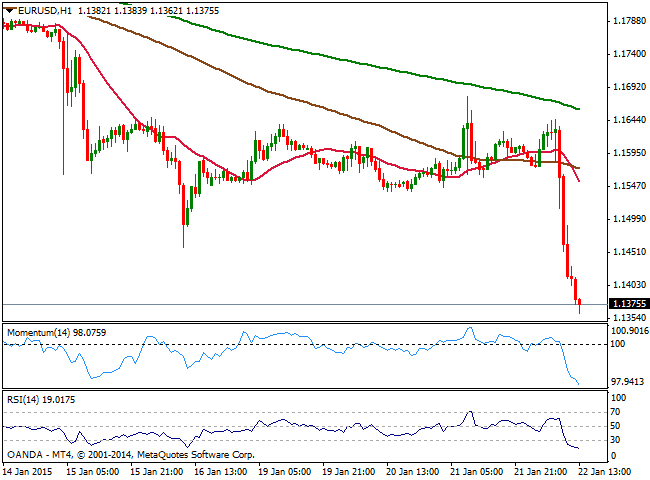

EUR/USD Current price: 1.1375

View Live Chart for the EUR/USD

The ECB has finally launched sovereign quantitative easing, in the way of purchases of EUR 60 billion a month beginning in March 2015 until September 2016, of national bonds and agency bonds. The package of over EUR 1T was largely above what market had priced in, but not a surprise after SNB’s move last Thursday, when it decided to lift the EUR/CHF peg. The program is open-ended as according to Draghi, it’s ‘intended to be carried out until end-September 2016 and will in any case be conducted until we see a sustained adjustment in the path of inflation.' The EUR/USD swung in a 120 pips with the news, but as the press conference faded the EUR capitulate against its rivals, falling as low as 1.1362 against the greenback.

Technically, it has accomplished a long term target, as per reaching 1.1370 static support area, where the pair presents several weekly and daily lows back from 2003, so some consolidation at current levels and even a limited bounce, should not be surprise. Short term, the pair is extremely oversold according to technical indicators and with RSI at 18 which supports some upward correction in the near term. In the 4 hours chart indicators maintain a strong upward momentum, not yet ready to turn higher. Nevertheless, this ECB move has somehow reaffirmed the dominant bearish trend, and despite USD longs may be overcrowded, the pair is now set to reach the key psychological figure of 1.10 in the upcoming weeks.

Support levels: 1.1360 1.1330 1.1290

Resistance levels: 1.1420 1.1460 1.1515

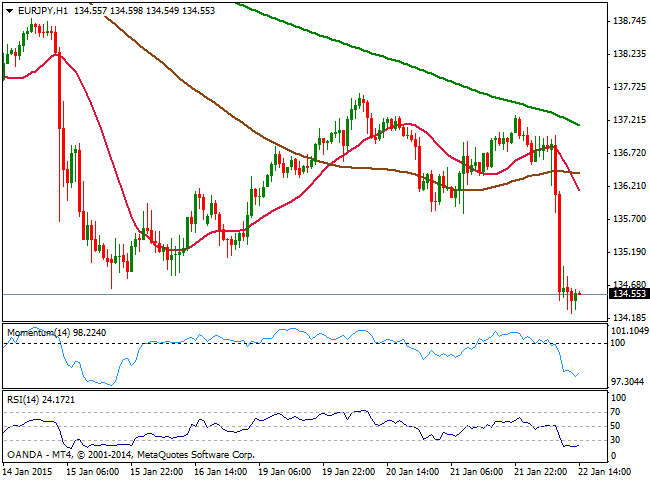

EUR/JPY Current price: 134.54

View Live Chart for the EUR/JPY

Despite stocks surged with the news, putting the Japanese Yen under pressure, the EUR/JPY cross nose- dived to 134.24, level not seen since last October. Market was all about EUR weakness after the ECB announcement. Technically, the 1 hour chart shows that indicators aim higher in extreme oversold territory, aiming to correct higher, although price consolidates near its lows whilst moving averages are now well above current price. In the 4 hours chart however, indicators are biased strongly down, supporting a continuation of current downward movement, with a break below 134.12, October 2014 low required to confirm an approach to the 130.00 figure.

Support levels: 134.15 133.70 133.35

Resistance levels: 134.90 135.40 135.85

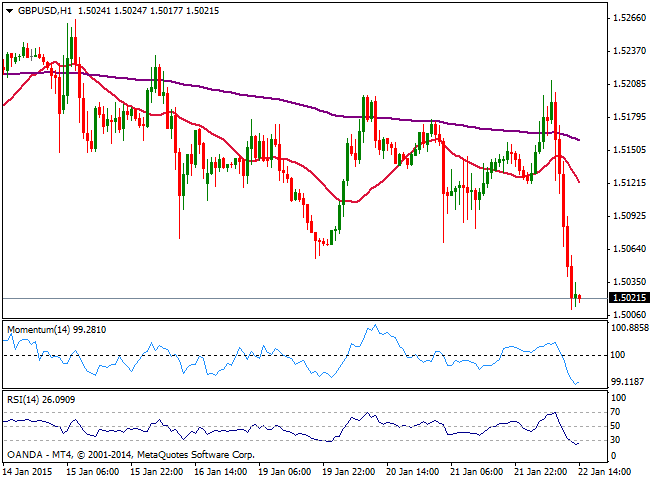

GBP/USD Current price: 1.5021

View Live Chart for the GBP/USD

The GBP/USD pair lost over 200 pips this Thursday, having surged early Europe up to 1.5211 before breaking lower. Trading at a fresh 1 and a half year low, early data showed that British government borrowing rose sharply in December, with Britain's headline public borrowing up to 13.1 billion pounds from 10.3 billion pounds a year before. Technically, the 1 hour chart shows price hovering a few pips above the daily low of 1.5010, and with indicators losing their bearish slope in oversold levels, not yet suggesting an upward corrective movement. In the 4 hours chart indicators maintain a clear bearish momentum ahead of Asian opening, supporting a continued slide, particularly on a break below the mentioned daily low.

Support levels: 1.5010 1.4980 1.4950

Resistance levels: 1.5035 1.5080 1.5125

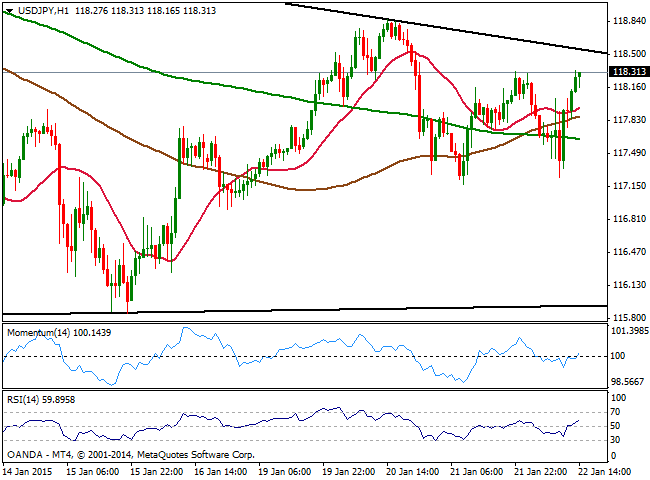

USD/JPY Current price: 118.30

View Live Chart for the USD/JPY

The USD/JPY is sharply higher by US close, trading near its weekly high as dollar index hit a fresh multi-year high following ECBs’ stimulus news above 94.40 mid American afternoon. The stunning recovery in equity markets all over the world also favors the upside in the pair. Asian share markets should also cheer European money injection and remain bid today, meaning the pair will likely continue rising. From a technical point of view and in the short term, the 1 hour chart shows that price is now above their midlines, still in a tight range, whilst indicators crossed their midlines to the upside and continue to head higher, supporting some further advances. In the 4 hours chart technical indicators maintain a neutral stance, while a daily descendant trend line offers immediate resistance around 118.55, the level to overcome to see an extension towards the 119.00 figure.

Support levels: 118.20 117.90 117.45

Resistance levels: 118.60 119.00 119.50

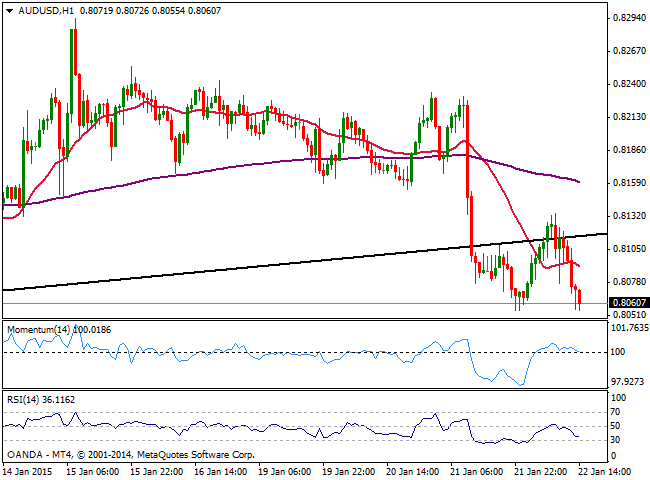

AUD/USD Current price: 0.8060

View Live Chart of the AUD/USD

The AUD/USD failed to regain the upside and fell below the 0.8100 figure, trading near its daily low of 0.8055. In Australia, MI Inflation Expectations posted a gain of 3.2%. HIA New Home Sales softened in December, with a gain of 2.2%, while in the US, unemployment claims missed expectations rising to 307K. Data has been quite positive in Australia this week, but not enough to oppose to dollar momentum on Central Bank’s imbalances. The 1 hour chart shows that the price extended below its 20 SMA, whilst indicators turn lower pointing for a break lower. In the 4 hours chart indicators retraced from their midlines, maintaining strong bearish slopes whilst 20 SMA turned lower now offering resistance around 0.8140, all of which supports the shorter term view, particularly following a break below 0.8033 this year low.

Support levels: 0.8035 0.7990 0.7960

Resistance levels: 0.8115 0.8140 0.8190

Recommended Content

Editors’ Picks

GBP/USD rises above 1.3300 after UK Retail Sales data

GBP/USD trades with a positive bias for the third straight day on Friday and hovers above the 1.3300 mark in the European morning on Friday. The data from the UK showed that Retail Sales rose at a stronger pace than expected in August, supporting Pound Sterling.

USD/JPY recovers to 142.50 area during BoJ Governor Ueda's presser

USD/JPY stages a modest recovery toward 142.50 in the European morning following the initial pullback seen after the BoJ's decision to maintain status quo. In the post-meeting press conference, Governor Ueda reiterated that they will adjust the degree of easing if needed.

Gold consolidates weekly gains, with sight on $2,600 and beyond

Gold price is looking to build on the previous day’s rebound early Friday, consolidating weekly gains amid the overnight weakness in the US Dollar alongside the US Treasury bond yields. Traders now await the speeches from US Federal Reserve monetary policymakers for fresh hints on the central bank’s path forward on interest rates.

Shiba Inu is poised for a rally as price action and on-chain metrics signal bullish momentum

Shiba Inu remains strong on Friday after breaking above a symmetrical triangle pattern on Thursday. This breakout signals bullish momentum, further bolstered by a rise in daily new transactions that suggests a potential rally in the coming days.

Bank of Japan set to keep rates on hold after July’s hike shocked markets

The Bank of Japan is expected to keep its short-term interest rate target between 0.15% and 0.25% on Friday, following the conclusion of its two-day monetary policy review. The decision is set to be announced during the early Asian session.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.