Assessing the possibility of an Ethereum price pullback to $1,284

- Ethereum price shows mixed feelings as it encounters the $1,543 hurdle.

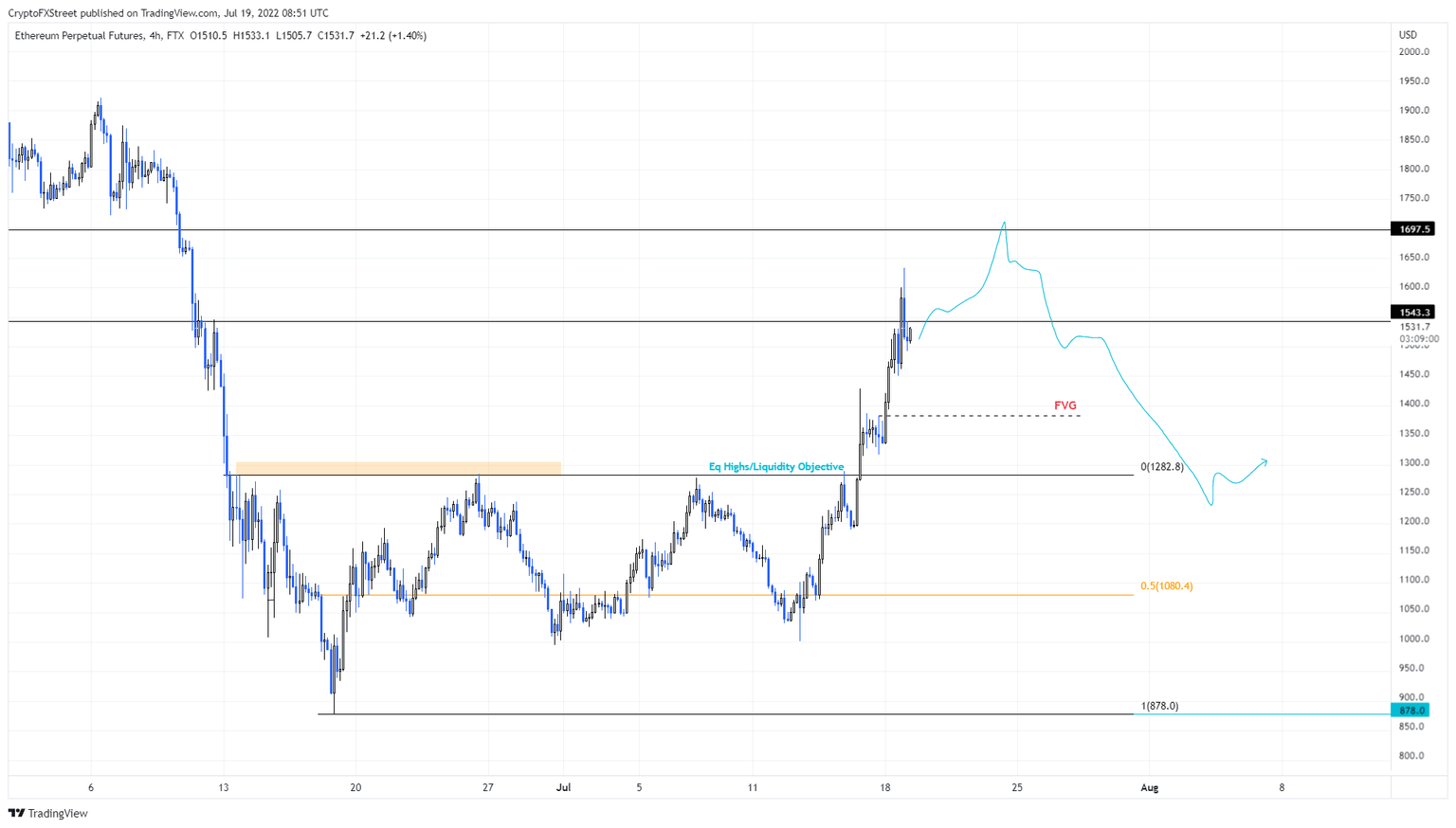

- Although a spike to roughly $1,700 may or may not come, a retracement to $1,284 seems likely.

- A daily candlestick close above $1,700 will invalidate the bearish thesis for ETH.

Ethereum price has been on an exponential rally since July 13 and has reached one of two significant levels. A retracement to stable support levels is required before ETH climbs to the next hurdle.

Ethereum price to do more after a break

Ethereum price has gained 63% over the last five days and is currently grappling with the $1,543 hurdle. However, eager investors willing to invest now need to be careful as the chances of a retracement are high.

After such an expansive, Ethereum price has tagged the $1,543 hurdle but is struggling to establish a directional bias. This indecision is due to the selling pressure from early investors booking profits and buying pressure from late bulls.

Although there is a chance ETH might expand higher, the upside is limited to $1,700. A retracement seems plausible and likely after an explosive move seen between July 13 and July 19.

Therefore, investors must be prepared for a pullback to the $1,284 support barrier, where buyers could come in again to scoop Ethereum at a discounted price.

ETH/USDT 4-hour chart

On the other hand, if Ethereum price fails to stay above the $1,284 level, it would signal a potential move to the range’s midpoint at $1,080. However, if ETH produces a daily candlestick close above $1,700 and flips it into a support level, the bearish thesis will face invalidation.

Such a development could see Ethereum price reach for the $2,000 psychological level next.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.