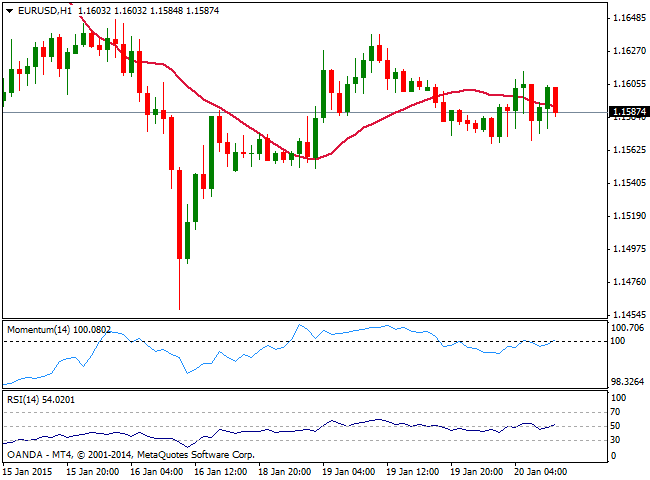

EUR/USD Current price: 1.1556

View Live Chart for the EUR/USD

Currency pairs are yet to find their north this week with range trading prevailing across the board, exception made by commodity currencies as NZD and CAD fell sharply against the dollar. The American currency surged alongside with Asian equities in an early spike of risk appetite, with the greenback bid despite US equities gave up early week gains. From the fundamental side, there was no relevant data in the US, and in Europe German ZEW survey surprised to the upside, with investors’ confidence rising for the most in almost a year, although the reading was not enough to support the EUR/USD pair that traded for most of the day below the 1.1600 level.

The range will likely prevail on Wednesday, with the pair contained between 1.15 and 1.16 ahead of the ECB decision on Thursday. In the meantime, the short term picture presents a mild bearish tone, with the 1 hour chart showing the price is extending below its 20 SMA as indicators aim lower in negative territory. In the 4 hours chart 20 SMA continued to cap the upside, now around 1.1595, whilst indicators present a tepid bearish slope below their midlines, supporting the downside despite lacking momentum.

Support levels: 1.1540 1.1510 1.1460

Resistance levels: 1.1595 1.1640 1.1680

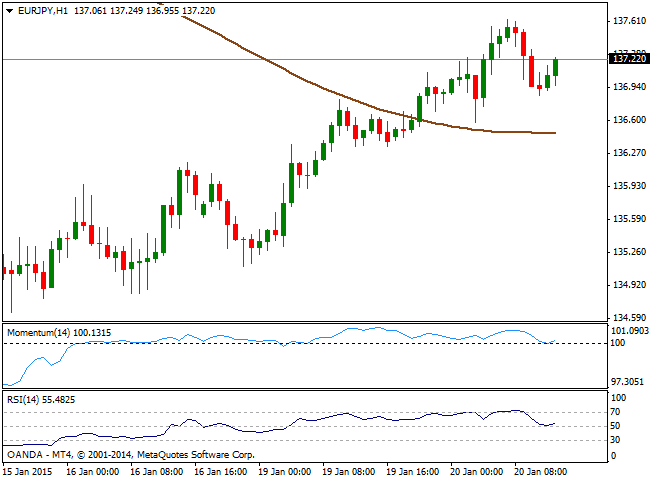

EUR/JPY Current price: 137.21

View Live Chart for the EUR/JPY

The Japanese yen weakened against most of its rivals on the back of Nikkei’s gains, with the local benchmark surging over 2.0% in the day. During the upcoming Asian session, the BOJ will have its monthly monetary policy meeting, largely expected to remain on hold, although any remarks on inflation may be enough to give fresh direction to yen crosses. In the meantime, the EUR/JPY advanced to a fresh 4-day high of 137.63, holding above the 137.00 level ahead of Asian opening. The 1 hour chart shows that price found short term support around its 100 SMA now around 136.40, whilst indicators aim higher after bouncing from their midlines, supporting further advances. In the 4 hours chart however, indicators are beginning to look exhausted to the upside, and suggest a short term downward correction movement ahead. If the mentioned 136.40 level is enough to attract buyers however, the pair may recover again towards the 138.00 price zone.

Support levels: 136.90 136.40 135.85

Resistance levels: 137.55 138.00 138.45

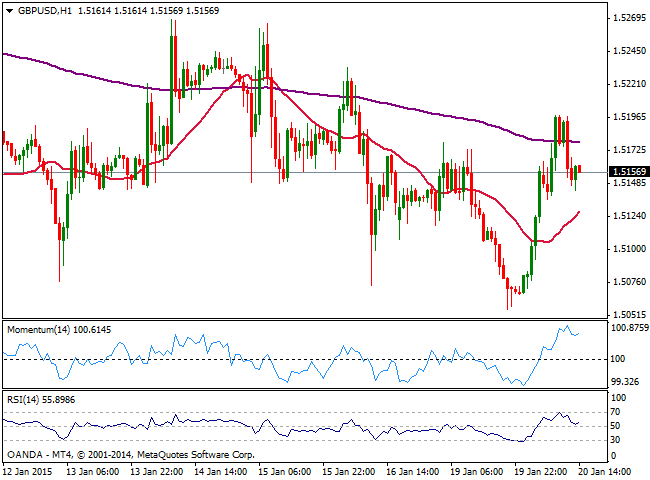

GBP/USD Current price: 1.5156

View Live Chart for the GBP/USD

The GBP/USD pair enjoyed some early demand during Asian hours, reaching a daily high of 1.5198 before finding sellers. The pair however erased all of its Monday losses, and is now expected to consolidate ahead of Wednesday UK data which includes BOE’s Minutes and monthly employment figures. Minutes are not expected to be a surprise, as Governor Carney seems determinate to keep the ongoing economic policy for most of this 2015. When it comes to employment, market attention will likely focus in wages rather than employment creation, as weak salaries had been a key hurdle in inflation growth. Technically, the short term picture maintains a positive bias, as per indicators turning back north after correcting overbought readings, and the price well above a bullish 20 SMA. In the 4 hours chart indicators aim higher around their midlines, while the price hovers above a flat 20 SMA, all of which indicates a clear lack of momentum at the time being.

Support levels: 1.540 1.5110 1.5070

Resistance levels: 1.5190 1.5225 1.5250

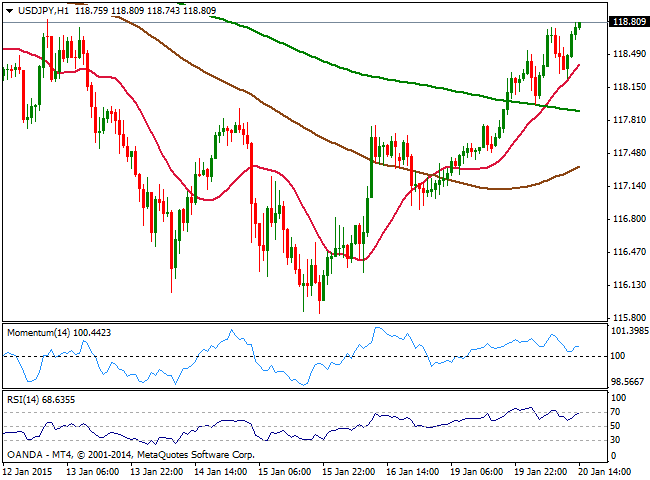

USD/JPY Current price: 118.80

View Live Chart for the USD/JPY

The USD/JPY pair trades at a fresh 6-day high around current 180.80 level, supported by renewed dollar demand. The 1 hour chart for the pair shows that the price extended its advance above its 200 SMA with a shorter 20 SMA offering immediate intraday support now around 118.40. Indicators in the same time frame had regained the upside after a failure approach to break below their midlines, suggesting the pair may continue to advance. In the 4 hours chart indicators lost their upward strength but remain well above their midlines, as the price advances firmly above a now bullish 20 SMA, supporting the shorter term view.

Support levels: 118.30 117.90 117.35

Resistance levels: 119.20 119.50 120.00

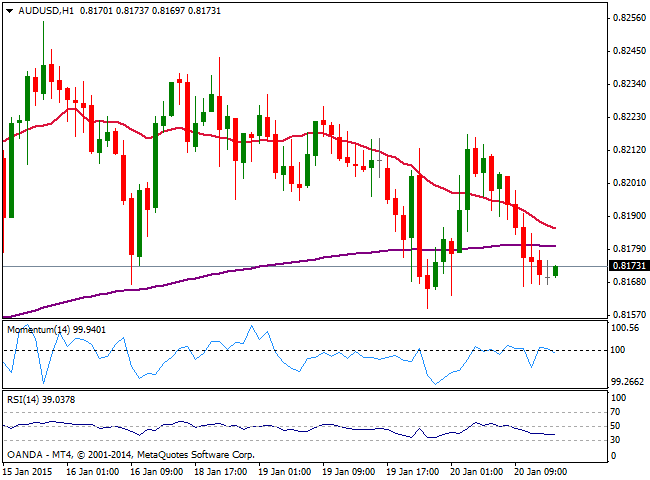

AUD/USD Current price: 0.8172

View Live Chart of the AUD/USD

The AUD/USD pair legged down to the 0.8160 price zone early this Tuesday, weighed by soft Chinese growth figures as yearly GDP for 2014 closed at 7.3% while in the 4Q the economy grew just 1.5%. There will be no relevant data coming from Australia or China today, leaving AUD/USD in the hands of market sentiment. The 1 hour chart shows that the price trades near its daily low of 0.8159 and below a bearish 20 SMA, albeit indicators hold in neutral territory. In the 4 hours chart, the pair is biased lower as per 20 SMA offering now dynamic resistance around 0.8215, while indicators turn south below their midlines.

Support levels: 0.8145 0.8110 0.8070

Resistance levels: 0.8215 0.8240 0.8290

Recommended Content

Editors’ Picks

USD/JPY holds near 155.50 after Tokyo CPI inflation eases more than expected

USD/JPY is trading tightly just below the 156.00 handle, hugging multi-year highs as the Yen continues to deflate. The pair is trading into 30-plus year highs, and bullish momentum is targeting all-time record bids beyond 160.00, a price level the pair hasn’t reached since 1990.

AUD/USD stands firm above 0.6500 with markets bracing for Aussie PPI, US inflation

The Aussie Dollar begins Friday’s Asian session on the right foot against the Greenback after posting gains of 0.33% on Thursday. The AUD/USD advance was sponsored by a United States report showing the economy is growing below estimates while inflation picked up.

Gold soars as US economic woes and inflation fears grip investors

Gold prices advanced modestly during Thursday’s North American session, gaining more than 0.5% following the release of crucial economic data from the United States. GDP figures for the first quarter of 2024 missed estimates, increasing speculation that the US Fed could lower borrowing costs.

Ethereum could remain inside key range as Consensys sues SEC over ETH security status

Ethereum appears to have returned to its consolidating move on Thursday, canceling rally expectations. This comes after Consensys filed a lawsuit against the US SEC and insider sources informing Reuters of the unlikelihood of a spot ETH ETF approval in May.

Bank of Japan expected to keep interest rates on hold after landmark hike

The Bank of Japan is set to leave its short-term rate target unchanged in the range between 0% and 0.1% on Friday, following the conclusion of its two-day monetary policy review meeting for April. The BoJ will announce its decision on Friday at around 3:00 GMT.