Swipe price raises doubts about new rally as SXP loses bullish momentum

- Swipe price fails to identify a rising wedge conclusively.

- SXP is connecting the cryptocurrency and fiat worlds.

- Three-day Relative Strength Index (RSI) flashing a bearish momentum divergence.

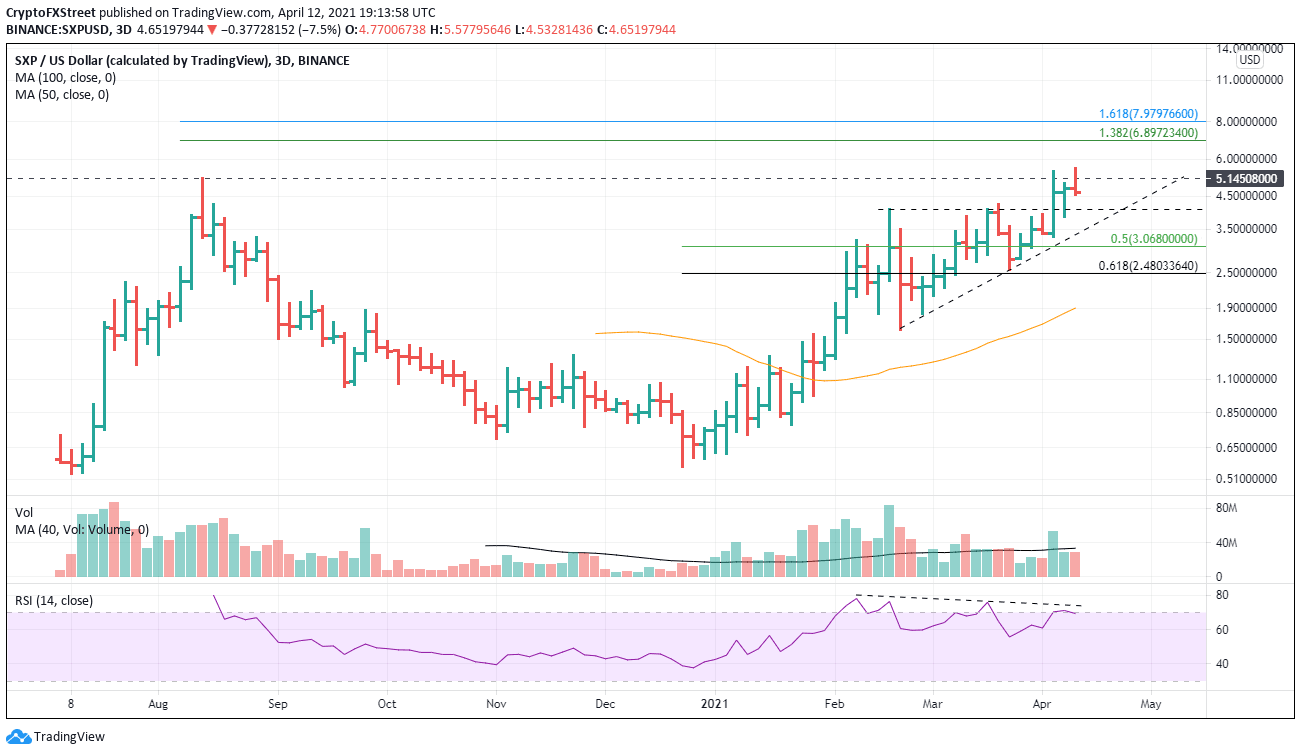

Swipe price has been wedging higher since mid-February until the April 10 breakout into all-time highs. The bearish reversal on April 10 combined with another bearish reversal today should caution traders that the upside will be limited in the short-term, and the potential for a deeper correction is now present.

Swipe price first needs a deeper correction

It is correct to point out that it can take various attempts to overtake a previous all-time high, but when the crack is on waning momentum, as is the case with SXP, the odds of success get ratcheted down. The Swipe RSI has been in a downtrend since the high in early February. Momentum is not on the side of a sustainable rally beyond 2020 high.

SXP may oscillate around the 2020 high at $5.14 for a few more days, but the working thesis forecasts a correction to at least the rising trendline from the February low at $3.38, a decline of nearly 30% from the current price. Not far below is the 50% retracement of the rally beginning in December 2020 at $3.07.

A deeper correction should find support at the near convergence of the late March low at $2.54 and the 61.8% retracement level at $2.48.

SXP/USD 3-day chart

Of course, if some speculators did add to positions on the breakout, they need to be mindful that the drift could continue longer and may even test the 138.2% extension at $6.90 before finally reaching exhaustion. The key is to give a little space to SXP to prove itself.

Author

Sheldon McIntyre, CMT

Independent Analyst

Sheldon has 24 years of investment experience holding various positions in companies based in the United States and Chile. His core competencies include BRIC and G-10 equity markets, swing and position trading and technical analysis.