- Bitcoin is trapped in a tight range marginally above $7,000.

- European politicians are going to discuss crypto related risks in Vienna.

Bitcoin dipped marginally below $7,000 handle and touched $6,960 low during early Asian hours as the upside movement ground to a halt despite positive developments, including the announcement of new crypto index fund launched by Morgan Creek Digital. The digital coin No. 1 is changing hands at $7,000, slightly down both on a daily basis and since the beginning of Thursday.

More regulatory scrutiny to come

Meanwhile, a new regulatory storm might be brewing in Europe as European politicians will discuss the risks and challenges created by digital assets when they meet in Vienna on September 7. The draft note contains a reference to usual suspects such as lack of transparency, money laundering, and terrorist financing, Bloomberg reports.

Bitcoin's technical picture

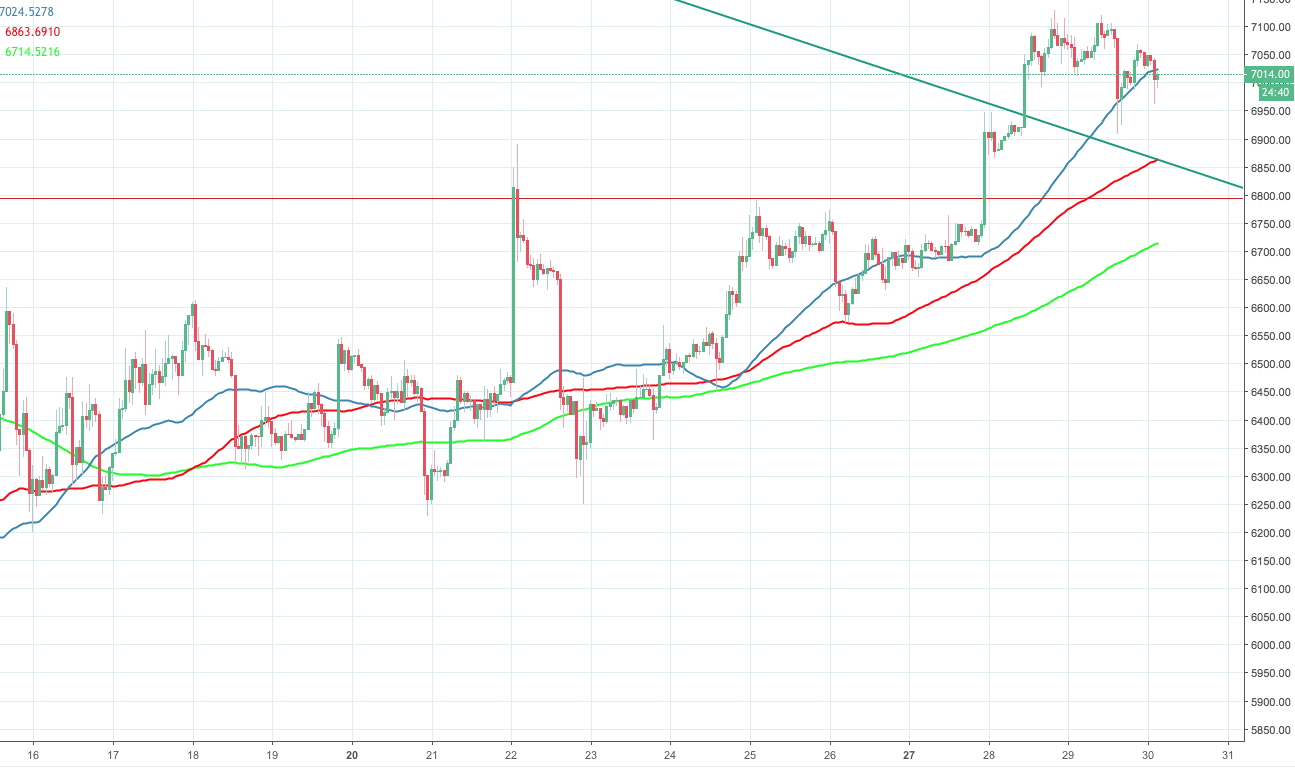

BTC/USD remains close to the critical $7,000. Bearish attempts to take the price lower haven't been successful so far, which means that the coin is still locked in a tight range. A resistance zone packed with strong technical levels goes from the current price to as high as $7,128 (Tuesday's high). If it happens to be cleared, the upside may be extended towards $7,400 (38.2% Fibo retracement level).

On the downside, once below $7,000, the sell-off may gain traction and take the price to the downside trendline and SMA100 1-hour chart (both currently at $6,863).

BTC/USD, 1-hour chart

Get 24/7 Crypto updates in our social media channels: Give us a follow at @FXSCrypto and our FXStreet Crypto Trading Telegram channel

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

Vitalik Buterin slams controversial gambling project ZKasino following scam allegations

Ethereum founder Vitalik Buterin took to Warpcaster, a new type of social network, to condemn ZKasino, a decentralized gambling platform based on Layer 2 Ethereum protocol zkSync.

Starknet jumps 2% after notice inviting specific groups to claim STRK airdrop

Starknet Foundation addressed the groups within the STRK community that were unable to receive the token’s airdrop during the first round. The Layer 2 chain organized an airdrop event in February.

XRP price capped at $0.55 despite retail holdings nearing all-time highs

Ripple price (XRP) failed to break resistance at $0.55 early Wednesday as traders continue to digest Ripple’s recent response to the Securities and Exchange Commission’s (SEC) allegations of illegally selling XRP as a security.

Binance founder Changpeng Zhao could face three-year jail time

US prosecutors are requesting Binance founder and former CEO Changpeng Zhao (CZ) to serve a three-year jail time, according to a Reuters report published Wednesday.

Bitcoin: BTC post-halving rally could be partially priced in Premium

Bitcoin (BTC) price briefly slipped below the $60,000 level for the last three days, attracting buyers in this area as the fourth BTC halving is due in a few hours. Is the halving priced in for Bitcoin? Or will the pioneer crypto note more gains in the coming days?