What Is Trend Trading?

Trend trading is one of the most popular approaches to trading financial markets. The reason for this is the simplicity found in a trend trader’s strategy. If prices are typically rising, a trend trader will look to buy. When markets are declining, they will look sell. The key for a trend trader is to first determine the general direction of prices, and then look to join the wave of higher highs or lower lows.

What Makes a Trend?

Trend trading is all about direction, so before considering a buy or sell decision, trend traders will first identify if prices are rising or falling. Most bullish up trends can be seen on a chart as stair stepping as stocks reach higher highs and higher lows. Typically, in uptrends, traders will look to buy an underlying security. That’s not to say that there are not opportunities to sell, but a trend trader will usually trade with the prevailing direction of the market. The opposite is true with a downtrend. If a market is consistently dropping to new lows, a trend following strategy will elect to initiate new sell based positions.

As an example, below we can see a 4-Hour chart on BTC/USD. On the chart, the price of Bitcoin has steadily created a series of higher highs and higher lows. With this in mind, trend traders may look to plan new orders to go long in the market. In the event that prices begin a new trend and create lower lows, traders may then look to initiate new sell orders.

Technical Indicators for Trend Trading

To simplify the trend identification process, trend traders may also employ a series of technical indicators. Two of the most popular include Moving Averages and Donchian channels.

Let’s look at how these technical indicators can assist in trend trading.

Moving Averages

Moving averages are some of the most universally used indicators in markets. These charting lines are calculated by adding up a series of closing prices for a security and then dividing the total to find an average. If prices are seen as rising above the average, the trend may be interpreted as going up. If prices are declining faster than the average, the trend may be interpreted as downward.

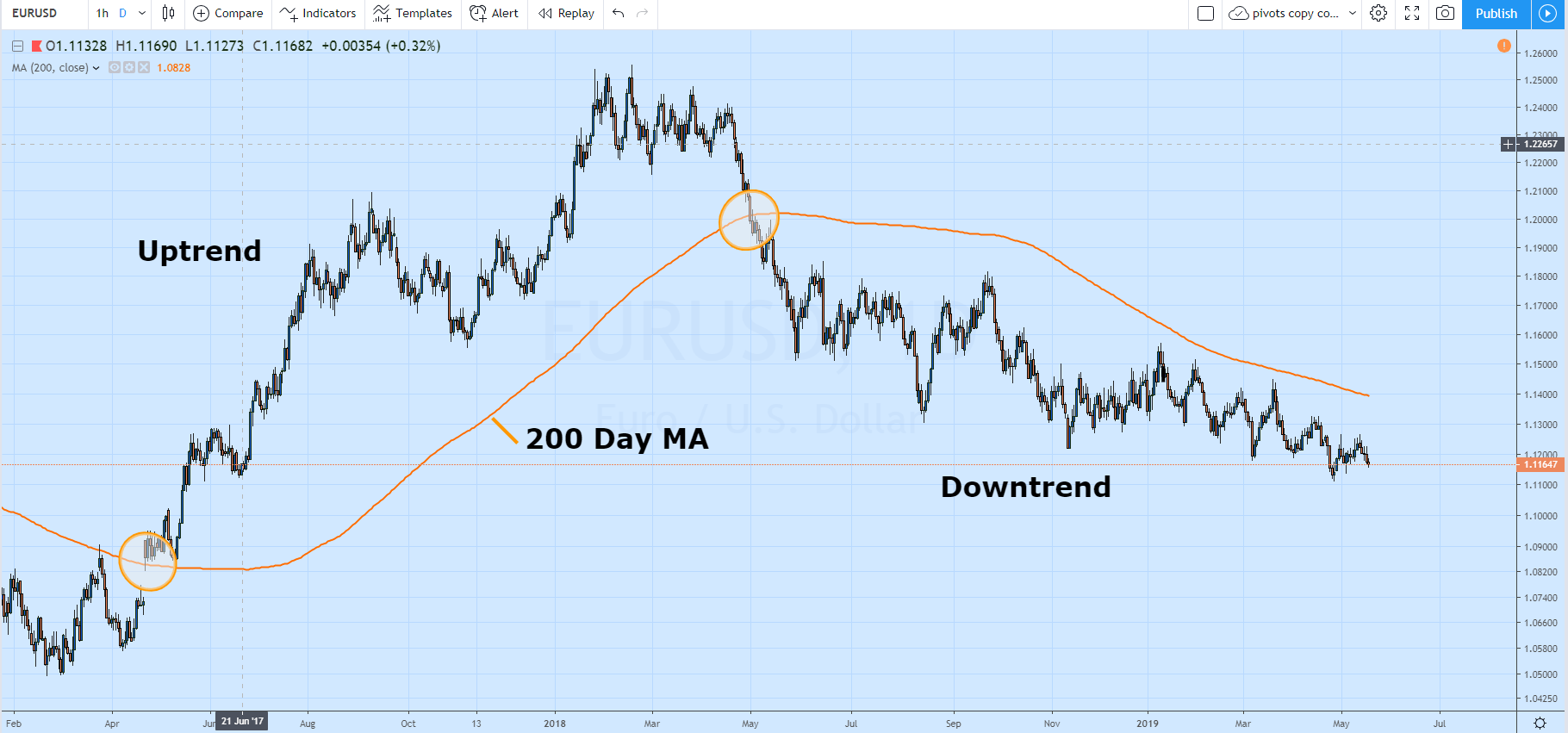

For example, using the EUR/USD Daily chart below, we can see a 200 period Simple Moving Average (MA) at work. When prices began trading above the average in April 2017, it was a strong signal that the EUR/USD was beginning to trend higher. Likewise, the EUR/USD is now trading back below the displayed average. This suggests that the EUR/USD is trending lower with the pair now residing just off of new 2019 lows.

Donchian Channels

The next indicator up for review is Donchian Channels. Donchian Channels are a handy indicator, as they are designed to display a chosen market’s previous high or low for a given period of time. As we learned previously, if markets are making higher highs the trend may be interpreted as going up. However, if markets are breaking through a lower Donchian Channel, selling in a downtrend may be considered.

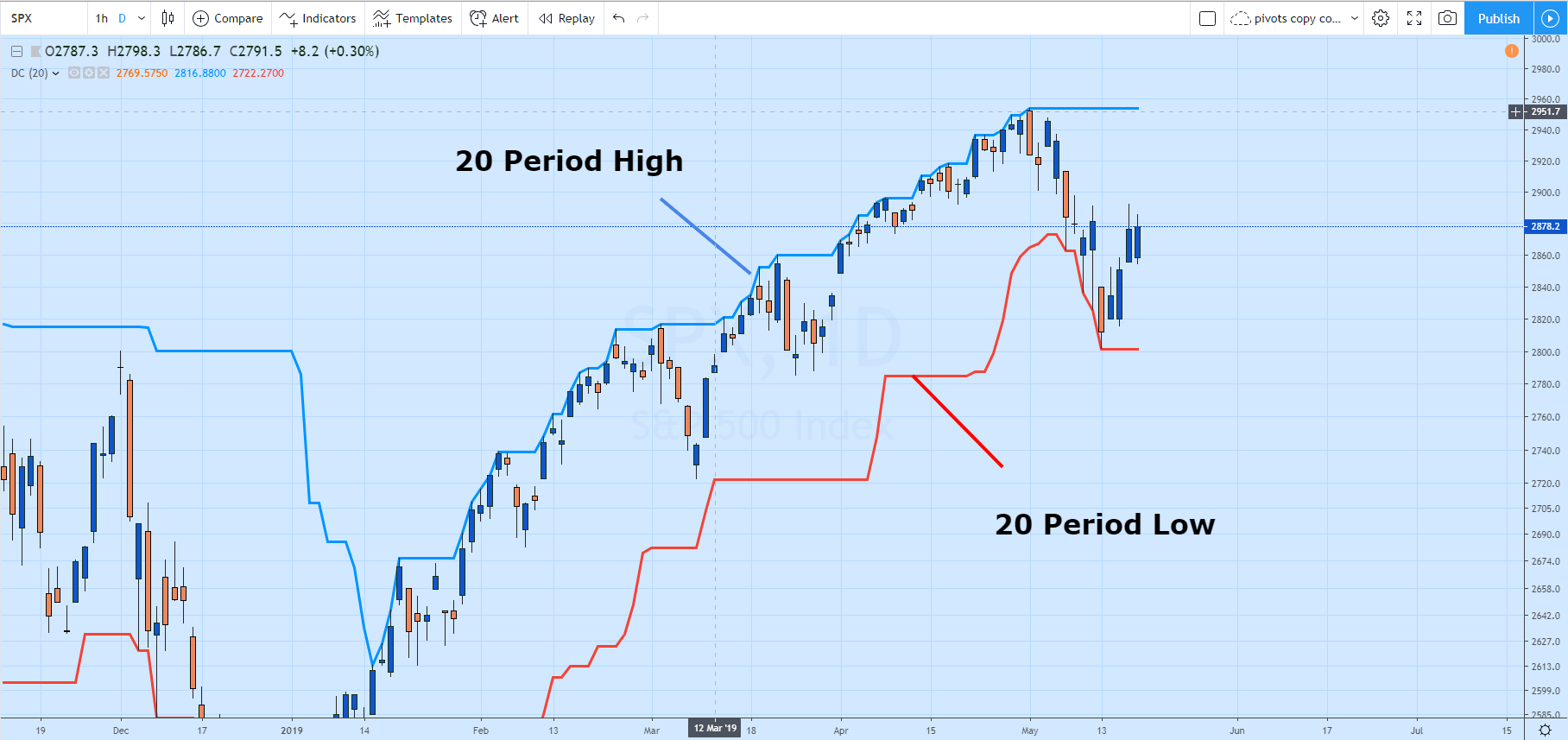

Referring to the chart below, we can see Donchian Channels in action on a SPX Daily chart with a 20 period setting. This means that the upper channel line represents the standing 20 day high, and the bottom line represents the current 20 day low. Traders should note that the SPX has previously been trending upward as the Index has steadily been creating higher highs. However, prices have recently moved to a new 20 day low. If the SPX continues to trade lower, trend traders may look for a new downtrend to emerge.

Time Frames for Trend Following

Finding the right time frame to chart is always a question to consider prior to placing a trade. The good news is that trends may be found on any time frame! One important consideration that trend traders should remember is that the higher time frame trends typically last longer than shorter ones. This means that trends can be found on 1 minute and 5 minute charts, but they would not be expected to last as long as monthly, weekly, or daily trends.

Risk Management for Trend Trading

Risk management should always be a consideration when implementing any strategy. Trend traders may employ any number of techniques to lock in profit as the market goes in their favor. One of the most popular methods is to use a trailing stop. Traders may consider using a previous low in an uptrend to set an initial stop and then trail their stop forward as new higher lows are created. Conversely, in a downtrend, traders may set a stop above a previous high. This way, as lower highs are created traders may consider trailing their stop and locking in profit as the trend progresses.

Trend trading is a popular method of following markets across asset classes because of its simplicity. Traders should remember that they can find trends on any chart, but the direction of the market should always be consulted before buying or selling. Then, as with any active trading strategy, risk should be managed as market conditions evolve. Now that you know more about the basics of trend trading, if you want to learn more about additional strategies that could help you make the right moves in any market condition, sign up for a free half day class.

This content is intended to provide educational information only. This information should not be construed as individual or customized legal, tax, financial or investment services. As each individual's situation is unique, a qualified professional should be consulted before making legal, tax, financial and investment decisions. The educational information provided in this article does not comprise any course or a part of any course that may be used as an educational credit for any certification purpose and will not prepare any User to be accredited for any licenses in any industry and will not prepare any User to get a job. Reproduced by permission from OTAcademy.com click here for Terms of Use: https://www.otacademy.com/about/terms

Editors’ Picks

AUD/USD holds hot Australian CPI-led gains above 0.6500

AUD/USD consolidates hot Australian CPI data-led strong gains above 0.6500 in early Europe on Wednesday. The Australian CPI rose 1% in QoQ in Q1 against the 0.8% forecast, providing extra legs to the Australian Dollar upside.

USD/JPY sticks to 34-year high near 154.90 as intervention risks loom

USD/JPY is sitting at a multi-decade high of 154.88 reached on Tuesday. Traders refrain from placing fresh bets on the pair as Japan's FX intervention risks loom. Broad US Dollar weakness also caps the upside in the major. US Durable Goods data are next on tap.

Gold price struggles to lure buyers amid positive risk tone, reduced Fed rate cut bets

Gold price lacks follow-through buying and is influenced by a combination of diverging forces. Easing geopolitical tensions continue to undermine demand for the safe-haven precious metal. Tuesday’s dismal US PMIs weigh on the USD and lend support ahead of the key US macro data.

Crypto community reacts as BRICS considers launching stablecoin for international trade settlement

BRICS is intensifying efforts to reduce its reliance on the US dollar after plans for its stablecoin effort surfaced online on Tuesday. Most people expect the stablecoin to be backed by gold, considering BRICS nations have been accumulating large holdings of the commodity.

US versus the Eurozone: Inflation divergence causes monetary desynchronization

Historically there is a very close correlation between changes in US Treasury yields and German Bund yields. This is relevant at the current juncture, considering that the recent hawkish twist in the tone of the Fed might continue to push US long-term interest rates higher and put upward pressure on bond yields in the Eurozone.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

Discover how to make money in forex is easy if you know how the bankers trade!

5 Forex News Events You Need To Know

In the fast moving world of currency markets, it is extremely important for new traders to know the list of important forex news...

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and...

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.