- The technical situation of the Top 3 does not admit doubts or games, the next decade awaits.

- The current indecision in the charts has little time to be clarified.

- This important moment is leaving retail investors indifferent.

At a time when it appears that the retail investor who had set his sights on the crypto segment is losing interest, institutional investors are improving their options for investing in this controversial sector.

A new investment product focused on Bitcoin was launched today by the French management company Napoleon Assets Management. With its "Napoleon Bitcoin Fund," it represents an essential milestone within the borders of the European Union.

A study carried out by one of the crypto investment managers, Grayscale, is also being published today, leaving us with important considerations for the future.

According to Grayscale, the Millennial generation will be the recipient of the Baby Boomers’ inheritance, worth an estimated 68 trillion dollars.

This vital data is of interest to Grayscale because of the consideration that the generation that is taking over the world in the new 21st century has among its investment goals assets such as Bitcoin or Ethereum.

Long before this massive adoption takes place, let's see how the cryptocurrency market is currently behaving. Yesterday, we reached the historical minimum level of Ethereum searches on Google.

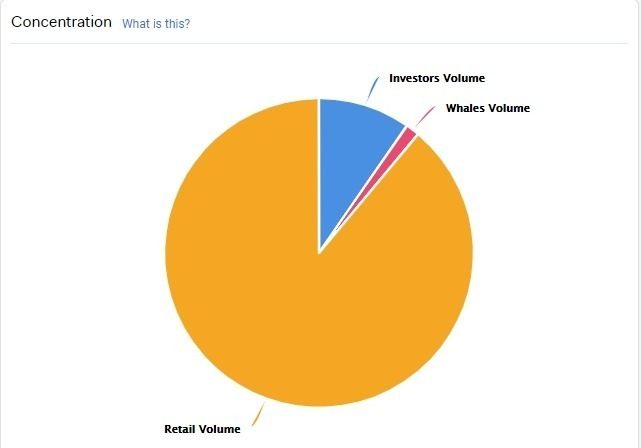

BTC Owners Distribution

Source: Intotheblock

ETH Owners Distribution

Source: Intotheblock

As we can see, the volume in Bitcoin comes mostly from retail operations with 88.95%, while in Ethereum it stays at 60.99%. In the daily volume of Bitcoin, the investor remains at a modest 9.64%, while in the case of Ethereum it reaches 31.5%.

What could this data tell us? We can quickly infer that the investor has a preference for Ethereum over Bitcoin. The high retail activity in Bitcoin is explained because it is "the King".

The vast majority of people who do not invest professionally are completely unaware of the crypto market, and if they know anything, if anything rings a bell, it is Bitcoin.

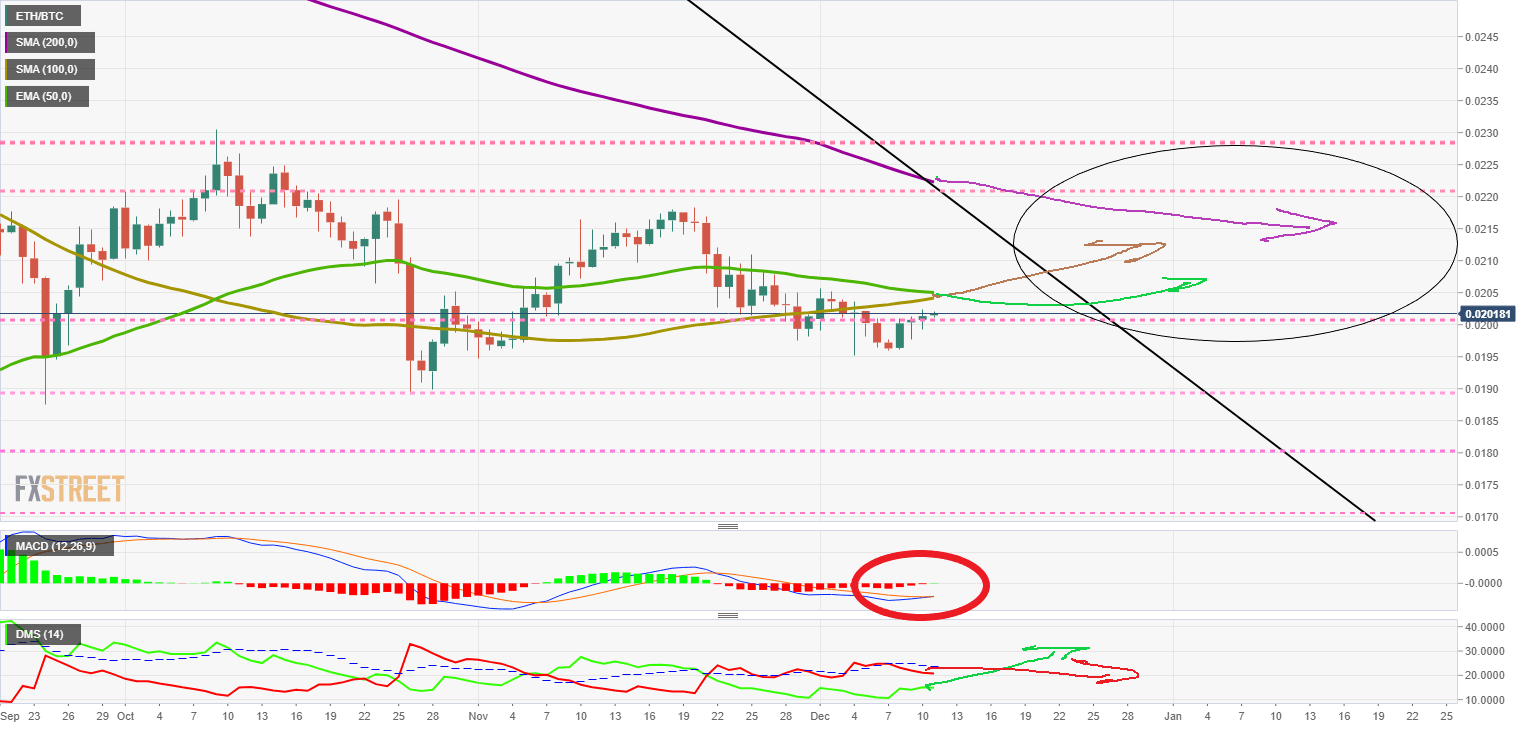

ETH/BTC Daily Chart

The ETH/BTC pair is at an exciting moment from a technical point of view. It is vital, a “do or die” moment that could define the price of the Ethereum for the following years.

The first important fact is that the ETH/BTC pair has once again surpassed the 0.020 level, a vital support level. As long as the moves in this zone, the upside potential remains intact.

The second fact comes from the closeness with the primary trend line that comes from the maximum historical levels. The encounter is inevitable and will not last beyond the end of the year. A failure in the attempt to cross would bury the value of the Ethereum against Bitcoin, perhaps forever.

The third datum is in the technical indicators applied to the ETH/BTC pair. The SMA100 leans upwards and prepares to cross the EMA50 upwards. The future encounter with the SMA200 insinuates that this would occur in the bullish zone of the scenario raised in point 2.

Besides, the MACD crosses over and sends an underlying bullish signal. The cross occurs very close to the indicator's zero lines, which announces that transition to full bullish mode will not be smooth or free of volatility.

Above the current price, the first resistance level is at 0.0205, then the second at 0.021 and the third one at 0.022.

Below the current price, the first support level is at 0.020; then, the second is at 0.019 and the third one at 0.018.

The MACD on the daily chart shows a full-bullish cross, albeit with minimal development. The structure accepts some bearish, deceptive maneuver, but the setup proposes rises.

The DMI on the daily chart shows the bulls increasing their authority levels, while the bears seem to defend the indicator's level 20, although their trajectory is downwards.

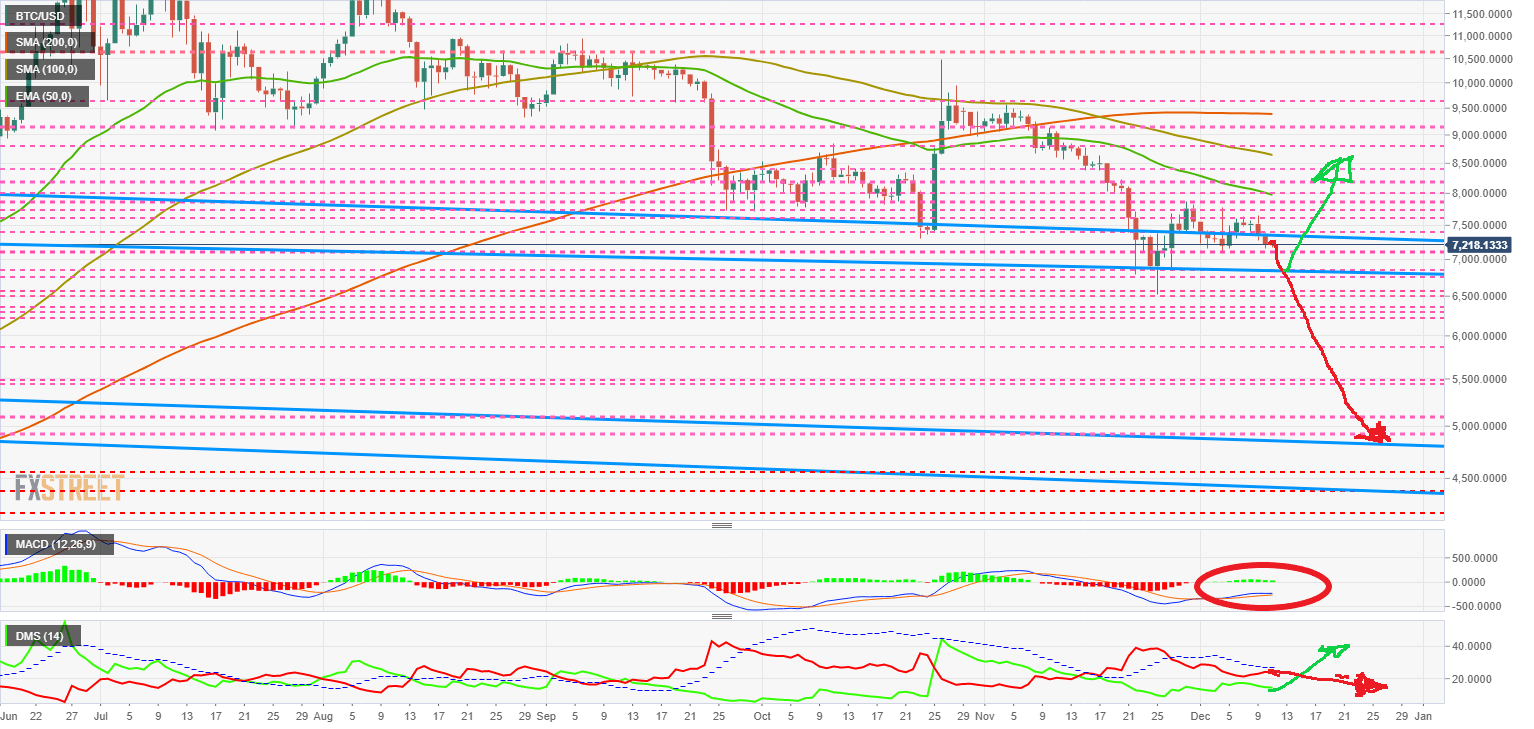

BTC/USD Daily Chart

The BTC/USD pair shows less clarity when moving directionally. The drop in volatility is solid and keeps the price between significant and reliable technical obstacles.

Below the $7,400 price level, the scenario is sideways bearish. If the price reaches a close below $6,750, the scene will become openly bearish.

Above $7,400, the scenario improves to bullish sideways, with the price level of $7,750 being the one that would place the BTC/USD pair in a technically bullish situation without a doubt.

The MACD on the daily chart shows that the technical timing is also delicate in the case of the BTC/USD pair. After crossing this bullish indicator, it lost strength and now threatens to undo the bullish cross. The pattern suggests that this should not happen and that we will see a robust bullish rebound.

The DMI on the daily chart shows how the bulls lose some momentum and move away from a possible leadership dispute with the bears. However, the trends are clear, and there will be an option to change leadership in the coming days.

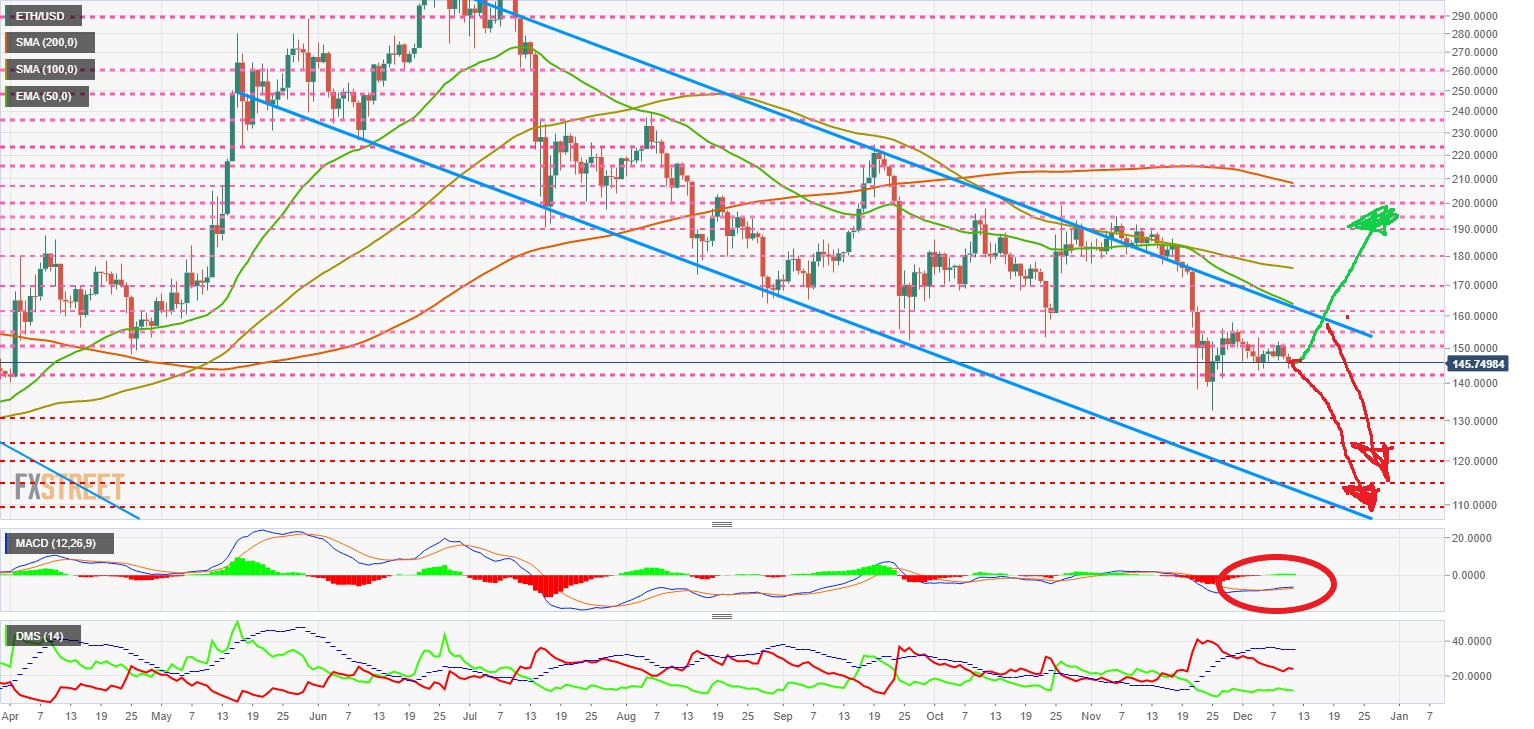

ETH/USD Daily Chart

The ETH/USD pair is currently trading at the $145 price level and continues to develop the long medium-term bearish channel that comes from the year's early highs. The scenario is complex, with resistance surprising at $150.

Moving averages are maintained in higher zones and at a considerable distance, which indicates a significant deviation of the Ethereum from the zone where it should be moving.

Above the $160 price level, the ETH/USD pair improves its bullish outlook laterally, although it would not be above the $180 level and the SMA100, where the scenario would be purely bullish.

On the downside, it remains in a downside scenario as long as it does not lose the $140 price level, when it would enter into a downside mode, worsening to below the $130 level.

The MACD on the daily chart shows a bullish cross that is as effective as it is weak at the same time.

The DMI on the daily chart shows how the bulls don't seem very confident of their chances, although the bears seem even less optimistic about their chances as they come down with strength.

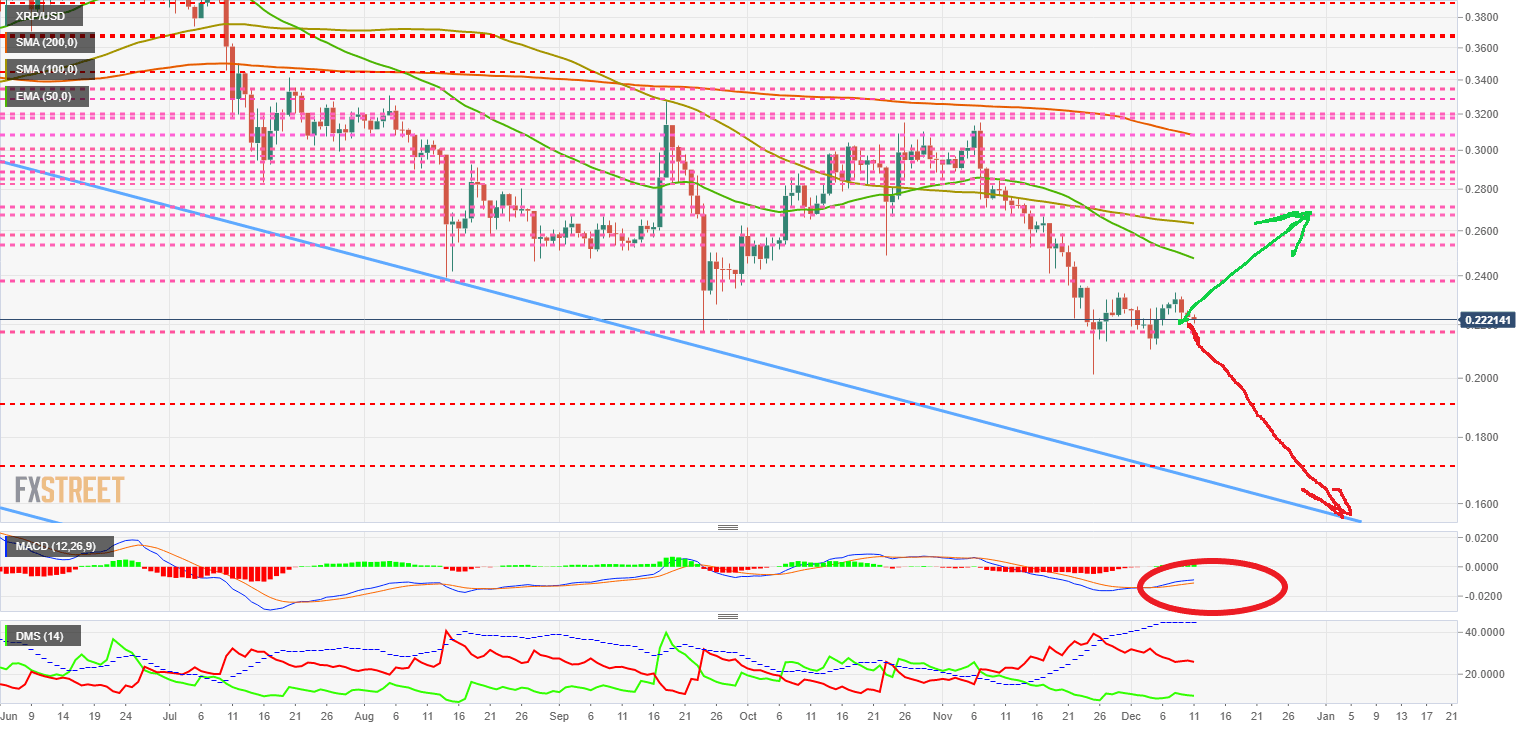

XRP/USD Daily Chart

The XRP/USD pair is currently trading at the $0.225 price level and has saved a delicate situation for now, as losing the key support level at $0.21 would severely damage its outlook.

Peace of mind for the XRP/USD pair will not come as long as it is not above medium-term averages, especially the EMA50 and the SMA100.

Above the current price, the first major hurdle is at $0.247, so at $0.263, the SMA100 marks the entrance to a more positive zone.

Below the critical risk is below $0.17, with small brackets at $0.20 and $0.18.

The MACD on the daily chart is the one with the most bullish profile among the Top 3 Cryptocurrencies, so the weakness shown by the XRP/USD pair contradicts the appearance of the chart.

The DMI on the daily chart shows bulls with little confidence in being able to conquer leadership, while bears don't have it very clear either, although they enjoy such an advantage that they don't have to worry about it right now.

Get 24/7 Crypto updates in our social media channels: Give us a follow at @FXSCrypto and our FXStreet Crypto Trading Telegram channel

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Google, Apple could remove Binance from their app store on Philippines SEC request

The Philippines SEC has requested Google and Apple to remove applications controlled by Binance from their App stores. The exchange’s Philippines-based users are finding the exchange inaccessible to remove their funds.

XRP rallies as Ripple slams SEC for penalties, asks regulator to establish likelihood of future violations

Ripple filed its response to the SEC lawsuit on Monday, arguing that XRP institutional sales before and after the court ruling show no disregard for the law. The firm asks for a civil penalty of no more than $10 million against the $2 billion requested by the SEC.

Here’s why Ondo price hit new ATH amid bearish market outlook Premium

Ondo price shows no signs of slowing down after setting up an all-time high (ATH) at $1.05 on March 31. This development is likely to be followed by a correction and ATH but not necessarily in that order.

PENDLE price soars 10% after Arthur Hayes’ optimism on Pendle derivative exchange

Pendle price is among the top performers in the cryptocurrency market today, posting double-digit gains. Its peers in the altcoin space are not as forthcoming even as the market enjoys bullish sentiment inspired by Bitcoin (BTC) price.

Bitcoin: BTC post-halving rally could be partially priced in Premium

Bitcoin (BTC) price briefly slipped below the $60,000 level for the last three days, attracting buyers in this area as the fourth BTC halving is due in a few hours. Is the halving priced in for Bitcoin? Or will the pioneer crypto note more gains in the coming days?