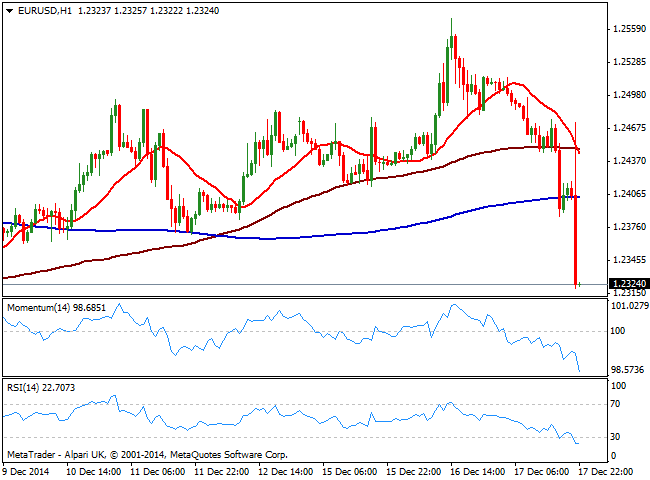

EUR/USD Current price: 1.2333

View Live Chart for the EUR/USD

Janet Yellen held her final press conference of the year following the Fed's last policy announcement on Wednesday, after switching “considerable time” for “patient” in the press release. The marked spiked 30 pips both sides of the board back and forth before the press conference, not sure of where to go. But as Yellen kept talking, the picture became more USD bullish, as the FED not only upgraded the assessment of the labor market, but also tiptoed a rate hike for 2015. Following an initial spike to 1.2473, the EUR/USD pair suddenly changed course and dropped to a fresh 7-day high of 1.2320 in less than an hour.

The short term picture shows that the price made a brief spike above a bearish 20 SMA that did not held before moving again well below its 100 and 200 SMAs. Indicators in the same time frame present a strong bearish tone in oversold territory after the 150 pips drop, with no signs of turning north at the time being. In the 4 hours chart the price was also rejected from its 20 SMA whilst indicators present a strong bearish momentum and supporting further declines. The immediate short term resistance stands now at 1.2360, followed by the 1.2400 level, while a break below 1.2310 will likely push the pair to fresh year lows.

Support levels: 1.2310 1.2270 1.2240

Resistance levels: 1.2360 1.2400 1.2445

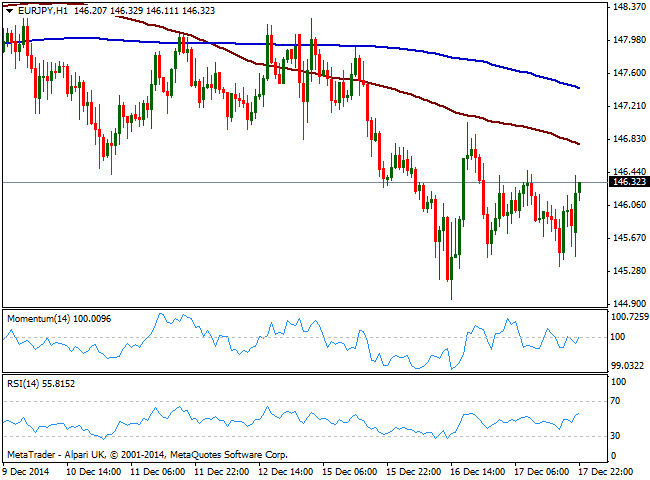

EUR/JPY Current price: 146.23

View Live Chart for the EUR/JPY

The EUR/JPY cross surged after the news, as yen gets hit by rising stocks and 10Y US yields up to 2.12% in the day. Trading within recent range, the EUR/JPY remains limited as per EUR weakness, with the 1 hour chart showing that the price is still well below its 100 SMA currently offering dynamic resistance at 146.70, while indicators aim slightly higher in neutral territory. In the 4 hours chart indicators bounced from oversold levels but remain well below their midlines and far from anticipating an upward move. Nevertheless, yen gains will likely remain limited with local share markets on the run, with scope to advance up to 147.45 during the upcoming Asian session.

Support levels: 145.90 145.50 145.10

Resistance levels: 146.35 146.80 147.45

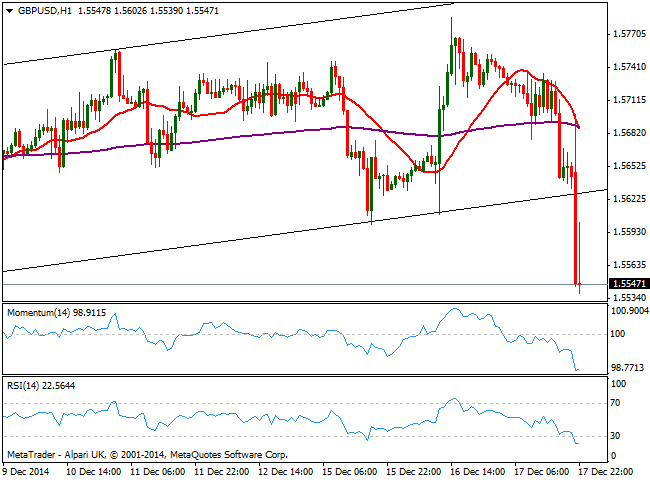

GBP/USD Current price: 1.5546

View Live Chart for the GBP/USD

The UK released its latest BOE Minutes and its monthly employment data early European morning, but it seems like it was a century ago. The unemployment rate remained steady at 6.0%, slightly above expectations of a 5.9%, while wages grew more than inflation in October, which is a positive sign for the still struggling economy. Minutes of the latest meeting on the other hand, offer no news as the Central Bank decided to keep its economic policy unchanged and there was no change in the votes either. When it comes to the technical picture, the GBP/USD pair has broken to the downside with the FED’s decision, reaching 1.5539, 1 pip below the year low set earlier this month. In the 1 hour chart indicators halted in extreme oversold levels, but a spike up to 1.5600 quickly reversed suggesting bears remain in control. In the 4 hours chart technical readings are biased lower well into negative territory, supporting further declines if the 1.5540 area finally gives up.

Support levels: 1.5540 1.5490 1.5450

Resistance levels: 1.5590 1.5630 1.5665

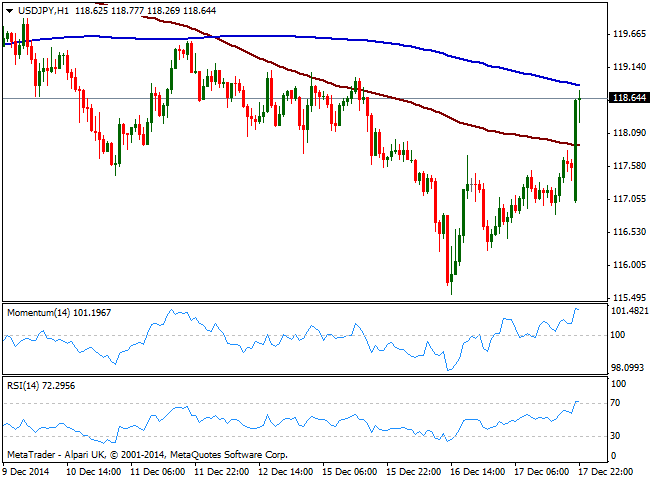

USD/JPY Current price: 118.63

View Live Chart for the USD/JPY

The American dollar finally surged against its Japanese rival, with the USD/JPY pair jumping to 118.78 and erasing these last 2 days losses. The pair recovers alongside with stocks, and seems positioned to continue advancing over Asian hours, as Nikkei futures also trade higher. From a technical point of view, the 1 hour chart shows indicators are losing some of the upward momentum in overbought territory but are far from suggesting a reversal, with price advances towards it 200 SMA, a few pips above the current level and immediate resistance at 118.90. In the 4 hours chart technical readings also present a positive tone, with indicators crossing their midlines to the upside, and supporting the shorter term view, moreover if mentioned resistance is broken.

Support levels: 118.20 117.75 117.30

Resistance levels: 118.90 119.45 119.90

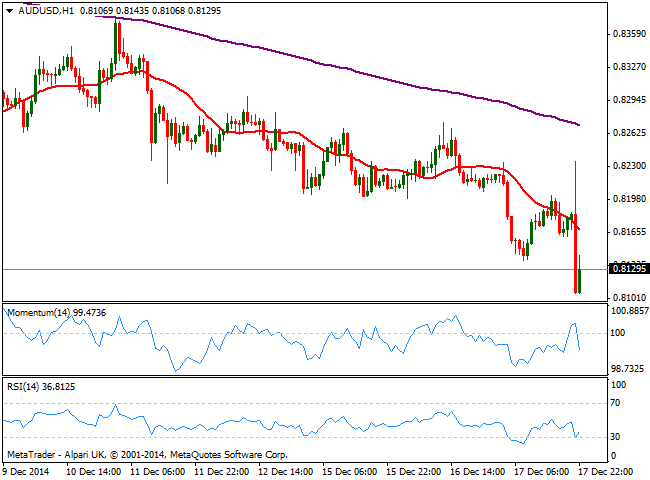

AUD/USD Current price: 0.8125

View Live Chart of the AUD/USD

The AUD/USD pair broke below the 0.8200 figure early Wednesday, reaching 0.8138 before bouncing back towards the 0.8200 area. The early move lower was due stops getting triggered below the mentioned level, with no precise catalyst behind it. With the FED, the pair initially surged to 0.8235 before nose-diving to 0.8106, levels not seen since early June 2010. Despite whatever fundamentals may offer, in the particular case of this pair is the dominant bearish long term trend what leads, and selling higher is the name of the game still. In the short term, the 1 hour chart shows 20 SMA extending its decline above current levels whilst momentum heads lower below 100 and RSI bounces from the 30 level up now at 35. In the 4 hours chart indicators maintain their bearish slopes whilst 20 SMA capped the upside now around 0.8215, supporting the shorter term view. A multi-year Fibonacci support is located at 0.7940, 61.8% of the 0.6291/1.107 rally, and seems likely the pair will continue its slide at least towards that level next big bearish target for the upcoming days.

Support levels: 0.8105 0.8060 0.8020

Resistance levels: 0.8140 0.8200 0.8230

Recommended Content

Editors’ Picks

USD/JPY pops and drops on BoJ's expected hold

USD/JPY reverses a knee-jerk spike to 142.80 and returns to the red below 142.50 after the Bank of Japan announced on Friday that it maintained the short-term rate target in the range of 0.15%-0.25%, as widely expected. Governor Ueda's press conference is next in focus.

AUD/USD bears attack 0.6800 amid PBOC's status-quo, cautious mood

AUD/USD attacks 0.6800 in Friday's Asian trading, extending its gradual retreat after the PBOC unexpectedly left mortgage lending rates unchanged in September. A cautious market mood also adds to the weight on the Aussie. Fedspeak eyed.

Gold consolidates near record high, bullish potential seems intact

Gold price regained positive traction on Thursday and rallied back closer to the all-time peak touched the previous day in reaction to the Federal Reserve's decision to start the policy easing cycle with an oversized rate cut.

Ethereum rallies over 6% following decision to split Pectra upgrade into two phases

In its Consensus Layer Call on Thursday, Ethereum developers decided to split the upcoming Pectra upgrade into two batches. The decision follows concerns about potential risks in shipping the previously approved series of Ethereum improvement proposals.

Bank of Japan set to keep rates on hold after July’s hike shocked markets

The Bank of Japan is expected to keep its short-term interest rate target between 0.15% and 0.25% on Friday, following the conclusion of its two-day monetary policy review. The decision is set to be announced during the early Asian session.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.