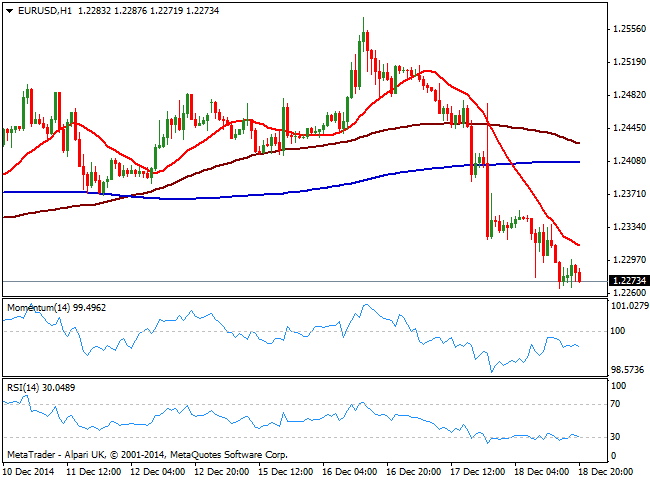

EUR/USD Current price: 1.2278

View Live Chart for the EUR/USD

The EUR/USD pair extended its decline on Thursday down to 1.2266, having remained capped below the 1.2300 figure for most of the US session. The latest FED’s decision has restored investors’ confidence with stocks closing strongly up across the world. Earlier on the day, German IFO survey showed confidence rose for a second month as the economy shows signs of strengthening, but it was not enough to trigger EUR demand. In the US data came out mixed, with unemployment claims decreasing to 289K in the week ending Dec 12, but Markit Services PMI edged lower down to 53.6. But the main fundamental weight came from the SNB, as the Switzerland Central Bank surprise markets cutting rates to negative, in order to discourage safe-haven buying of francs, down to -0.25% and protect EUR/CHF peg.

The short term technical picture for the EUR/USD continues to favor the downside, as the 1 hour chart shows that the price remained contained in its advances by a strongly bearish 20 SMA, whilst indicators head south well into negative territory. In the 4 hours chart indicators also head clearly lower despite in oversold territory, whilst 20 SMA turned south well above current price. The year low stands at 1.2240, and is acting now as the immediate support level, with a break below it probably triggering large stops and fueling the selloff towards the 1.2150 price zone.

Support levels: 1.2240 1.2190 1.2150

Resistance levels: 1.2315 1.2360 1.2400

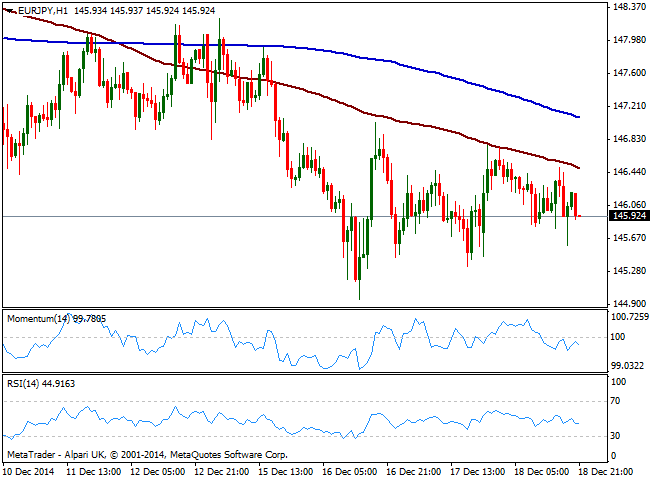

EUR/JPY Current price: 145.92

View Live Chart for the EUR/JPY

The EUR/JPY cross edged lower in the day, lead by EUR weakness. Despite the Japanese yen has been also on the losing side this Thursday, the pair trades below the 146.00 level and with the 1 hour chart showing 100 SMA acting as dynamic resistance since early Asian session, currently at 146.50, while indicators head lower below their midlines. In the 4 hours chart indicators diverge from each other around their midlines, giving little clues on upcoming direction. The overall stance however is still bearish, with a break below 145.55 exposing the weekly low of 144.95.

Support levels: 145.55 144.95 144.60

Resistance levels: 146.15 146.50 146.90

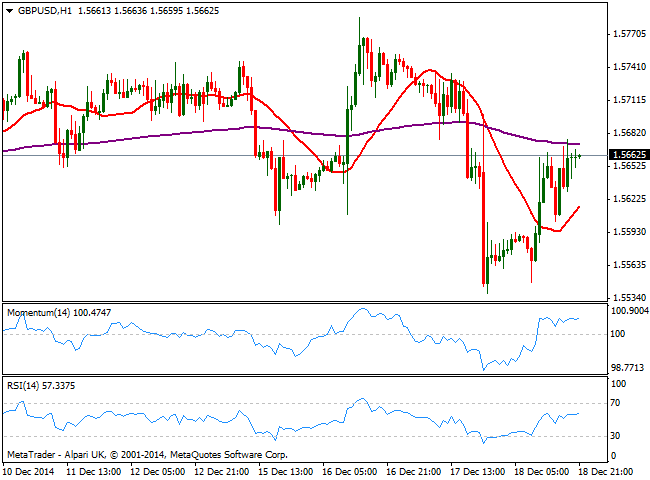

GBP/USD Current price: 1.5662

View Live Chart for the GBP/USD

The British Pound held to its early gains against the greenback, triggered by UK Retail Sales that surged above expectations in November, as Black Friday boosted sales. The monthly reading rose 1.6%, the biggest increase this year, and the YoY reading gained 6.4%, the largest in over a decade. The GBP/USD pair posted a higher low daily basis of 1.5548 before surging to 1.5676 mid American afternoon, consolidating a few pips below it afterwards. Technically, the 1 hour chart shows 20 SMA turned back higher below the current price, while indicators lost directional strength but remain in positive territory. In the 4 hours chart however, indicators are biased lower in negative territory, while the price is being unable to overcome its 20 SMA around the mentioned daily high. The 1.5610/20 area is the immediate static support for the upcoming hours, and it will take a clear break below to confirm a bearish continuation in the pair, while sellers may surge on advances up to 1.5730/70 price zone.

Support levels: 1.5615 1.5590 1.5540

Resistance levels: 1.5685 1.5735 1.5770

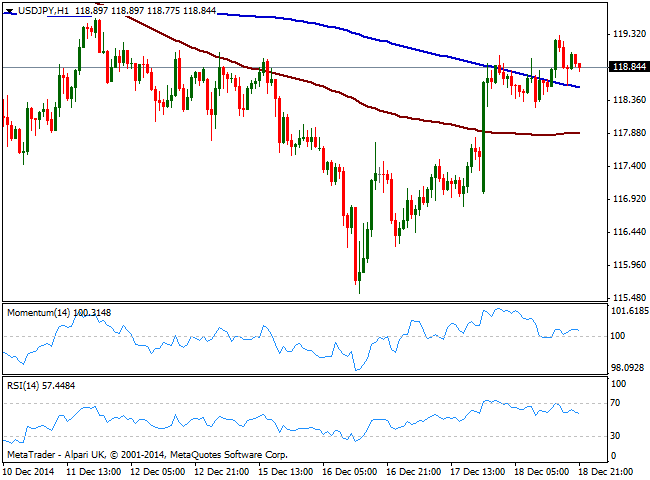

USD/JPY Current price: 118.84

View Live Chart for the USD/JPY

The USD/JPY pair has showed a quite shallow advance despite markets’ renewed optimism, surging to a fresh 4.day high of 119.30, but retracing back below the 119.00 figure to close the day barely 20 pips above its opening. Lately, the yen has been quite attached to Russia and Oil developments, strengthening on risk aversion and seems investors are still wary when it comes to sell the yen. Technically, the 1 hour chart shows price advanced above its 200 SMA that anyway maintains a bearish slope, now acting as dynamic support around 118.50. Indicators in the same time frame turned lower but remain above their midlines, which limits chances of a slide in the short term. In the 4 hours chart momentum continues to head higher above 100 while RSI stands around 56, supporting the shorter term view. At this point, the pair needs to advance above 119.45 to be able to extend its gains towards the 120.00 figure, with increasing downward potential mentioned 118.50 support gives up.

Support levels: 118.50 118.20 117.70

Resistance levels: 119.00 119.45 119.90

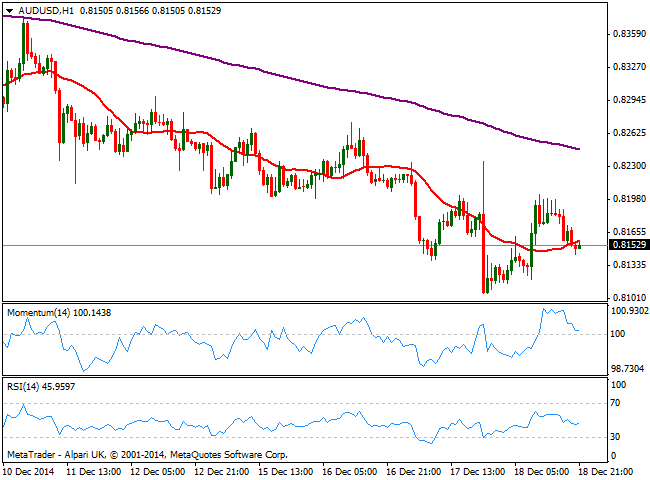

AUD/USD Current price: 0.8152

View Live Chart of the AUD/USD

The Australian dollar surged against the greenback after reaching 0.8106 following the FED, with the AUD/USD pair reaching a daily high of 0.8202, before retracing some. The early recovery was due to easing concerns over the Russian crisis and a mild recovery in commodity prices. Trading mid range, the AUD/USD 1 hour chart shows that the price is hovering around its 20 SMA, while indicators remain above their midlines. In the 4 hours chart the bearish bias prevails with the price still unable to overcome its 20 SMA, currently around 0.8190, and indicators heading south into negative territory. Despite the pair may continue to correct higher especially if the price advances above 0.8200, the dominant trend is still bearish and sellers may surge near 0.8270 if reached. Nevertheless the downside continues to be favored with large stops suspected below 0.8105: if triggered, the pair can extend down to 0.7940 key long term support.

Support levels: 0.8145 0.8105 0.8060

Resistance levels: 0.8190 0.8230 0.8270

Recommended Content

Editors’ Picks

USD/JPY pops and drops on BoJ's expected hold

USD/JPY reverses a knee-jerk spike to 142.80 and returns to the red below 142.50 after the Bank of Japan announced on Friday that it maintained the short-term rate target in the range of 0.15%-0.25%, as widely expected. Governor Ueda's press conference is next in focus.

AUD/USD bears attack 0.6800 amid PBOC's status-quo, cautious mood

AUD/USD attacks 0.6800 in Friday's Asian trading, extending its gradual retreat after the PBOC unexpectedly left mortgage lending rates unchanged in September. A cautious market mood also adds to the weight on the Aussie. Fedspeak eyed.

Gold consolidates near record high, bullish potential seems intact

Gold price regained positive traction on Thursday and rallied back closer to the all-time peak touched the previous day in reaction to the Federal Reserve's decision to start the policy easing cycle with an oversized rate cut.

Ethereum rallies over 6% following decision to split Pectra upgrade into two phases

In its Consensus Layer Call on Thursday, Ethereum developers decided to split the upcoming Pectra upgrade into two batches. The decision follows concerns about potential risks in shipping the previously approved series of Ethereum improvement proposals.

Bank of Japan set to keep rates on hold after July’s hike shocked markets

The Bank of Japan is expected to keep its short-term interest rate target between 0.15% and 0.25% on Friday, following the conclusion of its two-day monetary policy review. The decision is set to be announced during the early Asian session.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.