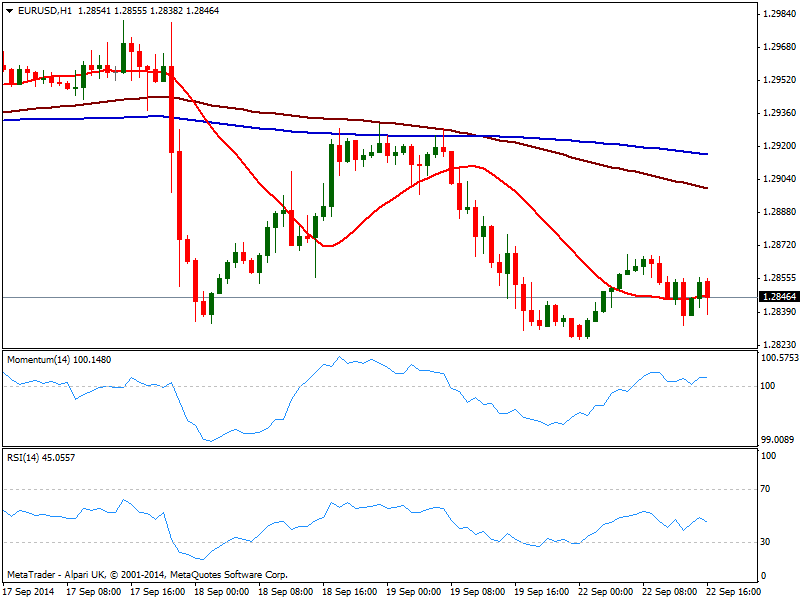

EUR/USD Current price: 1.2846

View Live Chart for the EUR/USD

The EUR/USD trades in a quiet range this Monday, midway between 1.2826 and 1.2867 ahead of US data in a few minutes. Draghi’s words so far are unable to affect the pair, with the ECB President stating that TLTRO was among expected, not concern on the small allotment of this first round. Technically, the hourly chart shows indicators above their midlines but far from suggesting upward strength, as price hovers around a flat 20 SMA. In the 4 hours chart indicators stand in neutral territory, while 20 SMA caps the upside around 1.2880: as long as below this last chances of a recovery seem quite limited, while risk to the downside increases on a price acceleration through 1.2810.

Support levels: 1.2810 1.2770 1.2840

Resistance levels: 1.2865 1.2910 1.2950

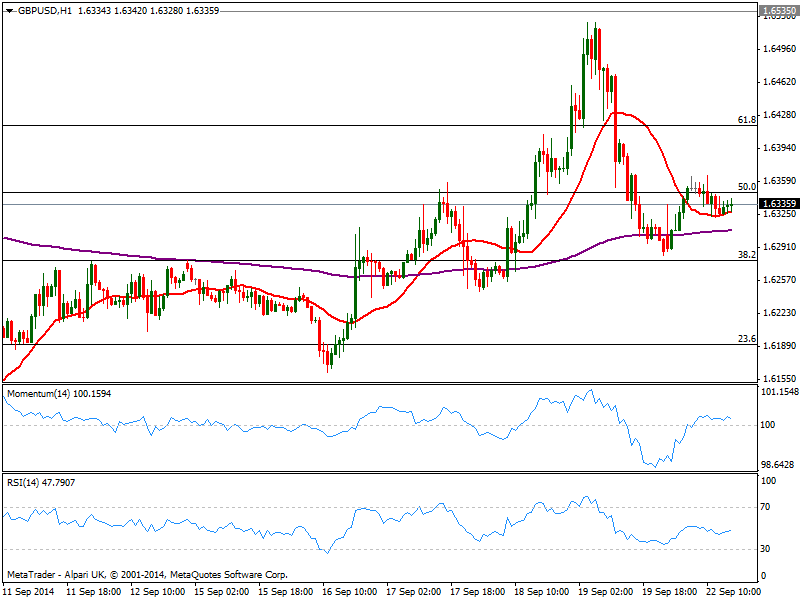

GBP/USD Current price: 1.6335

View Live Chart for the GBP/USD

The GBP/USD stands quite static below 1.6345 Fibonacci resistance, having been unable to extend beyond it despite a couple spikes higher: the hourly chart shows price attached to its 20 SMA and indicators flat around their midlines, reflecting the lack of short term direction. In the 4 hours chart 20 SMA stands at mentioned 1.6345 level reinforcing its strength, as indicators lose upward potential and turn lower above their midlines.

Support levels: 1.6300 1.6275 1.6220

Resistance levels: 1.6345 1.6410 1.6470

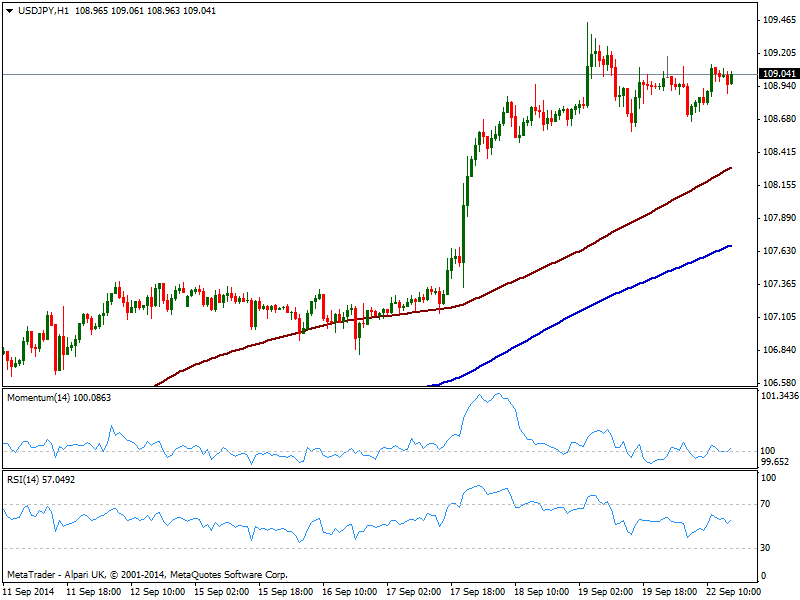

USD/JPY Current price: 109.04

View Live Chart for the USD/JPY

The USD/JPY has recovered the 109.00 figure, having found buyers around 108.65 daily low, and with a mild positive tone in the short term, as per the hourly chart showing price well above moving averages and indicators turning higher around their midlines, still quite neutral. In the 4 hours chart momentum regains the upside above 100 after erasing overbought readings, while RSI also corrected partially. The upside continues to be favored, with a break above recent high of 109.45 pointing for a test of critical 110.00 level, with buyers waiting on dips towards 108.50/60 price zone.

Support levels: 108.95 108.55 108.10

Resistance levels: 109.45 109.75 110.20

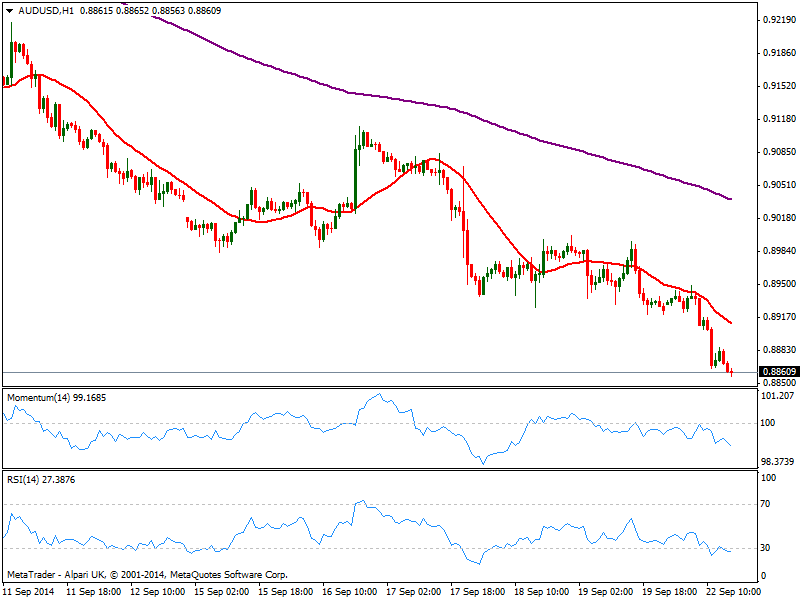

AUD/USD Current price: 0.8860

View Live Chart of the AUD/USD

The AUD/USD continues to shed ground having broke below 0.8900 support early European morning. The pair trades a few pips above its daily low with a strong bearish momentum coming from the hourly chart, as indicators head strongly south below their midlines while 20 SMA caps the upside around 0.8910. In the 4 hours chart the bearish momentum is even stronger, with RSI below 30 with no signs of turning higher at the time being. Sellers will likely surge on recoveries up to 0.8910, yet a break below 0.8830 support should lead to an extension of the dominant bearish trend.

Support levels: 0.8830 0.8800 0.8770

Resistance levels: 0.8880 0.8910 0.8950

Recommended Content

Editors’ Picks

USD/JPY holds near 155.50 after Tokyo CPI inflation eases more than expected

USD/JPY is trading tightly just below the 156.00 handle, hugging multi-year highs as the Yen continues to deflate. The pair is trading into 30-plus year highs, and bullish momentum is targeting all-time record bids beyond 160.00, a price level the pair hasn’t reached since 1990.

AUD/USD stands firm above 0.6500 with markets bracing for Aussie PPI, US inflation

The Aussie Dollar begins Friday’s Asian session on the right foot against the Greenback after posting gains of 0.33% on Thursday. The AUD/USD advance was sponsored by a United States report showing the economy is growing below estimates while inflation picked up.

Gold soars as US economic woes and inflation fears grip investors

Gold prices advanced modestly during Thursday’s North American session, gaining more than 0.5% following the release of crucial economic data from the United States. GDP figures for the first quarter of 2024 missed estimates, increasing speculation that the US Fed could lower borrowing costs.

Ethereum could remain inside key range as Consensys sues SEC over ETH security status

Ethereum appears to have returned to its consolidating move on Thursday, canceling rally expectations. This comes after Consensys filed a lawsuit against the US SEC and insider sources informing Reuters of the unlikelihood of a spot ETH ETF approval in May.

Bank of Japan expected to keep interest rates on hold after landmark hike

The Bank of Japan is set to leave its short-term rate target unchanged in the range between 0% and 0.1% on Friday, following the conclusion of its two-day monetary policy review meeting for April. The BoJ will announce its decision on Friday at around 3:00 GMT.