- GBP/USD has been recovering as US yields retreat from their highs.

- Britain's covid vaccine achievements may allow the pound to extend its recovery.

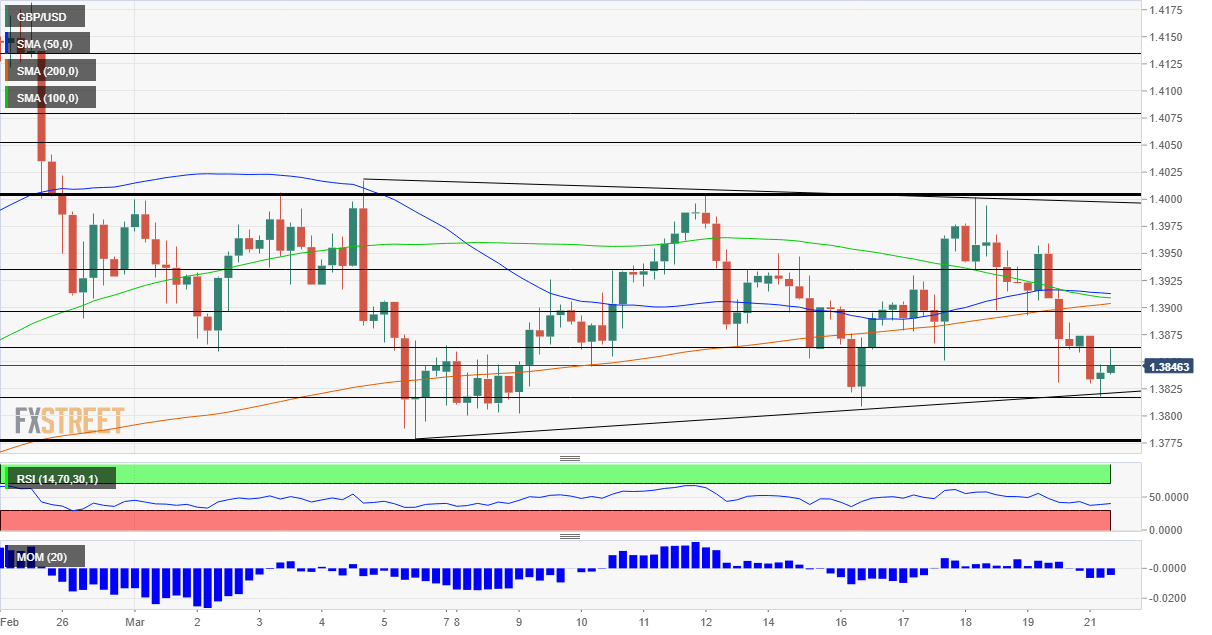

- Monday's four-hour chart is showing cable is setting higher highs.

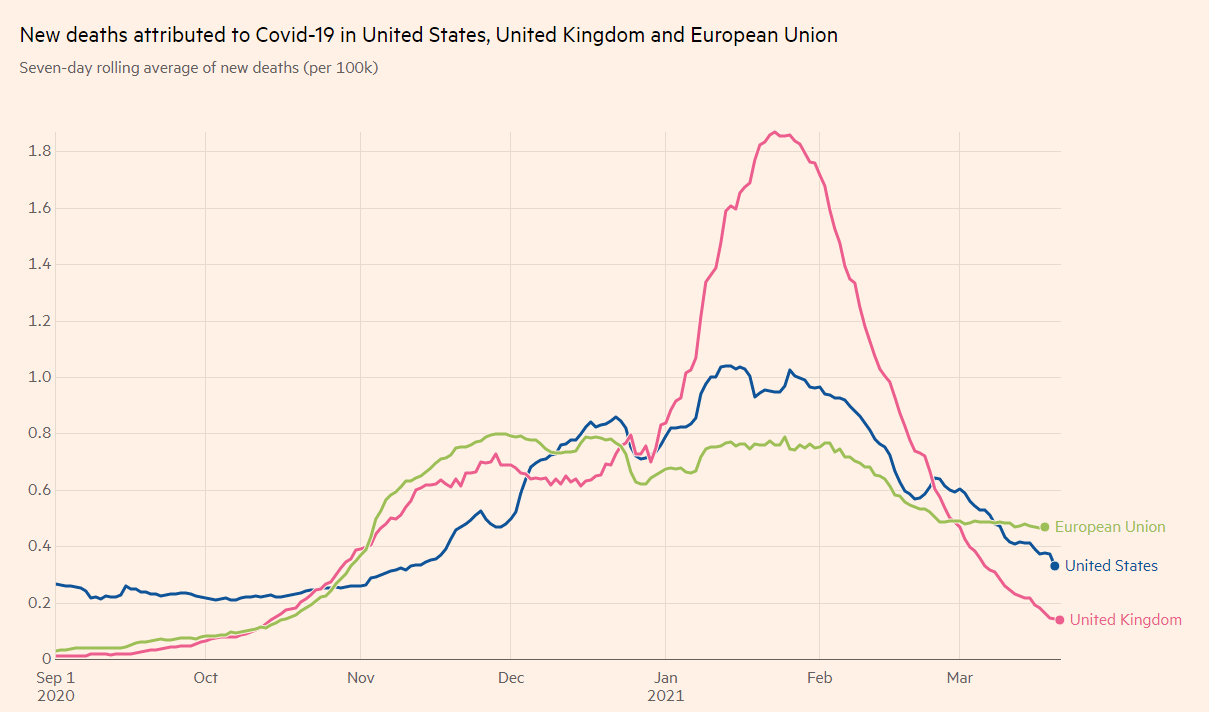

Nearly 27 jabs per second – that is on reflections of Britain's record day of vaccinations on Saturday, which concluded with over 873,000 injections. The UK's rapid immunization campaign is having a material effect in pushing death rates down, and sterling up, allowing it to weather dollar strength. Will it continue?

Vaccines allow Britain's gradual reopening to proceed with confidence, especially after the country reached 50% of all adults. The downside comes due to clashes with the EU over imports and exports of doses. The bloc is far behind the UK and is frustrated that AstraZeneca's inoculations made on EU territory are exported to Britain. Brussels has threatened to block shipments and UK Prime Minister Boris Johnson will reportedly call leaders on the continent to calm things down.

COVID-19-related deaths are falling in the UK:

Source: FT

The UK is already suffering from potential issues with vaccine supplies from India and may and another delay would postpone the administering of second doses. Nevertheless, the campaign may have reached a point of no return where a significant part of the population has enough immunity to prevent new lockdowns. Such optimism may continue supporting the pound.

In the US, returns on ten-year Treasuries have stabilized around 1.70% after storming higher late on Friday. The Federal Reserve announced it is letting the pandemic era SLR exemption to lapse – a move that forces commercial banks to reduce some of their bond holdings. After several jitters, investors concluded that the effect is limited.

The next moves for the greenback are also set to come from the Federal Reserve. Chair Jerome Powell will deliver a speech on Monday, the first out of three public appearances in which he will likely reiterate his message of ongoing support – and dismissal of inflation concerns. Bond auctions due out later in the week are also eyed.

Powell's second and third and speeches are before Congress, which recently approved President Joe Biden's $1.9 trillion covid relief program – and may be asked to debate additional measures. According to the media in Washington, the White House is planning a bill that includes infrastructure spending and tax hikes. Markets have yet to react.

All in all, while the dollar is set to remain strong, sterling has a fair chair of putting up a fight.

GBP/USD Technical Analysis

Pound/dollar has been setting higher lows since it hit a low of 1.3775 in early March. This is a bullish sign that counters downside momentum on the four-hour chart. Cable is also trading under the 50, 100 and 200 Simple Moving Averages. While bears are in the lead, bulls are not giving up.

Resistance awaits at the daily high of 1.3860, followed by 1.39, which provided support last week. Further above, 1.3940 and 1.40 are eyed.

Support is at 1.3820, which is the daily low, followed by 1.3805 and 1.3775 mentioned earlier.

Three questions to consider as economic data comes into view

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

AUD/USD remained bid above 0.6500

AUD/USD extended further its bullish performance, advancing for the fourth session in a row on Thursday, although a sustainable breakout of the key 200-day SMA at 0.6526 still remain elusive.

EUR/USD faces a minor resistance near at 1.0750

EUR/USD quickly left behind Wednesday’s small downtick and resumed its uptrend north of 1.0700 the figure, always on the back of the persistent sell-off in the US Dollar ahead of key PCE data on Friday.

Gold holds around $2,330 after dismal US data

Gold fell below $2,320 in the early American session as US yields shot higher after the data showed a significant increase in the US GDP price deflator in Q1. With safe-haven flows dominating the markets, however, XAU/USD reversed its direction and rose above $2,340.

Bitcoin price continues to get rejected from $65K resistance as SEC delays decision on spot BTC ETF options

Bitcoin (BTC) price has markets in disarray, provoking a broader market crash as it slumped to the $62,000 range on Thursday. Meanwhile, reverberations from spot BTC exchange-traded funds (ETFs) continue to influence the market.

US economy: slower growth with stronger inflation

The dollar strengthened, and stocks fell after statistical data from the US. The focus was on the preliminary estimate of GDP for the first quarter. Annualised quarterly growth came in at just 1.6%, down from the 2.5% and 3.4% previously forecast.