-

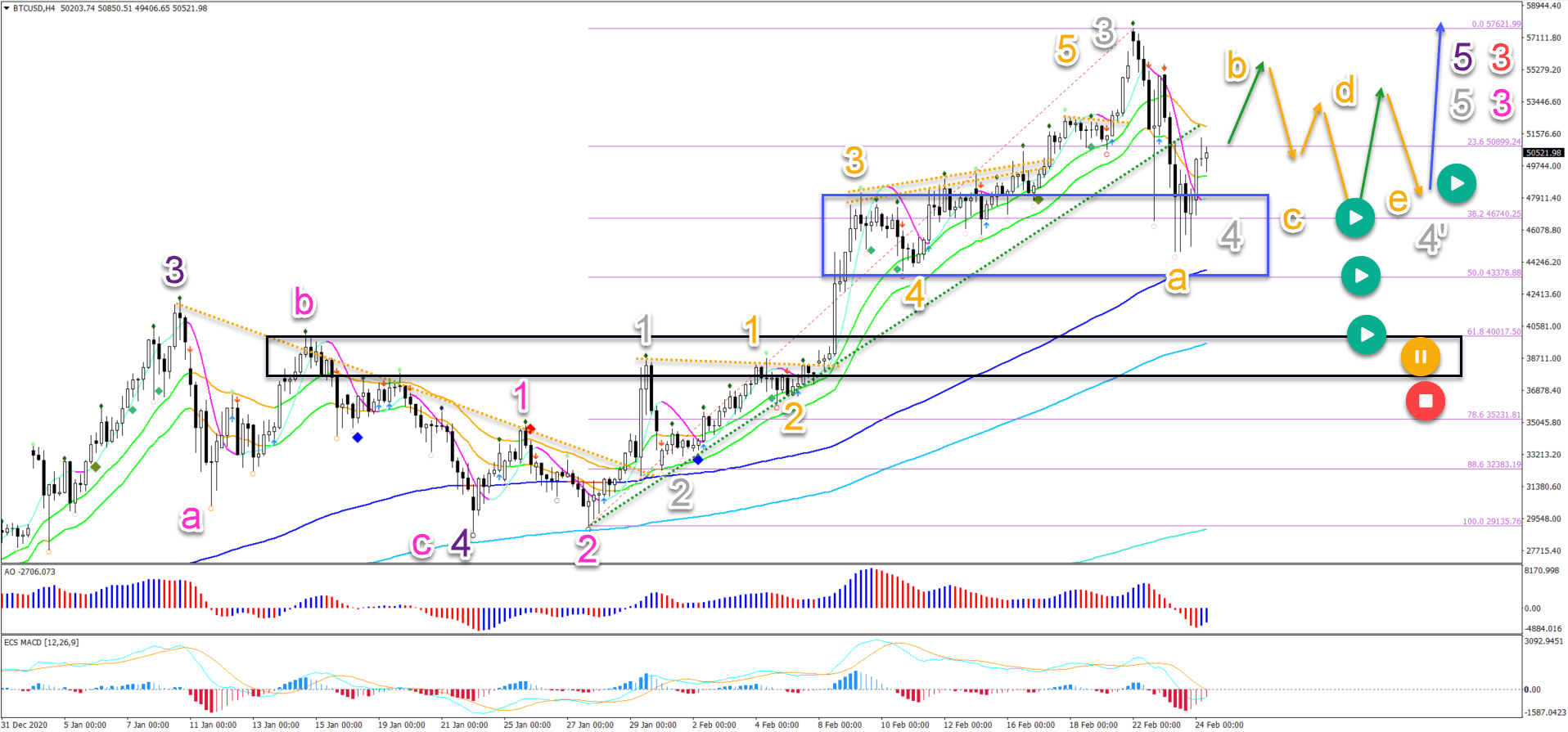

Bitcoin (BTC/USD) made a bullish breakout last week which reached the expected target at $57.5k.

-

Bitcoin has made a bullish bounce at the 38.2% Fibonacci retracement support level. Although the bearish decline was fierce, the bulls were able to stop and reverse it.

-

The resistance trend line (orange) will not be an easy level to break. But if price action does break it, then a bullish wave C (green) is expected.

However, the bearish retracement has been much more impulsive than previous pullbacks in the current uptrend.

Let’s review the status of the uptrend in combination with the chart plus wave patterns.

Price charts and technical analysis

The BTC/USD bearish retracement seems to be similar to the ETH/USD pullback in yesterday’s analysis: a wave 4 pattern (grey).

Just like Ethereum, Bitcoin has made a bullish bounce at the 38.2% Fibonacci retracement support level (blue box). Although the bearish decline was fierce, the bulls were able to stop and reverse it.

The strong decline is typical for a wave A of a larger ABCDE triangle pattern (orange). Which is why a triangle has the best probability at the moment. Let’s review the daily chart above:

-

A push up should retest the previous top (wave B orange).

-

A bearish bounce the previous top could confirm the wave B (orange).

-

ABC patterns and a lower high and higher low should confirm the larger ABCDE movement (orange and green arrows).

-

Once the ABCDE triangle pattern is completed, an uptrend continuation is expected to push price action higher towards $65k and $75k.

-

A bearish break below the 38.2% Fib invalidates the ABCDE triangle but price action is still expected to find support at the 50-61.8% Fibonacci levels.

-

Only a break below the next support zone (black box) would invalidate the current wave analysis (red circle) and indicate a deeper retracement.

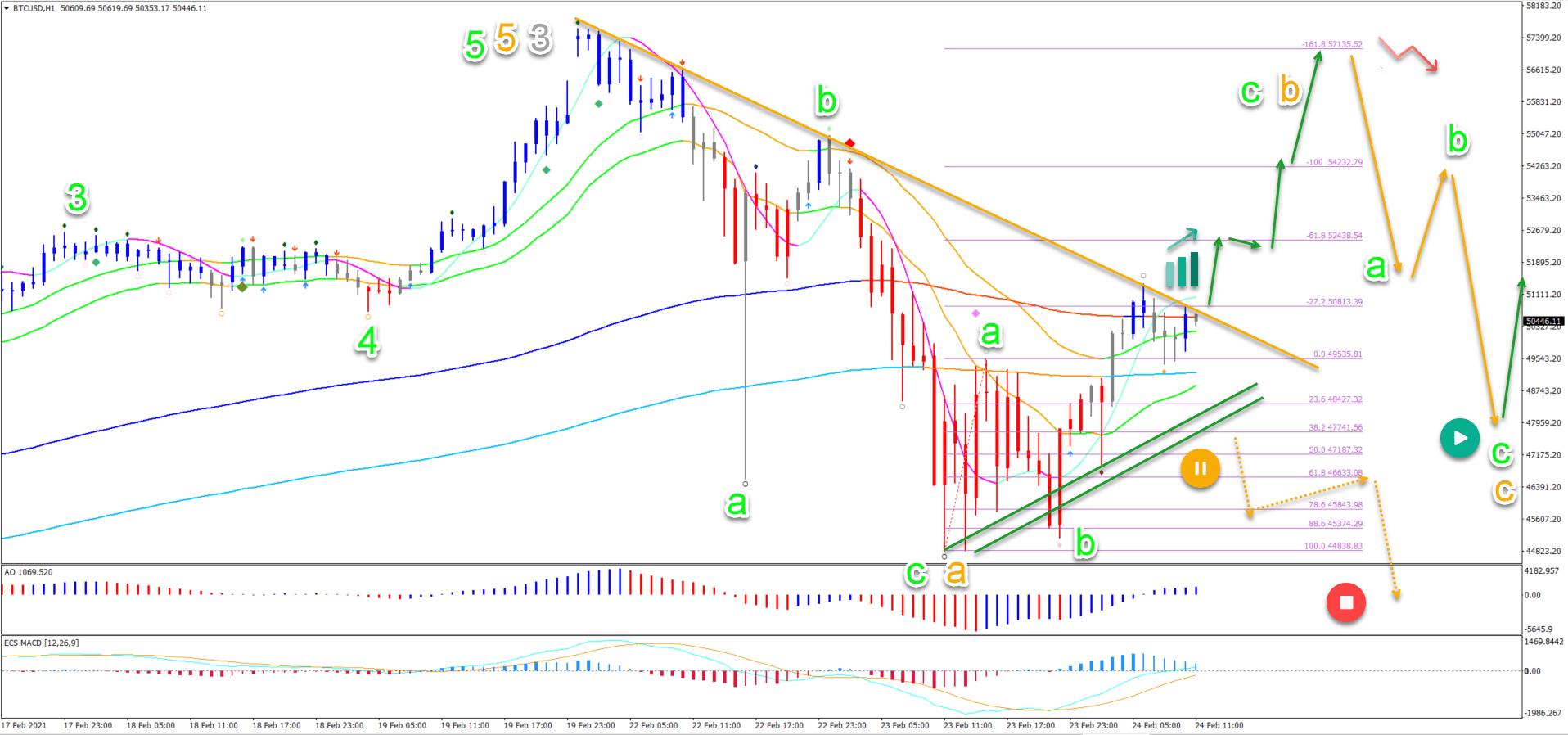

On the 1 hour chart, the bearish price action yesterday was an ABC (green) correction in the wave A (orange).

The resistance trend line (orange) will not be an easy level to break. But if price action does break it, then a bullish wave C (green) is expected.

The main target for the immediate breakout is the previous top. Here a bearish bounce is likely (red arrow), which could create a wave C (orange) downwards (orange arrows).

Only an immediate bearish breakout below the support lines (green) could indicate more downside pressure (dotted orange arrows) sooner than expected. In that case, price action could reach the next support zone at $40k-$44k.

The analysis has been done with the ecs.SWAT method and ebook.

Elite CurrenSea Training Program(s) should not be treated as a recommendation or a suggestion to buy or sell any security or the suitability of any investment strategy for Student. The purchase, sale, or advice regarding any security, other financial instrument or system can only be performed by a licensed Industry representative; such as, but not limited to a Broker/Dealer, Introducing Broker, FCM and/or Registered Investment Advisor. Neither Elite CurrenSea nor its representatives are licensed to make such advisements. Electronic active trading (trading) may put your capital at risk, hence all trading decisions are made at your own risk. Furthermore, trading may also involve a high volume & frequency of trading activity. Each trade generates a commission and the total daily commission on such a high volume of trading can be considerable. Trading accounts should be considered speculative in nature with the objective being to generate short-term profits. This activity may result in the loss of more than 100% of an investment, which is the sole responsibility of the client. Any trader should realise the operation of a margin account under various market conditions and review his or her investment objectives, financial resources and risk tolerances to determine whether margin trading is appropriate for them. The increased leverage which margin provides may heighten risk substantially, including the risk of loss in excess of 100% of an investment.

Recommended Content

Editors’ Picks

SEC doubles down on TRON's Justin Sun lawsuit dismissing claims over jurisdiction

The SEC says it has jurisdiction to bring Justin Sun to court as he traveled extensively to the US. Sun asked to dismiss the suit, arguing that the SEC was targeting actions taken outside the US.

XRP fails to break past $0.50, posting 20% weekly losses

XRP trades range-bound below $0.50 for a sixth consecutive day, accumulating 20% losses in the last seven days. Ripple is expected to file its response to the SEC’s remedies-related opening brief by April 22.

ImmutableX extends recovery despite $69 million IMX token unlock

ImmutableX unlocked 34.19 million IMX tokens worth over $69 million early on Friday. IMX circulating supply increased over 2% following the unlock. The Layer 2 blockchain token’s price added nearly 3% to its value on April 19.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price briefly slipped below the $60,000 level for the last three days, attracting buyers in this area as the fourth BTC halving is due in a few hours. Is the halving priced in for Bitcoin? Or will the pioneer crypto note more gains in the coming days?

Bitcoin: BTC post-halving rally could be partially priced in Premium

Bitcoin (BTC) price briefly slipped below the $60,000 level for the last three days, attracting buyers in this area as the fourth BTC halving is due in a few hours. Is the halving priced in for Bitcoin? Or will the pioneer crypto note more gains in the coming days?