WTI oil

WTI oil regained traction and bounced around $3 on Friday, on revived supply fears on almost total shutdown of production in OPEC member Libya, due to unrest in the country.

Fresh strength correct strong fall on Wednesday, when the US announced measures to lower record fuel prices, although oil price is on track for the second consecutive weekly loss, as fears that rising interest rates would slow already fragile growth and push global economy into recession.

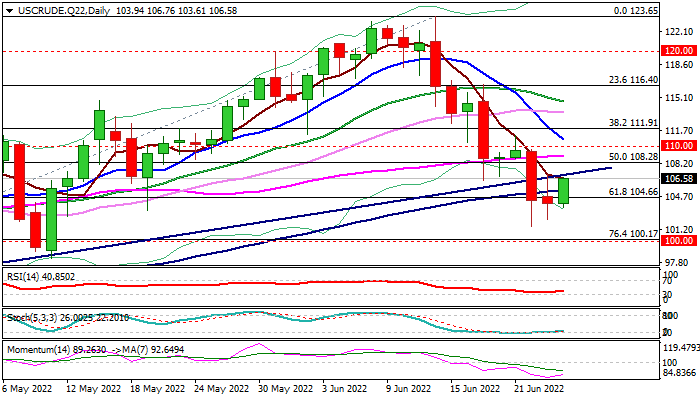

Technical picture on daily chart is overall bearish but signals are mixed, as negative momentum remains strong, but stochastic reverse from oversold territory and RSI turned north.

Fresh recovery was also attracted by next week’s daily cloud twist and pressures broken trendline support at $106.96 (bull-trendline off Apr 11 low), close above which would add to positive near-term signals, however more evidence of reversal would require lift above psychological $110 barrier and June 31 lower top at $111.13.

Res: 106.96; 108.28; 109.09; 110.00.

Sup: 105.40; 104.66; 103.61; 102.30.

Interested in WTI technicals? Check out the key levels

The information contained in this document was obtained from sources believed to be reliable, but its accuracy or completeness cannot be guaranteed. Any opinions expressed herein are in good faith, but are subject to change without notice. No liability accepted whatsoever for any direct or consequential loss arising from the use of this document.

Recommended Content

Editors’ Picks

AUD/USD turns south toward 0.6400 after mixed Australian jobs data

AUD/USD has come under renewed selling pressure and turned south toward 0.6400 after Australian employment data pointed to loosening labor market conditions, fanning RBA rate cut expectations and weighing on the Aussie Dollar.

USD/JPY remains below 154.50 amid weaker US Dollar

USD/JPY keeps losses for the second successive session, trading below 154.50 in Asian trading on Thursday. The pair is undermined by the latest US Dollar pullback, Japan's FX intervention risks and a softer risk tone.

Gold retreats as lower US yields offset the impact of hawkish Powell speech

Gold prices retreated from close to weekly highs during the North American session on Wednesday amid an improvement in risk appetite. The bullish impulse arrived despite hawkish commentary by US Federal Reserve officials.

OMNI post nearly 50% loss after airdrop and exchange listing

Omni network lost nearly 50% of its value on Wednesday after investors dumped the token following its listing on top crypto exchanges. A potential reason for the crash may be due to the wider crypto market slump.

US stock continue to stumble as traders rethink rates

US stocks grappled with uncertainty on Wednesday in the wake of a cautious string of commentary from the US Federal Reserve officials. The S&P 500 is currently experiencing its longest non-bullish streak in months.