- Gold's failure to break above $2,000 attracted sellers this week.

- A daily close below $1,930 could open the door for additional losses toward $1,900.

- Gold's volatility could rise on US Q1 GDP and March PCE inflation data.

Gold started the week on a bullish note and reached its highest level in more than a month near $2,000 on Monday. With risk flows dominating the financial markets on Tuesday, the yellow metal suffered heavy losses. Following a consolidation phase at around $1,950 in the second half of the week, XAU/USD faced renewed bearish pressure on Friday and ended up nearly 2% down on a weekly basis.

What happened last week?

Thin trading conditions on Easter Monday allowed gold to rise toward $2,000. The greenback, however, managed to hold its ground amid rising US Treasury bond yields and made it difficult for XAU/USD to continue to push higher. St. Louis Fed President James Bullard said on Monday that the Fed might want to consider 75 basis points rate hikes and reiterated that the policy rate needs to rise to 3.5% by the end of the year to tame inflation.

With European traders returning from a four-day holiday, the global bond selloff picked up steam on Tuesday and the yield on the benchmark 10-year US Treasury bond came within a touching distance of 3%. Additionally, Wall Street’s main indexes rose sharply on upbeat earnings figures and triggered a liquidation in gold positions.

During the Asian trading hours on Wednesday, yields on the 10-year US Treasury Inflation-Protected Securities (TIPS) moved into positive territory for the first time in more than two years. This market development caused gold to lose interest as an inflation hedge and XAU/USD dropped below $1,940. Despite the fact that the greenback suffered heavy losses against its major rivals, especially the euro, mid-week, the pair failed to stage a convincing rebound.

Hawkish comments from FOMC Chairman Jerome Powell on Thursday helped the dollar regather its strength. Although XAU/USD’s losses remained limited amid the negative shift witnessed in the risk mood, the precious struggled to attract bulls.

While speaking at the IMF Spring Meetings on Thursday, FOMC Chairman Powell reiterated that they are planning to get interest rates "expeditiously" to neutral. When asked about the market pricing of three 50 basis points (bps) rate hikes over the next three meetings, Powell acknowledged that 50 bps rate increases will be on the table moving forward. Commenting on the state of the US economy, Powell noted that the US labor market was still very tight and that the economy was very strong.

As global yields continued to rise after the IMF event on Friday, gold extended its slide and fell to a fresh two-week low of $1,931. The data from the US showed that the S&P Global Composite PMI declined to 55.1 in April from 57.7 in March. This print came in worse than the market consensus of 58.1 but had little to no impact on the dollar's market valuation. Hence, XAU/USD registered losses for the second straight day and closed the week below $1,950.

Next week

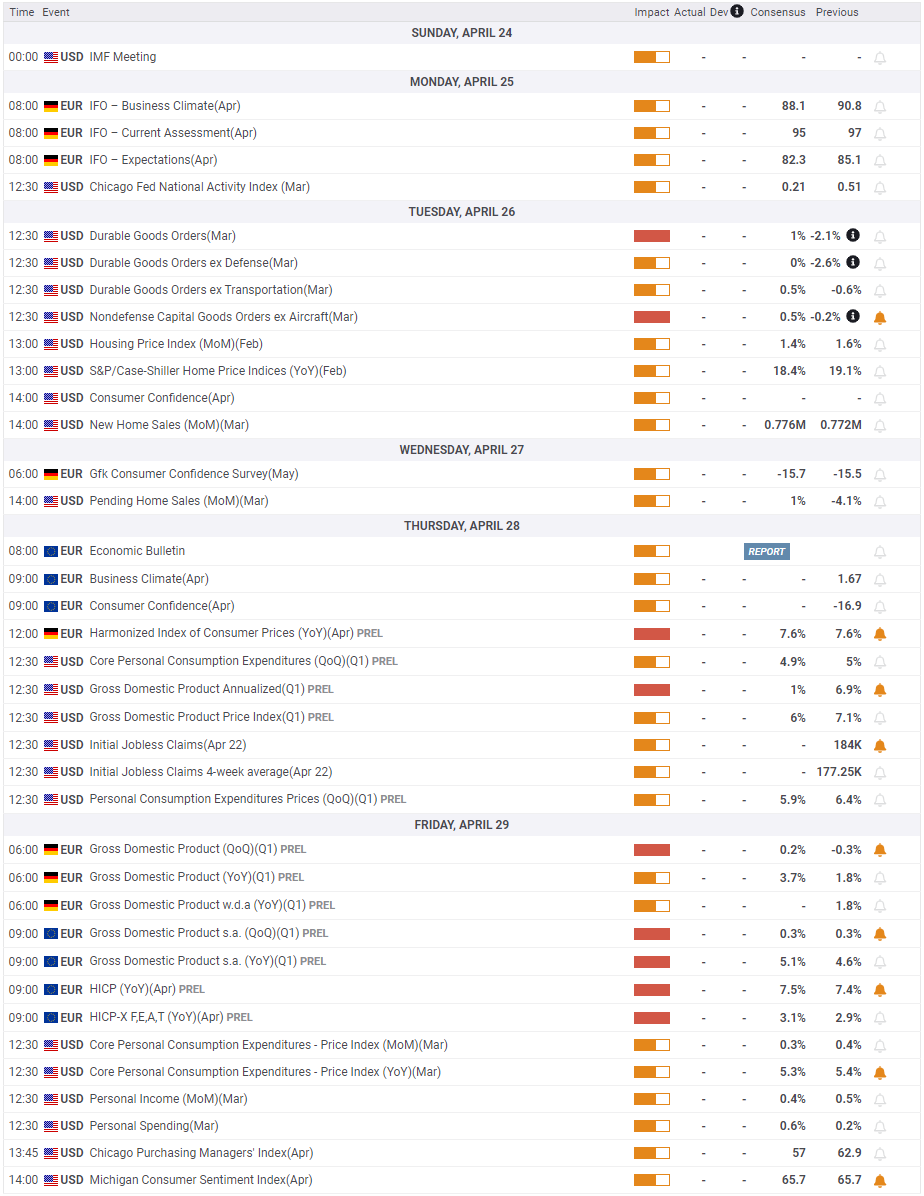

March Durable Goods Orders data and the Conference Board’s Consumer Confidence Index for April will be featured in the US economic docket on Tuesday. Ahead of Thursday’s first-quarter Gross Domestic Product report, however, investors are likely to ignore Tuesday’s data.

Markets expect the US economy to expand at an annualized rate of 1% in Q1 following the 6.9% growth recorded in the fourth quarter of 2021. In case the GDP reading surpasses analysts’ forecast, this would confirm the Fed’s view that the economy will be able to handle aggressive tightening. On the other hand, a disappointing GDP print could cause the dollar to lose interest and open the door for an XAU/USD recovery.

On Friday, April inflation data from the eurozone will be watched closely by market participants. Earlier in the week, several European Central Bank (ECB) policymakers voiced their willingness to hike the policy rate as early as July and said that policy rates could turn positive by the end of the year. Although ECB President Christine Lagarde repeated on Thursday that they will maintain “optionality” amid heightened uncertainty, a hotter-than-expected inflation reading could fuel a rally in EUR/USD. In such a scenario, the selling pressure surrounding the dollar should help gold edge higher.

Finally, the US Bureau of Economic Analysis will release the Personal Consumption Expenditures (PCE) Price Index, the Fed’s preferred gauge of inflation, on Friday. Core PCE Price Index is forecast to edge lower to 5.3% on a yearly basis in March from 5.4% in February. A soft PCE inflation figure should weigh on the dollar, supporting gold, and vice versa for a stronger result.

Gold technical outlook

The Fibonacci 50% retracement level of the February-March uptrend seems to have formed strong support at $1,930. The 50-day SMA is reinforcing that level as well. Meanwhile, the Relative Strength Index (RSI) indicator on the daily chart is holding near 50, suggesting that sellers are struggling to dominate gold's price action for the time being.

With a daily close below $1,930, XAU/USD could fall toward $1,900 (psychological level, 61.8% Fibonacci retracement) and target $1,880 (static level, 100-day SMA) next.

On the upside, $1,960 (Fibonacci 38.2% retracement) aligns as first resistance. In case buyers manage to flip that level into support, $1,980 (static level) could be seen as the next bullish target ahead of $2,000 (psychological level, Fibonacci 23.6% retracement).

Gold sentiment poll

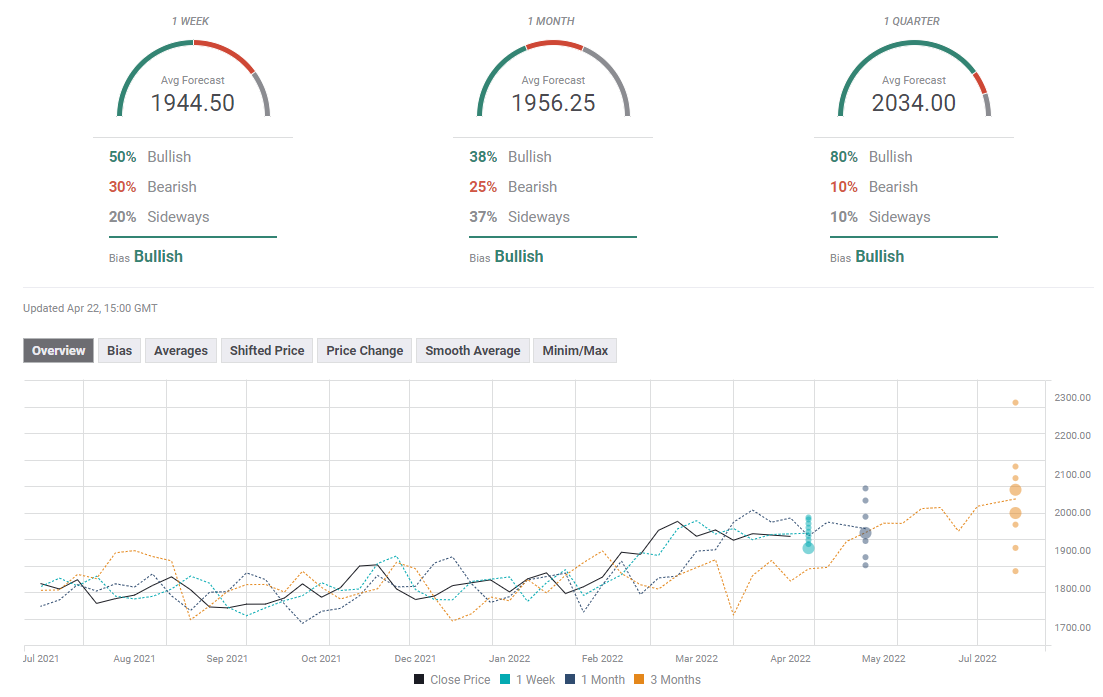

Gold's indecisiveness in the short term is reflected by the FXStreet Forecast Poll, which shows that 50% of experts are bullish on the one-week view against 30% and 20% bearish and neutral, respectively. The one-quarter view is overwhelmingly bullish with an average target of $2,034.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD regains traction, recovers above 1.0700

EUR/USD regained its traction and turned positive on the day above 1.0700 in the American session. The US Dollar struggles to preserve its strength after the data from the US showed that the economy grew at a softer pace than expected in Q1.

GBP/USD returns to 1.2500 area in volatile session

GBP/USD reversed its direction and recovered to 1.2500 after falling to the 1.2450 area earlier in the day. Although markets remain risk-averse, the US Dollar struggles to find demand following the disappointing GDP data.

Gold climbs above $2,340 following earlier drop

Gold fell below $2,320 in the early American session as US yields shot higher after the data showed a significant increase in the US GDP price deflator in Q1. With safe-haven flows dominating the markets, however, XAU/USD reversed its direction and rose above $2,340.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

After the US close, it’s the Tokyo CPI

After the US close, it’s the Tokyo CPI, a reliable indicator of the national number and then the BoJ policy announcement. Tokyo CPI ex food and energy in Japan was a rise to 2.90% in March from 2.50%.