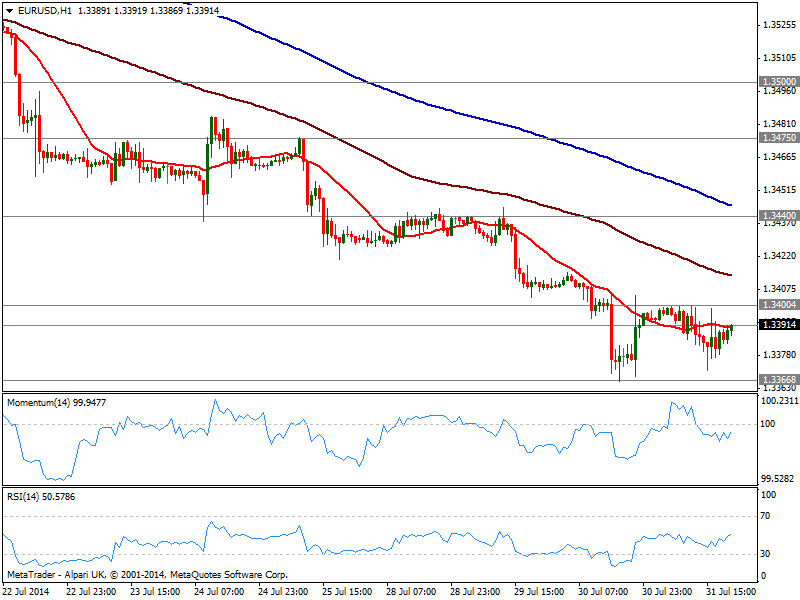

EUR/USD Current price: 1.3391

View Live Chart for the EUR/USD

Little may have happened in this consolidative Thursday, but at the end of the day, one thing stands out: Europe is at a brink of deflation with yearly basis inflation ticking down to 0.4% and the ECB at a cross road, condemning the EUR to fall if it acts increasing liquidity, or not acting at all next week. But that’s looking way too ahead, as Friday will bring US employment figure, that an make it or break if for current dollar strength: market is expecting something around 230K in average with the last months, and anything above that should put the dollar in the bullish track; below 200K on the other way, will delay trends’ decissions to ECB meeting next week.

Anyway and from a technical point of view, the EUR/USD spent the day consolidating its latest loses in between 1.3370 and 1.3400. Short term, the hourly chart shows price also below a flat 20 SMA and indicators directionless in negative territory, while the 4 hours chart maintains a bearish tone. Break below 1.3370 on strong US data, may see the pair extending its decline down to 1.3295, November 2013 monthly low.

Support levels: 1.3370 1.3335 1.3295

Resistance levels: 1.3405 1.3440 1.3475

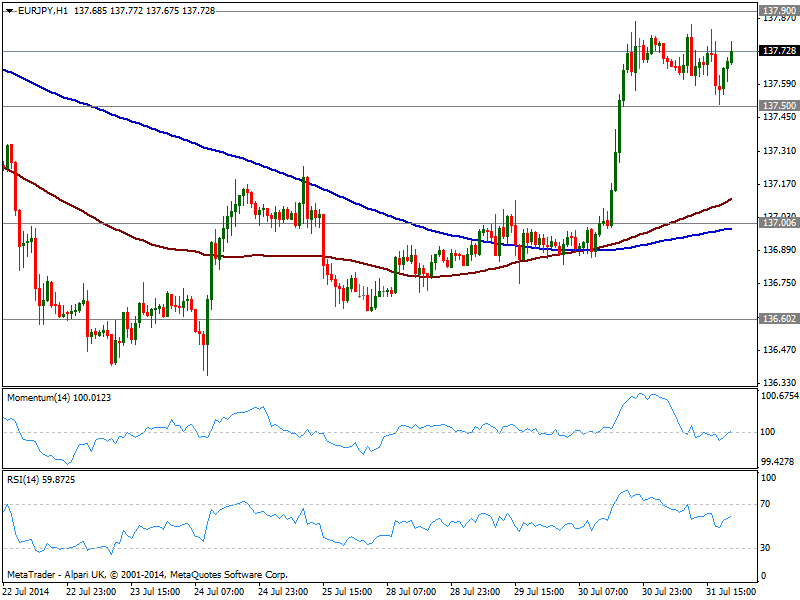

EUR/JPY Current price: 137.71

View Live Chart for the EUR/JPY

Yen halted its fall against its rivals, in fact resisting pretty well considering US indexes fell sharply on Thursday, erasing all of their monthly gains: weak earnings reports plus worries over Portuguese Espirito Santo bank and Argentinean default weighted in Wall Street. The EUR/JPY closed the day unchanged after finding short term buyers around 137.50, still the immediate support to watch. The short term picture is mild bullish, as price develops well above its 100 and 200 SMAs, with the shortest finally above the larger, albeit indicators hold in neutral territory. In the 4 hours chart however, indicators lost the upward potential and turn south, still above their midlines.

Support levels: 137.50 137.90 136.60

Resistance levels: 137.90 138.40 138.85

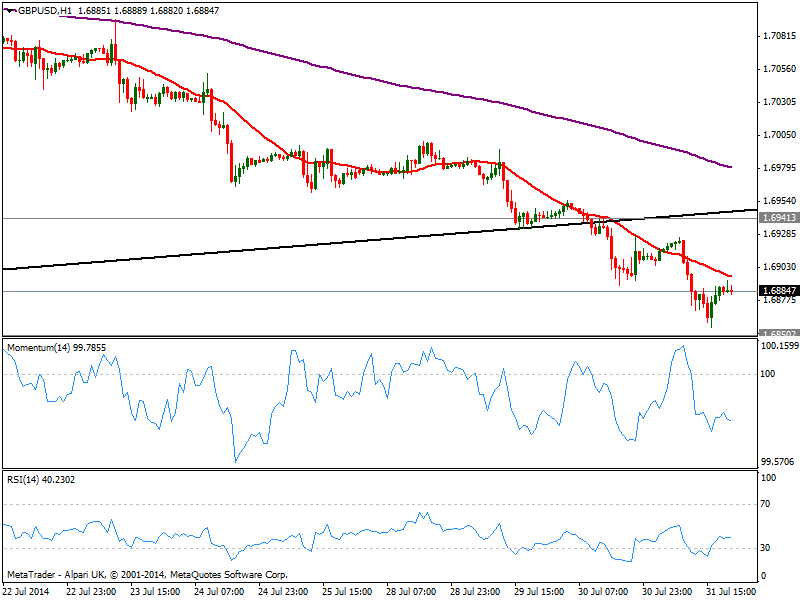

GBP/USD Current price: 1.6884

View Live Chart for the GBP/USD

The GBP/USD fell as low as 1.6856 before bouncing, still confined below the 1.6900 figure, and with the hourly chart showing the bearish tone remains intact: 20 SMA caps the upside a few pips above current price, while indicators head south in negative territory. In the 4 hours chart indicators attempt shy bounces from oversold territory, still quite weak and far from suggesting a recovery, while 20 SMA extended its decline and stands in the 1.6950 area acting as dynamic resistance.

Support levels: 1.6850 1.6815 1.6770

Resistance levels: 1.6880 1.6920 1.6950

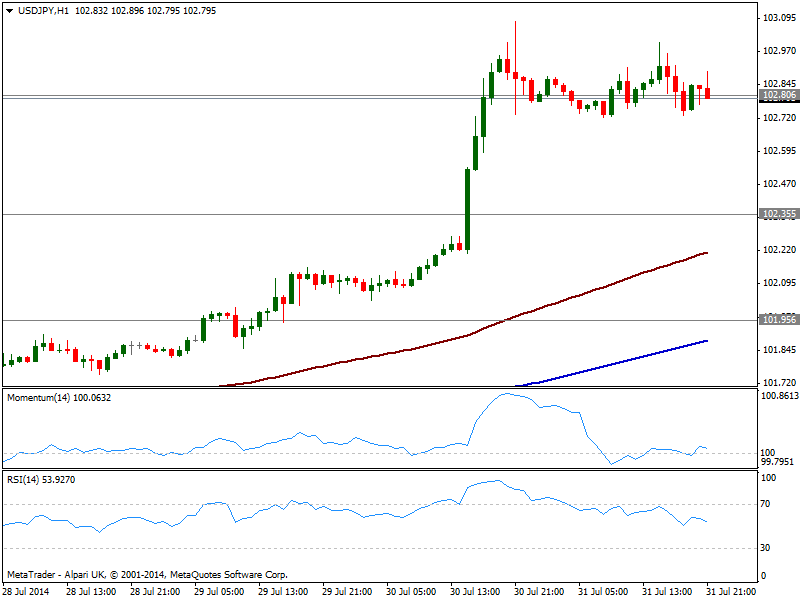

USD/JPY Current price: 102.79

View Live Chart for the USD/JPY

Having failed to extend beyond 103.00, the USD/JPY trades steadily around 102.80 area, coming under pressure not only because stocks in red, but also because US yields, giving up most of yesterday’s gains. The hourly chart however shows price holding in a tight range with moving averages still heading higher below current price, and indicators flat in neutral territory. In the 4 hours chart technical readings ease from overbought territory supporting some downward correction towards 102.35, albeit range will likely prevail ahead of US news, which at the end will be the ones deciding the pair’s destiny.

Support levels: 102.35 101.95 101.60

Resistance levels: 103.10 103.40 103.80

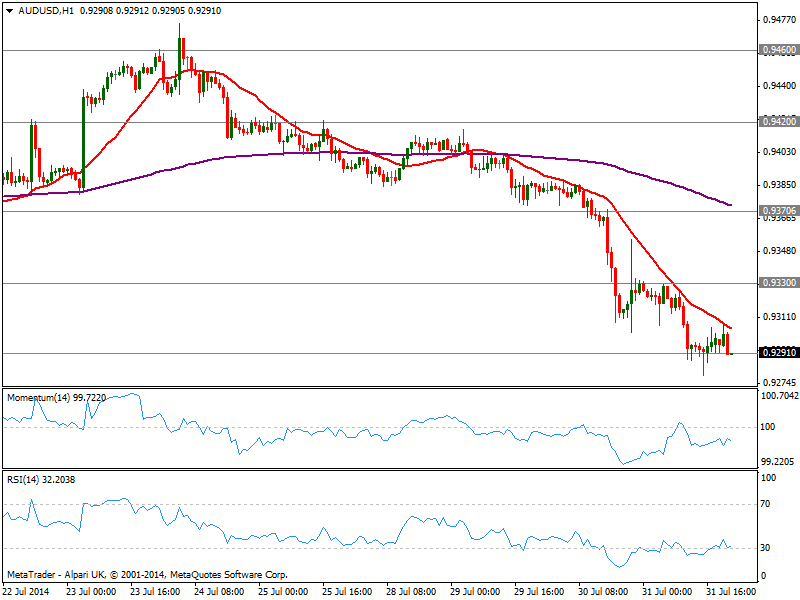

AUD/USD Current price: 0.9291

View Live Chart for the AUD/USD

Aussie got hit by local disappointing data, extending its decline to 0.9278 against the greenback, fresh 8-week low. The pair enters Asian session maintaining the short term bearish tone, having been unable to establish back above the 0.9300 level and with the hourly chart showing a clear bearish tone. In the 4 hours chart, indicators are losing their downward potential in oversold levels, but the overall picture is still weak: a break below 0.9260 strong static midterm support, can see the pair extending its decline below the 0.9200 figure before the week is over.

Support levels: 0.9260 0.9220 0.9175

Resistance levels: 0.9300 0.9330 0.9370

Recommended Content

Editors’ Picks

USD/JPY holds near 155.50 after Tokyo CPI inflation eases more than expected

USD/JPY is trading tightly just below the 156.00 handle, hugging multi-year highs as the Yen continues to deflate. The pair is trading into 30-plus year highs, and bullish momentum is targeting all-time record bids beyond 160.00, a price level the pair hasn’t reached since 1990.

AUD/USD stands firm above 0.6500 with markets bracing for Aussie PPI, US inflation

The Aussie Dollar begins Friday’s Asian session on the right foot against the Greenback after posting gains of 0.33% on Thursday. The AUD/USD advance was sponsored by a United States report showing the economy is growing below estimates while inflation picked up.

Gold soars as US economic woes and inflation fears grip investors

Gold prices advanced modestly during Thursday’s North American session, gaining more than 0.5% following the release of crucial economic data from the United States. GDP figures for the first quarter of 2024 missed estimates, increasing speculation that the US Fed could lower borrowing costs.

FBI cautions against non-KYC Bitcoin and crypto money transmitting services as SEC goes after MetaMask

US FBI has issued a caution to Bitcoiners and cryptocurrency market enthusiasts, coming on the same day as when the US Securities and Exchange Commission is on the receiving end of a lawsuit, with a new player adding to the list of parties calling for the regulator to restrain its hand.

Bank of Japan expected to keep interest rates on hold after landmark hike

The Bank of Japan is set to leave its short-term rate target unchanged in the range between 0% and 0.1% on Friday, following the conclusion of its two-day monetary policy review meeting for April. The BoJ will announce its decision on Friday at around 3:00 GMT.