- Cryptocurrencies have suffered a blow with Bitcoin dropping temporarily below $500.

- All top three digital coins need to cling onto support lines in order to consolidate and resume the rally.

- Here are the levels to watch according to the Confluence Detector.

After finding at least seven reasons for the surge, cryptocurrencies consolidated on higher ground and recently suffered a blow. Is this a continuation of the correction or perhaps a worrying change of course?

This looks more like a correction, but to convince the skeptics, digital assets need to hold onto critical support lines, until the next

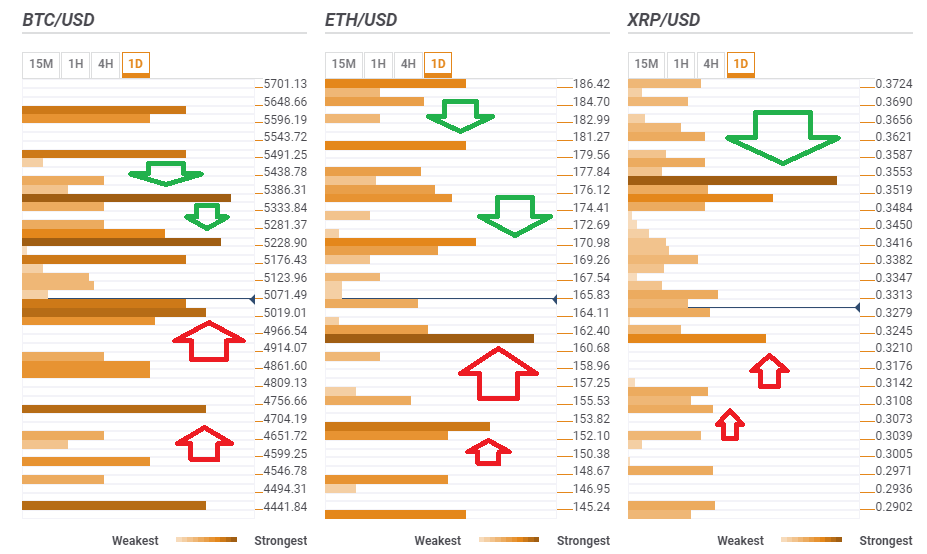

This is what the Crypto Confluence Detector shows in its latest update:

BTC/USD needs to hold onto $5,019

Bitcoin, the grandaddy of cryptocurrencies, has managed to bounce back above $5,000 quite quickly and needs to hold onto $5,019 where we see the convergence of the Simple Moving Average 10-1d, the Pivot Point one-day Support 2, the previous 1h-low, the Bollinger Band 15min-Lower, the Fibonacci 161.8% one-day, the Fibonacci 23.6% one-week, the SMA 10-15m, and others.

Further down, additional support awaits at $4,861 where we see the Fibonacci 38.2% one-week and the PP one-day Support 3. The next target is $4,730 where the PP one-month R3 awaits.

BTC/USD has its first upside target at $5,228 where the confluence of the following levels awaits: the SMA 5-1d, the SMA 100-1h, the BB 15min-Upper, the BB 4h-Middle, and the SMA 10-4h.

Further up, the next upside target is $5,355 which is the meeting point of the previous weekly high and the Fibonacci 38.2% one-day.

ETH/USD must hold onto $161

Ethereum has a very clear support line at $161 where the previous 4h-low, the PP one-month low, the PP one-day S2, and the BB 1h-Lower converge.

Vitalik Buterin's brainchild's next support is $153 which is a juncture including the SMA 200-1d, the PP one-day, the BB one-day Middle, and the PP one-month Resistance 1.

ETH/USD has an initial upside target at $171 which is the confluence of the BB 15min-Upper, the Fibonacci 23.6% one-week, the SMA 50-4h, the PP 1d-S1, the previous daily low, and the SMA 50-15m.

The next upside target is at $180 where the Fibonacci 38.2% one-day and the previous weekly high converge.

XRP/USD is somewhat weaker, as usual

Ripple enjoys support, albeit not that strong, at $0.3220 where we see the confluence of the SMA 50-1d, the PP 1w-S1, and the SMA 100-1d.

The next support line is even weaker, around $0.3108 which is where the previous weekly low and the Fibonacci 161.8% one-month.

Resistance is far but is quite substantial. At $0.3530 we see the convergence of the BB 4h-Middle, the Fibonacci 161.8% one-month, the Fibonacci 61.8% one-day, the Fibonacci 38.2% one-week, and the SMA 504h.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Ripple wipes out weekly gains, experts comment on role of Ripple stablecoin

Ripple declined to $0.52 on Thursday, erasing all gains registered earlier this week. Ripple SVP Eric van Miltenburg’s comments on the firm’s stablecoin, and how it is expected to benefit the XRP Ledger and native token XRP have raised concerns among crypto experts.

Hedera HBAR slips nearly 10% after air is cleared on mistaken link with giant BlackRock

HBAR price is down nearly 10% on Thursday, partly erasing gains inspired by the misinterpreted link with BlackRock. Despite the recent correction, Hedera’s price is up 44% in the past seven days.

The reason behind Bonk’s 105% rise and if you should buy now Premium

Bonk price has shot up 105% in the past five weeks. A retracement into $0.0000216 or the $0.0000152 to $0.0000186 imbalance would be a good buying opportunity. Patient investors can expect double-digit gains from BONK that could extend up to 70%.

Injective price weakness persists despite over 5.9 million INJ tokens burned

Injective price is trading with a bearish bias, stuck in the lower section of the market range. The bearish outlook abounds despite the network's deflationary efforts to pump the price. Coupled with broader market gloom, INJ token’s doomed days may not be over yet.

Bitcoin: BTC post-halving rally could be partially priced in Premium

Bitcoin (BTC) price briefly slipped below the $60,000 level for the last three days, attracting buyers in this area as the fourth BTC halving is due in a few hours. Is the halving priced in for Bitcoin? Or will the pioneer crypto note more gains in the coming days?