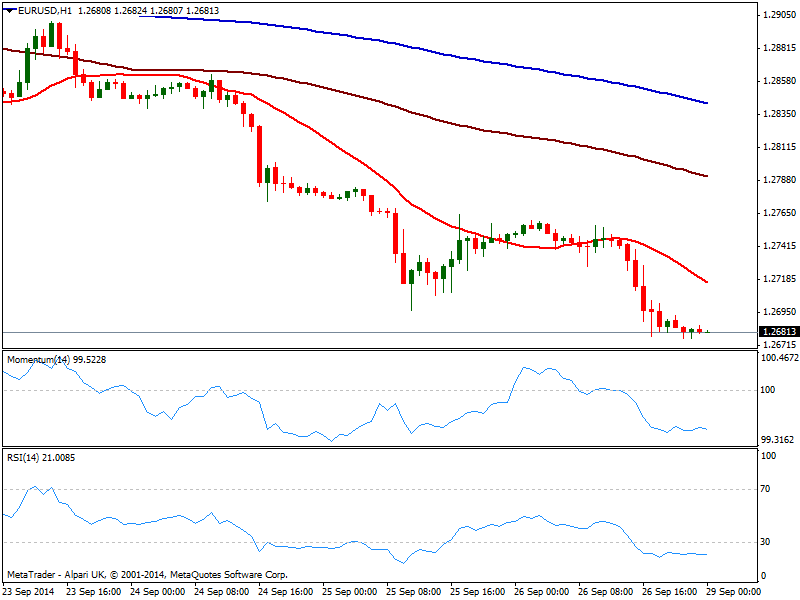

EUR/USD Current price: 1.2681

View Live Chart for the EUR/USD

The EUR/USD starts its critical week of the month at the year lows below the 1.2700 figure posted on Friday: later on the day, both economies will be releasing the most volatile data for each that is ECB monthly economic decision, and US employment figures. The European Central Bank is expected to launch even more facilities, while the US employment is expected to have pickup from the latest 142K: market will face both with high expectations the releases will fuel current bearish trend, so if any failure to deliver, some upward corrections could be expected in the pair by the end of the week. But it will take more than a 100 pips upside ride to call for a bottom.

In the meantime the short term picture shows the pair still biased lower, as the 1 hour chart shows price well below a bearish 20 SMA currently around 1.2715 and indicators flat in oversold territory. In the 4 hours chart 20 SMA also presents a bearish slope well above current price, while indicators lost the strong downward potential seen late Friday, now flat in oversold territory and with no signs of a possible upward correction yet. Further slides below 1.2660 should signal a downward continuation towards the 1.2620 level, with the upside limited by 1.2770 price zone.

Support levels: 1.2660 1.2625 1.2590

Resistance levels: 1.2715 1.2740 1.2770

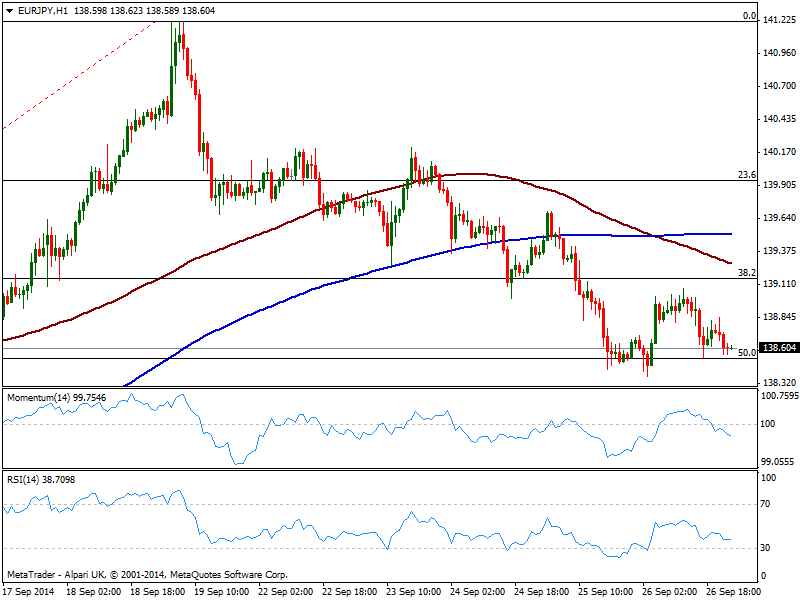

EUR/JPY Current price: 138.60

View Live Chart for the EUR/JPY

The EUR/JPY maintains the bearish tone for these last few days, with the retracement from 141.20 holding steady below 139.00. The pair trades around the 50% retracement of its latest daily bullish run from Sep 5th low of 135.81 to Sep 19th high posted at 131.21, with the 38.2% retracement of the same rally offering resistance now at 139.15, with the hourly chart showing price well below moving averages, and with 100 SMA having crossed to the downside 200 one, which reinforces the negative sentiment in the pair. Indicators in the same time frame head lower into negative territory, suggesting more slides ahead. In the 4 hours chart indicators turned lower in negative territory after correcting oversold readings, with scope to extend towards 137.90, 61.8% retracement of the same rally.

Support levels: 138.40 137.90 137.35

Resistance levels: 139.15 139.60 140.00

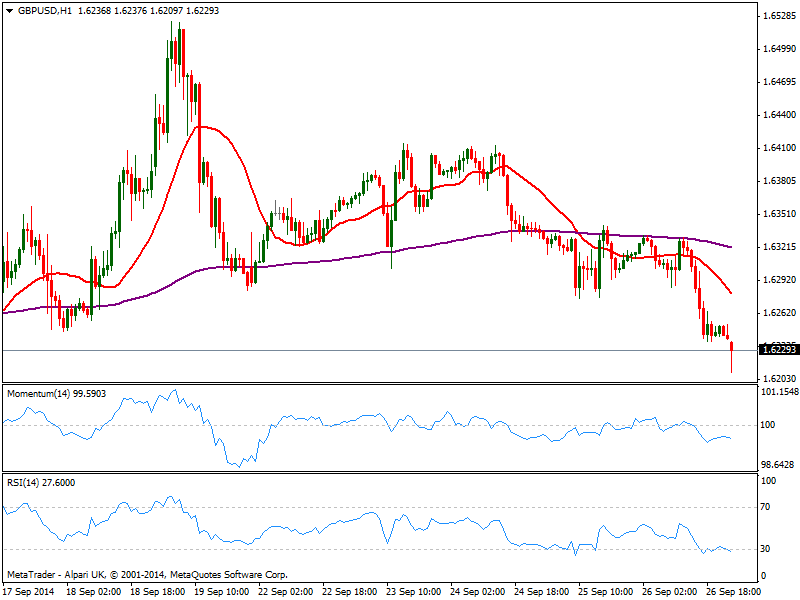

GBP/USD Current price: 1.6229

View Live Chart for the GBP/USD

Pound opens with a heavy tone against the greenback, with the pair gapping lower a handful of pips, so far testing 1.6209.The 1 hour chart shows a quite strong bearish bias with 20 SMA heading strongly south above current price and momentum regaining the downside in negative territory, while RSI resumes the downside after partially correcting oversold readings. In the 4 hours chart, technical readings also present a clear bearish tone, supporting a test of 1.6160 strong static support for the day. The upside should remain capped by another strong static level, 1.6345 price zone.

Support levels: 1.6220 1.6190 1.6160

Resistance levels: 1.6250 1.6300 1.6345

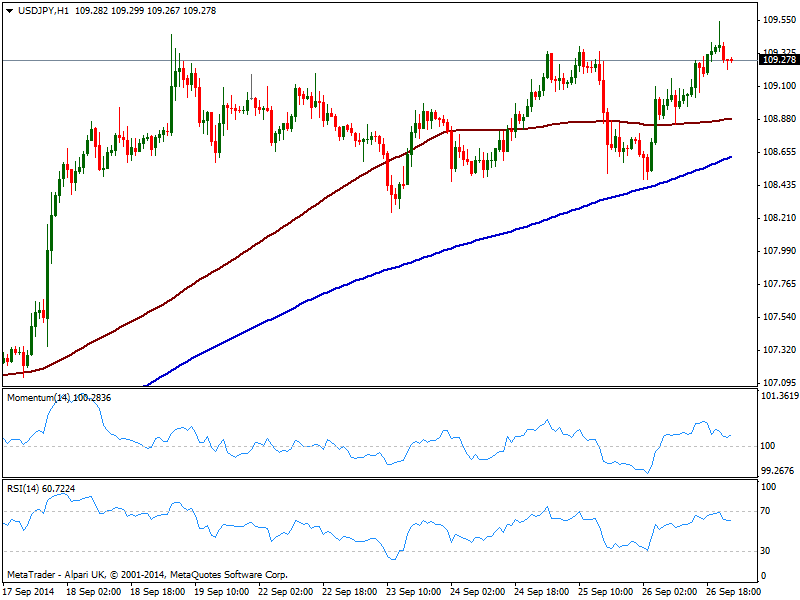

USD/JPY Current price: 109.27

View Live Chart for the USD/JPY

After briefly extending to a new year high of 109.54 late Friday, the USD/JPY starts the week a few pips below the level and maintaining the dominant positive tone despite unable to extend clearly. With the afore mentioned critical data, particularly US employment figures, should not be a surprise if the pair trades range bound for these first days of the week, with 108.50 area as the base. Technically, the short term picture shows price developing above 100 and 200 SMAs, with the latest approaching the first from below, usually a sign of exhaustion of the dominant trend. Indicators in the same time frame head higher above their midlines, which should keep the risk to the downside limited in a calendar empty Asian session. As for the 4 hours chart indicators are turning lower above their midlines, also suggesting some short term exhaustion, albeit not supporting yet a bearish move. Some further advances above 109.40/50 price zone should deny the possibility of a bearish movement and point for an approach to the 110.00 price zone.

Support levels: 108.90 108.50 108.20

Resistance levels: 109.45 109.80 110.20

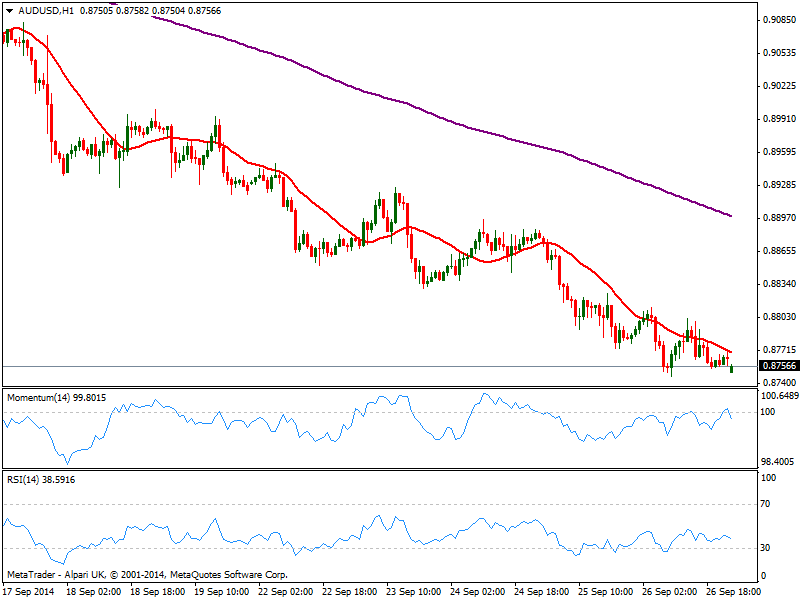

AUD/USD Current price: 0.8756

View Live Chart of the AUD/USD

The AUD/USD maintains its negative tone, with the pair gapping lower in the opening, albeit not far away from Friday’s close. The 1 hour chart shows 20 SMA capping the upside a few pips above current price while momentum turns south around 100, showing no actual strength. In the 4 hours chart however, the bearish tone is stronger with RSI flat at 32 and momentum heading south below 100. The overall stance is bearish for the day, with some follow through below 0.8745 supporting a slide towards 0.8700 area; short term 0.8770 is the resistance to follow, with 4 hour’s 20 SMA standing around the 0.8800 figure and probably attracting some short term sellers if reached.

Support levels: 0.8745 0.8710 0.8680

Resistance levels: 0.8770 0.8800 0.8840

Recommended Content

Editors’ Picks

USD/JPY pops and drops on BoJ's expected hold

USD/JPY reverses a knee-jerk spike to 142.80 and returns to the red below 142.50 after the Bank of Japan announced on Friday that it maintained the short-term rate target in the range of 0.15%-0.25%, as widely expected. Governor Ueda's press conference is next in focus.

AUD/USD bears attack 0.6800 amid PBOC's status-quo, cautious mood

AUD/USD attacks 0.6800 in Friday's Asian trading, extending its gradual retreat after the PBOC unexpectedly left mortgage lending rates unchanged in September. A cautious market mood also adds to the weight on the Aussie. Fedspeak eyed.

Gold consolidates near record high, bullish potential seems intact

Gold price regained positive traction on Thursday and rallied back closer to the all-time peak touched the previous day in reaction to the Federal Reserve's decision to start the policy easing cycle with an oversized rate cut.

Ethereum rallies over 6% following decision to split Pectra upgrade into two phases

In its Consensus Layer Call on Thursday, Ethereum developers decided to split the upcoming Pectra upgrade into two batches. The decision follows concerns about potential risks in shipping the previously approved series of Ethereum improvement proposals.

Bank of Japan set to keep rates on hold after July’s hike shocked markets

The Bank of Japan is expected to keep its short-term interest rate target between 0.15% and 0.25% on Friday, following the conclusion of its two-day monetary policy review. The decision is set to be announced during the early Asian session.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.