- GBP/USD has tumbled over 100 pips from the highs after a massive rally.

- Fed Chair Powell´s dovishness and the UK´s exit plan may trigger a new upward move after the correction ends.

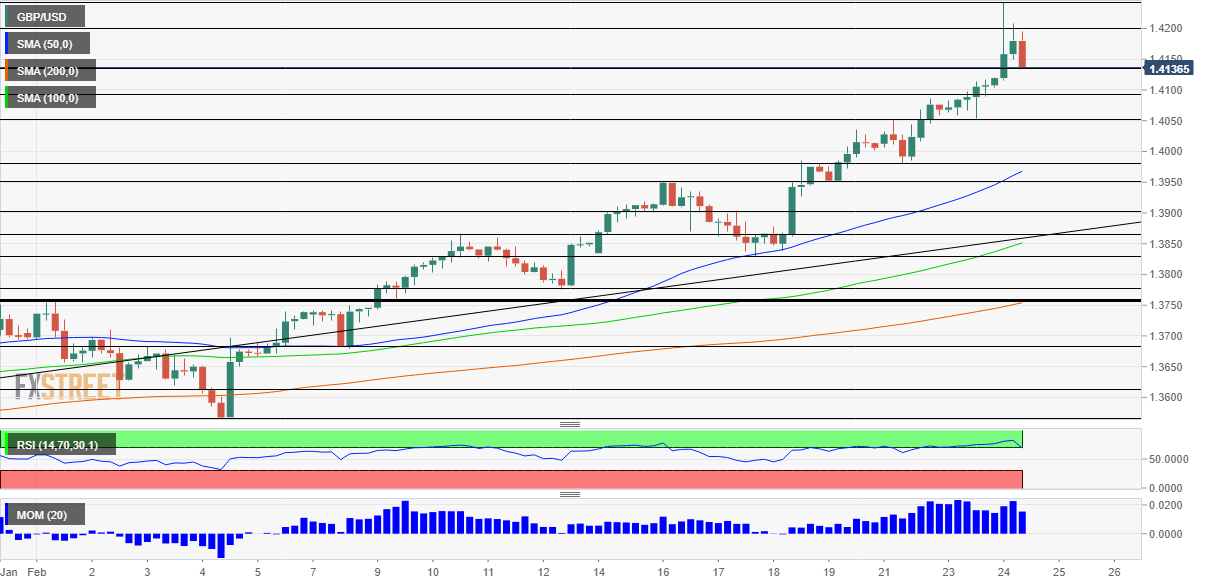

- Wednesday's four-hour chart is showing the currency pair is still suffering from overbought conditions.

Overheating requires a quick cooldown – not US inflation, but rather GBP/USD's rally. Jerome Powell, Chairman of the Federal Reserve, has pushed the dollar down by promising ongoing support to the economy. This "Powell Put" for stocks also contributed to propelling the pound to sky-high levels of 1.4240, last seen nearly three years ago. The reality check has come now.

Sterling's upside move was also underpinned by speculation that the UK may accelerate its exit from restrictions before the government's June 21 target date. Reports by the British press have yet to be confirmed – and will likely turn into nothing.

Quick vaccine-led recovery in Britain also led some market participants to bet on the Bank of England raising rates sooner rather than later. Similar to hiking borrowing costs in America, UK bond yields signaled an early move in response to higher inflation expectations. However, BOE Governor Andrew Bailey and his colleagues – slated for public appearances on Thursday – will likely play down any such move.

Bloated estimates about Britain's bounceback are behind the fall, but the picture remains positive for sterling as the vaccination campaign continues at full speed.

Back to the US, Powell appears before Congress again on Wednesday and will likely reiterate that the Fed "is not thinking about thinking of raising rates" as he once said. Stressing that ten million Americans remain unemployed and that the Fed is there to keep long-term borrowing costs low should alleviate markets. For the dollar, while ten-year Treasury yields hold below 1.50%, the dollar's gains will likely be limited.

See Dollar tumbles as Powell says no rate hike, no taper

Investors will also be awaiting stimulus news. The House is set to approve the $1.9 trillion bill on Friday but the real battle is in the Senate. Any comments from members in the upper chamber may rock markets.

All in all, once the correction is over, GBP/USD has room to rise.

GBP/USD Technical analysis

The Relative Strength Index on the four-hour chart is still above 70 – indicating overbought conditions but below extreme levels seen earlier. Other indicators such as momentum and cable's trading above the 50, 100 and 200 Simple Moving Averages are pointing up.

Support awaits at 1.4095, a temporary cap on the way up, and then by 1.4050, a support line seen earlier this week. Further below 1.3970 and 1.3950 are the next levels to watch.

Resistance is at 1.42, the round number, and then the new 2021 peak of 1.4240. The next lineup high is 1.43.

More Five factors moving the US dollar in 2021 and not necessarily to the downside

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0600 as focus shifts to Powell speech

EUR/USD fluctuates in a narrow range above 1.0600 on Tuesday as the better-than-expected Economic Sentiment data from Germany helps the Euro hold its ground. Fed Chairman Powell will speak on the policy outlook later in the day.

GBP/USD stays below 1.2450 after UK employment data

GBP/USD trades marginally lower on the day below 1.2450 in the early European session on Tuesday. The data from the UK showed that the ILO Unemployment Rate in February rose to 4.2% from 4%, weighing on Pound Sterling.

Gold price remains depressed near $2,370 amid bullish USD, lacks follow-through selling

Gold price (XAU/USD) attracts some sellers during the early part of the European session on Tuesday and reverses a major part of the overnight recovery gains from the $2,325-2,324 area, or a multi-day low.

XRP struggles below $0.50 resistance as SEC vs. Ripple lawsuit likely to enter final pretrial conference

XRP is struggling with resistance at $0.50 as Ripple and the US Securities and Exchange Commission (SEC) are gearing up for the final pretrial conference on Tuesday at a New York court.

Canada CPI Preview: Inflation expected to accelerate in March, snapping two-month downtrend

The Canadian Consumer Price Index is seen gathering some upside traction in March. The BoC deems risks to the inflation outlook to be balanced. The Canadian Dollar navigates five-month lows against the US Dollar.