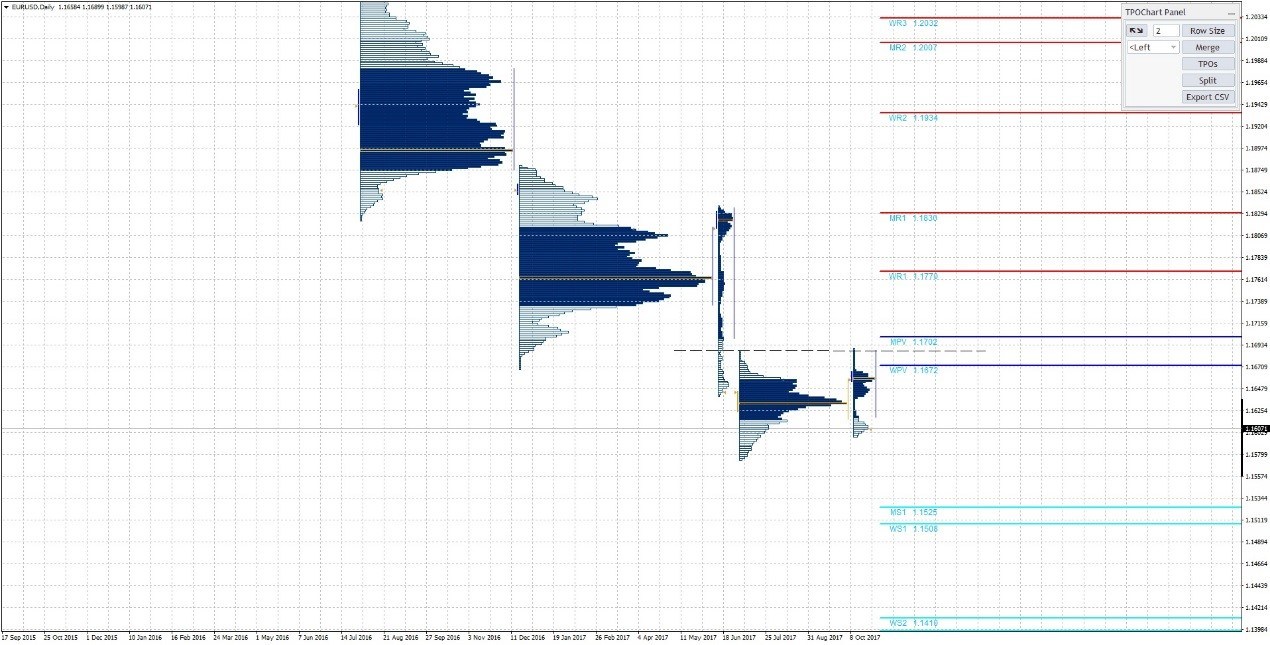

This is a market profile chart of the EURUSD.

We can clearly see that the move lower in the EUR is positively correlated with the move higher of the US-German 2y spread and that exactly is going to be the catalysts that will drive prices next.

In the short term, we are prepared for a potential move towards the 1.15 level, where we would be happy to evaluate potential long positions in favor of the EUR. We say this since we believe that the US FED will not be able, in this international financial environment, to begin a gradual hiking cycle. The Trump administration is against a strong dollar policy and we also believe that the so called “Trump trade” will fade, as the much anticipated tax cuts or any other measure will be meaningless and won’t have a material impact in the US economy. On the contrary we see further risks ahead and the spread will not continue to rise indefinitely.

Technically we can also notice on the profile chart the recent rejections and the thin volumes at the 1.17 area, where the sellers took control thus, in the short term, we are interested for any potential longs only above 1.17, if that area is accepted and we see volumes building up again.

However, the EUR didn’t only move lower against the USD but against the GBP too.

Would you like to guess, what happened to the GBP-German 2y yields differentials?

Take a look below.

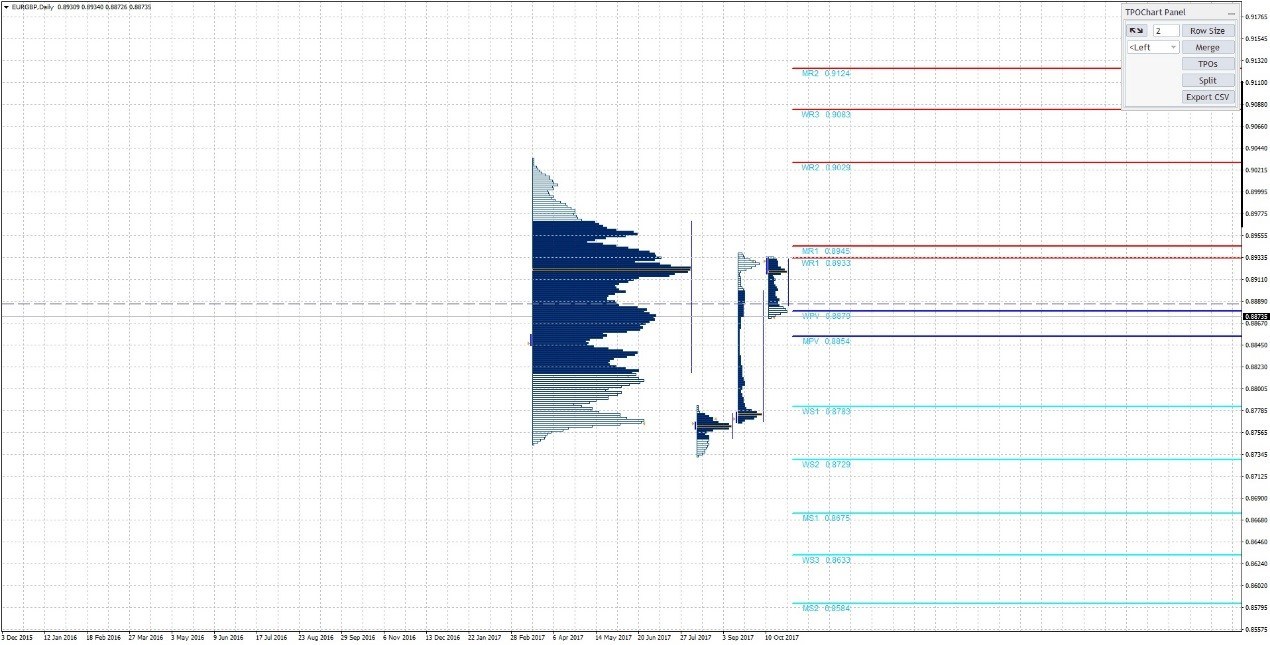

You can see that the yields spread spiked higher in favor of the UK. What happened to the EURGBP? Here, is the market profile chart.

The EUR moved lower of course against the GBP, as it was hard to break the confluence of resistances around 0.8940, as well as the High Volume node that is exactly on that area. Our target is the bottom of the balance around the 0.88 area. That depends of course on the yield differential over the next few days.

What about the GBP against the USD?

The spread is slightly in favor of the USD and this justifies the move higher of the USD against the GBP recently but, we can see that the spread struggles to break higher and price is consolidating inside this range. Of course, many depend on ongoing Brexit negotiations but we feel that the spread might start correcting lower.

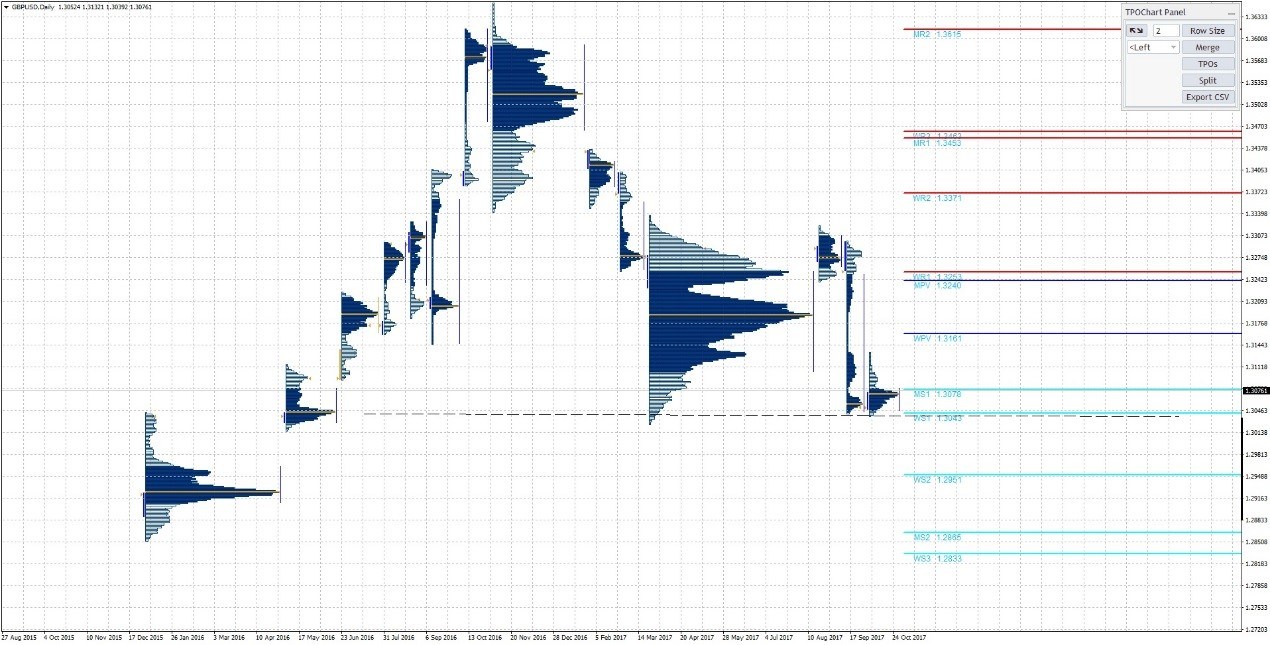

This is impacting the GBPUSD pair. Let’s take a look at the market profile chart.

Definitely, we will not be looking to sell the GBP against the USD at the bottom of that larger balance and the possibility of a correction in the spread.

In the short term, we will be looking for a small speculative position to the upside, around these levels, provided of course that the spread stays that way. But even if we have a correction lower in the GBPUSD, I am more biased to buy the GBP vs the USD, due to the yield spread and other fundamental factors that have to do with the US economy mostly.

In this article, we have shown you how fundamental factors, such as the interest rate differentials, can provide clarity and offer you a clear vision about what is likely to happen next. Combining fundamentals together with proper technical, can help you discover high probability setups, with good risk/reward characteristics. Over the next few weeks please pay attention to the short term spreads, since that is going to drive currencies and determine price action.

Thank you.

None of the fotis trading academy nor its owners (expressly including but not limited to Marc Walton), officers, directors, employees, subsidiaries, affiliates, licensors, service providers, content providers and agents (all collectively hereinafter referred to as the “fotis trading academy ”) are financial advisers and nothing contained herein is intended to be or to be construed as financial advice

Fotis trading academy is not an investment advisory service, is not an investment adviser, and does not provide personalized financial advice or act as a financial advisor.

The fotis trading academy exists for educational purposes only, and the materials and information contained herein are for general informational purposes only. None of the information provided in the website is intended as investment, tax, accounting or legal advice, as an offer or solicitation of an offer to buy or sell, or as an endorsement, recommendation or sponsorship of any company, security, or fund. The information on the website should not be relied upon for purposes of transacting securities or other investments.

You hereby understand and agree that fotis trading academy, does not offer or provide tax, legal or investment advice and that you are responsible for consulting tax, legal, or financial professionals before acting on any information provided herein. “This report is not intended as a promotion of any particular products or investments and neither the fotis trading academy group nor any of its officers, directors, employees or representatives, in any way recommends or endorses any company, product, investment or opportunity which may be discussed herein.

The education and information presented hereinen is intended for a general audience and does not purport to be, nor should it be construed as, specific advice tailored to any individual. You are encouraged to discuss any opportunities with your attorney, accountant, financial professional or other advisor.

Your use of the information contained herein is at your own risk. The content is provided ‘as is’ and without warranties of any kind, either expressed or implied. The fotis trading academy disclaims all warranties, including, but not limited to, any implied warranties of merchantability, fitness for a particular purpose, title, or non-infringement. The fotis trading academy does not promise or guarantee any income or particular result from your use of the information contained herein. The fotistrainingacademy.com assumes no liability or responsibility for errors or omissions in the information contained herein.

Under no circumstances will the fotis trading academy be liable for any loss or damage caused by your reliance on the information contained herein. It is your responsibility to evaluate the accuracy, completeness or usefulness of any information, opinion, advice or other content contained herein. Please seek the advice of professionals, as appropriate, regarding the evaluation of any specific information, opinion, advice or other content.

Marc Walton, a spokesperson of the fotis trading academy, communicates content and editorials on this site. Statements regarding his, or other contributors’ “commitment” to share their personal investing strategies should not be construed or interpreted to require the disclosure of investments and strategies that are personal in nature, part of their estate or tax planning or immaterial to the scope and nature of the fotis trading academy philosophy.

All reasonable care has been taken that information published on the Fotis trading academy website is correct at the time of publishing. However, the Fotis trading academy does not guarantee the accuracy of the information published on its website nor can it be held responsible for any errors or omissions.

Editors’ Picks

EUR/USD consolidates gains below 1.0700 amid upbeat mood

EUR/USD is consolidating its recovery below 1.0700 in the European session on Thursday. The US Dollar holds its corrective decline amid improving market mood, despite looming Middle East geopolitical risks. Speeches from ECB and Fed officials remain on tap.

GBP/USD clings to moderate gains above 1.2450 on US Dollar weakness

GBP/USD is clinging to recovery gains above 1.2450 in European trading on Thursday. The pair stays supported by a sustained US Dollar weakness alongside the US Treasury bond yields. Risk appetite also underpins the higher-yielding currency pair. ahead of mid-tier US data and Fedspeak.

Gold price shines amid fears of fresh escalation in Middle East tensions

Gold price rebounds to $2,380 in Thursday’s European session after posting losses on Wednesday. The precious metal holds gains amid fears that Middle East tensions could worsen and spread beyond Gaza if Israel responds brutally to Iran.

Ripple faces significant correction as former SEC litigator says lawsuit could make it to Supreme Court

Ripple (XRP) price hovers below the key $0.50 level on Thursday after failing at another attempt to break and close above the resistance for the fourth day in a row.

Have we seen the extent of the Fed rate repricing?

Markets have been mostly consolidating recent moves into Thursday. We’ve seen some profit taking on Dollar longs and renewed demand for US equities into the dip. Whether or not this holds up is a completely different story.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

Discover how to make money in forex is easy if you know how the bankers trade!

5 Forex News Events You Need To Know

In the fast moving world of currency markets, it is extremely important for new traders to know the list of important forex news...

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and...

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.