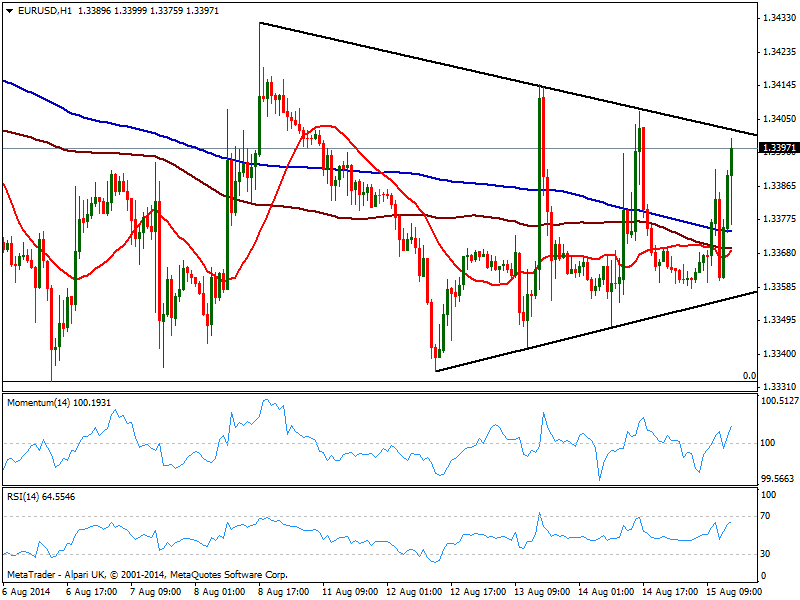

EUR/USD Current price: 1.3394

View Live Chart for the EUR/USD

Little happened early Europe with markets closed on holidays, with the EUR/USD trading within familiar levels. With US first batch of data out, the results are a mild negative dollar across the board, as PPI rose 1.7% in July yearly basis, missing expectations, while NY Manufacturing index went down to 14.6. The EUR/USD approaches the 1.3400 level again, with the hourly chart showing price inside a symmetrical triangle with the roof around 1.3402 offering immediate short term resistance. Indicators in the same time frame aim higher above their midlines, while price stands above moving averages, all converging in the 1.3360/70 area, reflecting the lack of clear directional strength. In the 4 hours chart the pair also presents a mild positive tone, yet unless a clear advance beyond 1.3440 buying at current levels remains risky.

Support levels: 1.3370 1.3330 1.3295

Resistance levels: 1.3405 1.3440 1.3485

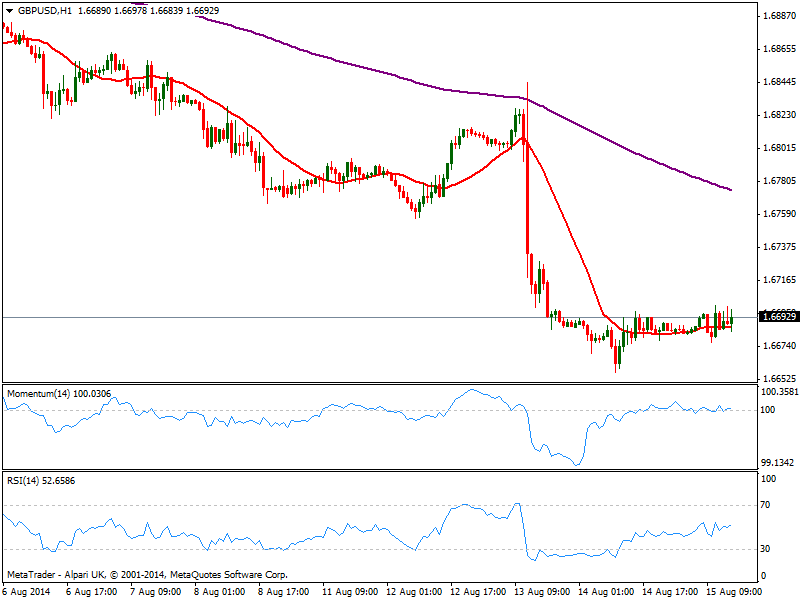

GBP/USD Current price: 1.6692

View Live Chart for the GBP/USD

The GBP/USD took the day off, as the pair seems unable to react to news from any of both economies. Earlier on the day, UK quarterly GDP printed 0.8% strongest in nearly 5 years. Nevertheless, the pair maintains a strong neutral technical outlook according to the hourly chart, with price hovering around a flat 20 SMA and indicators laying horizontal around their midlines. In the 4 hours chart the bearish tone prevails, with 20 SMA offering dynamic resistance now around 1.6730 in case the pair finally wakes up.

Support levels: 1.6650 1.6620 1.6580

Resistance levels: 1.6700 1.6730 1.6760

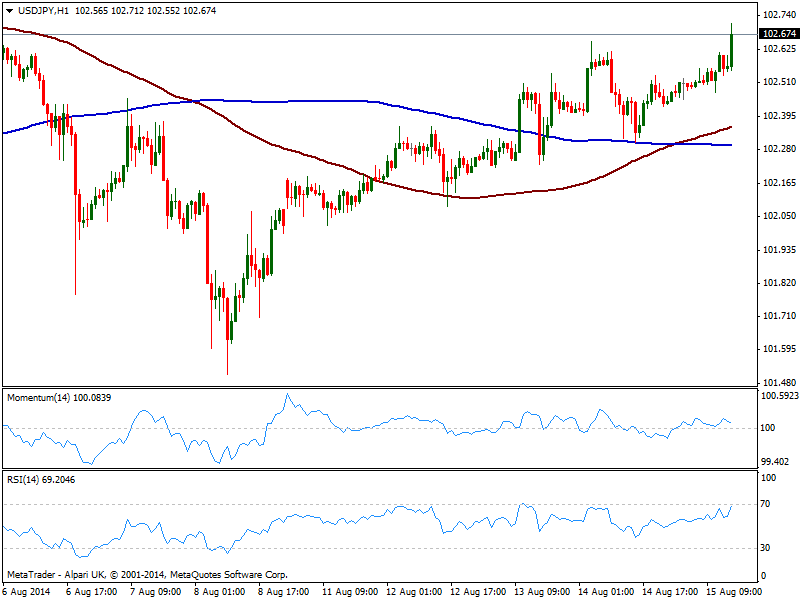

USD/JPY Current price: 102.66

View Live Chart for the USD/JPY

The USD/JPY extends its advance, approaching 102.80 static resistance area albeit still quite limited, considering the weekly range has barely reached 60 pips. Technically, the hourly chart shows price above moving averages, with 100 one above the 200, and indicators holding in positive territory. In the 4 hours chart the technical picture is also bullish, yet unless a clear acceleration above mentioned 102.80 the upside will remain limited.

Support levels: 102.30 101.95 101.60

Resistance levels: 102.80 103.10 103.45

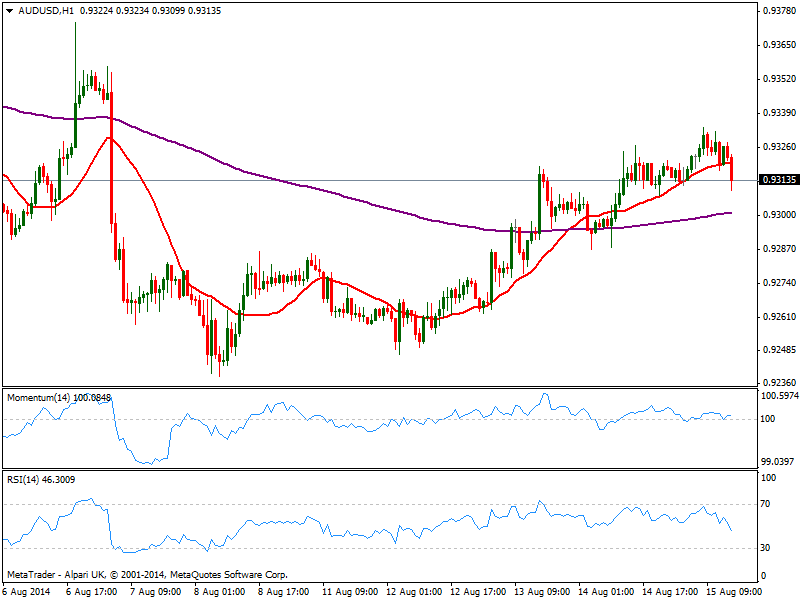

AUD/USD Current price: 0.9312

View Live Chart for the AUD/USD

The AUD/USD retraced from a daily high of 0.9333 weighted by a sudden slide in gold, down 15 bucks in an hour. Technically, the hourly chart shows price broke below its 20 SMA as indicators turned lower around their midlines, ready to trigger some bearish signals. In the 4 hours chart technical readings indicators turned lower in positive territory, while 20 SMA maintains a strong bullish slope below current price, currently in the 0.9300 price zone: a break below it should lead to further slides, eyeing then 0.9260 price zone.

Support levels: 0.9300 0.9260 0.9220

Resistance levels: 0.9330 0.9370 0.9410

Recommended Content

Editors’ Picks

GBP/USD rises above 1.3300 after UK Retail Sales data

GBP/USD trades with a positive bias for the third straight day on Friday and hovers above the 1.3300 mark in the European morning on Friday. The data from the UK showed that Retail Sales rose at a stronger pace than expected in August, supporting Pound Sterling.

USD/JPY keeps BoJ-led losses below 142.50, Ueda's presser eyed

USD/JPY remains in the red below 142.50 after the Bank of Japan announced on Friday that it maintained the short-term rate target in the range of 0.15%-0.25%, as widely expected. Governor Ueda's press conference is next in focus.

Gold consolidates weekly gains, with sight on $2,600 and beyond

Gold price is looking to build on the previous day’s rebound early Friday, consolidating weekly gains amid the overnight weakness in the US Dollar alongside the US Treasury bond yields. Traders now await the speeches from US Federal Reserve monetary policymakers for fresh hints on the central bank’s path forward on interest rates.

Shiba Inu is poised for a rally as price action and on-chain metrics signal bullish momentum

Shiba Inu remains strong on Friday after breaking above a symmetrical triangle pattern on Thursday. This breakout signals bullish momentum, further bolstered by a rise in daily new transactions that suggests a potential rally in the coming days.

Bank of Japan set to keep rates on hold after July’s hike shocked markets

The Bank of Japan is expected to keep its short-term interest rate target between 0.15% and 0.25% on Friday, following the conclusion of its two-day monetary policy review. The decision is set to be announced during the early Asian session.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.