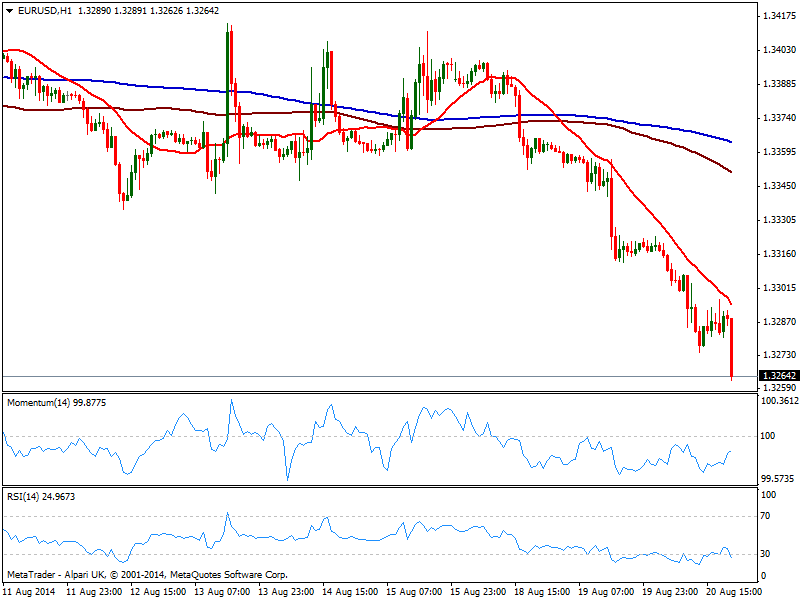

EUR/USD Current price: 1.3264

View Live Chart for the EUR/USD

The American dollar adds another day of gains, advancing after FOMC latest Minutes’ release: many officers said jobs gain might bring a sooner rate hike, giving the greenback a boost late US session, and despite several also pointed out the labor market is far from fully normal. But as the FED comes closer to normalization, higher will go the USD. Earlier on the day, soft European data pushed EUR/USD below the 1.3300 level, and the pair was unable to recover above it, now extending its decline to fresh year lows below 1.3270. The hourly chart shows 20 SMA with a steady bearish slope right above current price, while indicators hold in negative territory, lacking directional strength at the time being not yet reflecting latest slide. In the 4 hours chart however, indicators are biased lower despite in oversold levels, supporting a continuation of the dominant bearish trend.

Support levels: 1.3250 1.3210 1.3170

Resistance levels: 1.3300 1.3330 1.3370

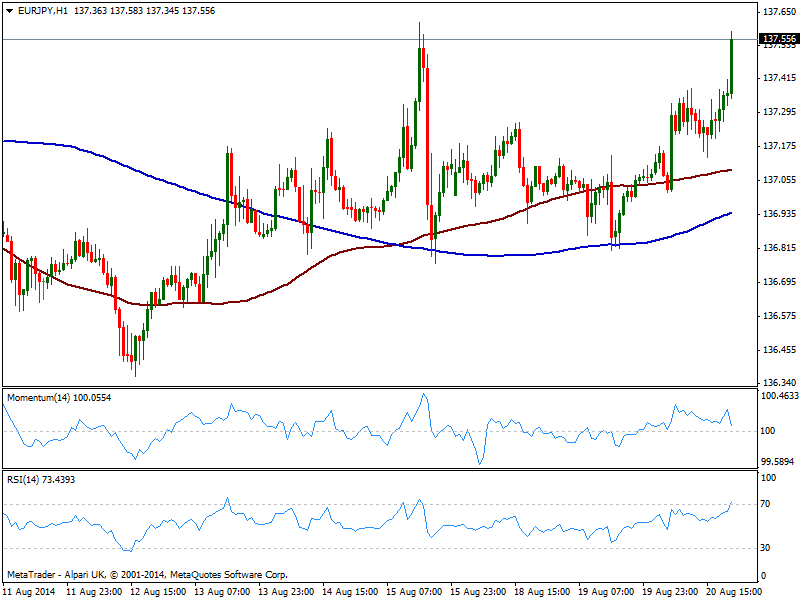

EUR/JPY Current price: 137.54

View Live Chart for the EUR/JPY

Yen weakness outstands on Wednesday despite the uneventful action in stocks markets, with most of US indexes hovering around their opening levels. Some news coming from Japan suggests the country is considering adding 1T of stimulus, which should continue to undermine any possible yen strength, something yet to be confirmed. The EUR/JPY however, quickly approaches the 137.60 level with the news, with the hourly chart showing a mild positive tone coming from technical readings, as price advances above flat moving averages, while indicators stand in positive territory, not yet reflecting latest advance. In the 4 hours chart technical readings present also a bullish tone yet gains should remain limited if EUR continues weakening across the board.

Support levels: 137.30 136.80 136.40

Resistance levels: 137.60 138.00 138.40

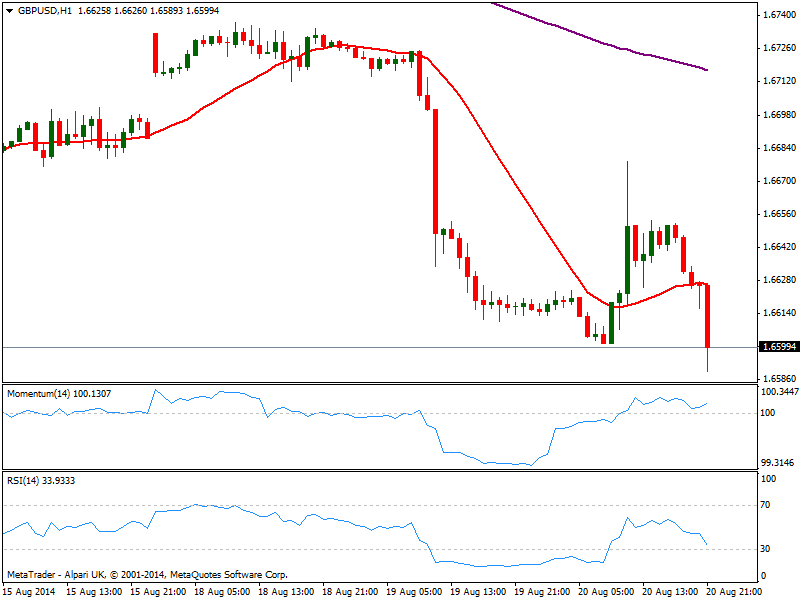

GBP/USD Current price: 1.6599

View Live Chart for the GBP/USD

The GBP/USD struggles to hold above the 1.6600 level, having posted so far a daily low of 1.6589. The pair saw a spark of upward momentum early Europe, when BoE’s Minutes showed 2 of the 9 voting members went for a rate hike as soon as this month. Nevertheless, the pair stalled at 1.6678 before reversing, with the 1 hour chart now showing price below its 20 SMA, momentum aiming higher in neutral territory and RSI gaining strong bearish tone into negative territory, keeping the pressure to the downside. In the 4 hours chart technical readings present a cleared bearish tone, with indicators turning strongly south after correcting oversold conditions.

Support levels: 1.6580 1.6545 1.6510

Resistance levels: 1.6630 16680 1.6710

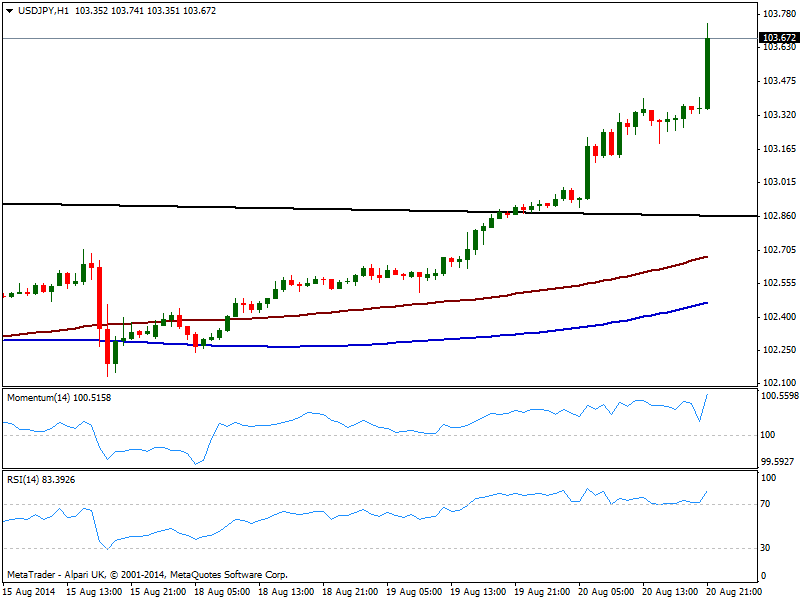

USD/JPY Current price: 103.70

View Live Chart for the USD/JPY

The USD/JPY reached 103.74 levels not seen since April this year, maintaining the positive tone seen on previous updates. Technically, the hourly chart shows a strong upward tone coming from indicators, albeit some consolidation below 103.70/80 may be seen before a new leg higher. In the 4 hours chart indicators aim strongly up despite in extreme overbought levels, supporting also some follow through in price for the upcoming sessions.

Support levels: 103.40 103.20 102.80

Resistance levels: 103.75 104.10 104.45

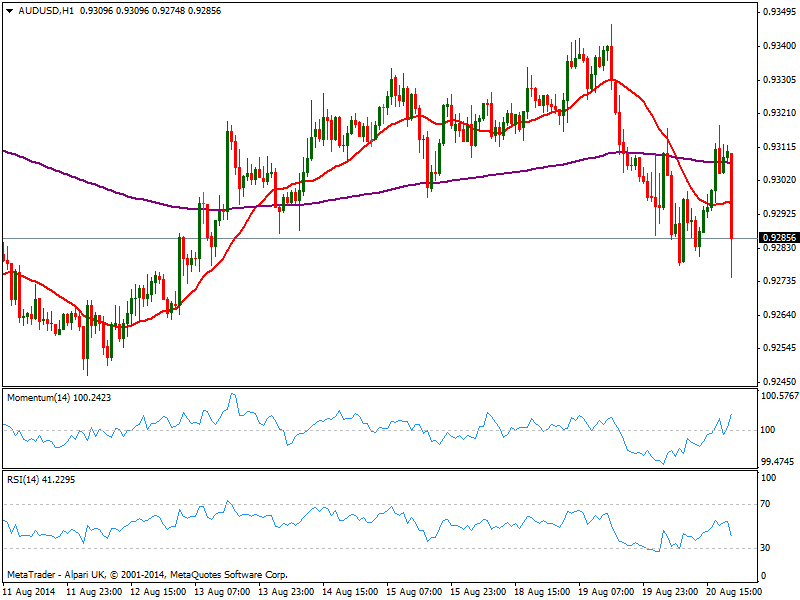

AUD/USD Current price: 0.9285

View Live Chart for the AUD/USD Aussie latest attempt of recovery against the greenback failed to hold above 0.9300: the pair is back under pressure, with price now breaking below its 20 SMA and indicators turning lower within mid range. In the 4 hours chart 20 SMA maintains a strong bearish slope and caps the upside around 0.9310, while indicators turned lower in negative territory, pointing for a continued slide that will likely extend on a strong break below 0.9250/60 strong static support zone.

Aussie latest attempt of recovery against the greenback failed to hold above 0.9300: the pair is back under pressure, with price now breaking below its 20 SMA and indicators turning lower within mid range. In the 4 hours chart 20 SMA maintains a strong bearish slope and caps the upside around 0.9310, while indicators turned lower in negative territory, pointing for a continued slide that will likely extend on a strong break below 0.9250/60 strong static support zone.Support levels: 0.9260 0.9220 0.9180

Resistance levels: 0.9330 0.9370 0.9410

Recommended Content

Editors’ Picks

USD/JPY holds near 155.50 after Tokyo CPI inflation eases more than expected

USD/JPY is trading tightly just below the 156.00 handle, hugging multi-year highs as the Yen continues to deflate. The pair is trading into 30-plus year highs, and bullish momentum is targeting all-time record bids beyond 160.00, a price level the pair hasn’t reached since 1990.

AUD/USD stands firm above 0.6500 with markets bracing for Aussie PPI, US inflation

The Aussie Dollar begins Friday’s Asian session on the right foot against the Greenback after posting gains of 0.33% on Thursday. The AUD/USD advance was sponsored by a United States report showing the economy is growing below estimates while inflation picked up.

Gold soars as US economic woes and inflation fears grip investors

Gold prices advanced modestly during Thursday’s North American session, gaining more than 0.5% following the release of crucial economic data from the United States. GDP figures for the first quarter of 2024 missed estimates, increasing speculation that the US Fed could lower borrowing costs.

FBI cautions against non-KYC Bitcoin and crypto money transmitting services as SEC goes after MetaMask

US FBI has issued a caution to Bitcoiners and cryptocurrency market enthusiasts, coming on the same day as when the US Securities and Exchange Commission is on the receiving end of a lawsuit, with a new player adding to the list of parties calling for the regulator to restrain its hand.

Bank of Japan expected to keep interest rates on hold after landmark hike

The Bank of Japan is set to leave its short-term rate target unchanged in the range between 0% and 0.1% on Friday, following the conclusion of its two-day monetary policy review meeting for April. The BoJ will announce its decision on Friday at around 3:00 GMT.