EUR/USD Current price: 1.1028

View Live Chart for the EUR/USD

The dollar is gathering some limited intraday momentum against most of its rivals, in a pretty quiet European morning. To the lack of fundamental releases in the region, the upcoming FED decision is adding uncertainty on what's next for the American currency, or better said, "when" this next will come. The US Central Bank has largely anticipated it will begin rising rates as soon as this year, albeit from early speculations the tightening would began in April, there days doubts are whether it will start in September, which may then signal 2 rate hikes this year, or in December. Given that there will be no forecast, neither a press conference following the decision, investors will be watching the wording of the statement, with an overall sense that the tone will flip to hawkish. Ahead of the US opening, the EUR/USD pair is under selling pressure, with the hourly chart showing that the price pressures its 100 SMA and the technical indicators head lower well below their mid-lines. In the 4 hours chart, the price is breaking below its 20 SMA, whilst the technical indicators are positioned to cross their mid-lines towards the downside, anticipating additional declines on a break below 1.1020, the immediate short term support.

Support levels: 1.1020 1.0990 1.0950

Resistance levels: 1.1080 1.1125 1.1160

GBP/USD Current price: 1.5640

View Live Chart for the GPB/USD

The GBP/USD pair trades at fresh weekly highs having reached 1.5648 after the release of positive UK mortgage approvals data that rose above expected in June. The short term picture is bullish, with the price accelerating above a bullish 20 SMA, and the technical indicators losing partially its bullish strength near overbought levels. In the 4 hours chart the upside looks more constructive after the 20 SMA advanced above the 200 EMA below the current price albeit the technical indicators also lack upward momentum, despite being well into positive territory. The pair has been rejected from the 1.5670 region several times during this July, which means it needs to advance beyond it to confirm a more sustainable recovery during the upcoming sessions.

Support levels: 1.5590 1.5545 1.5500

Resistance levels: 1.5670 1.5730 1.5770

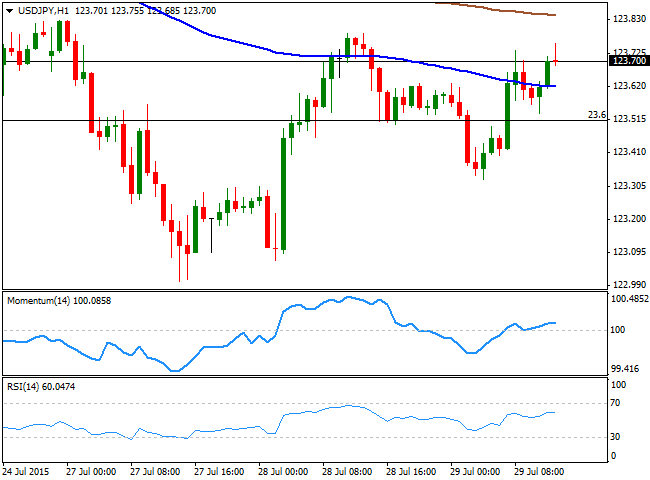

USD/JPY Current price: 123.69

View Live Chart for the USD/JPY

It´s all about the FED for the USD/JPY. The USD/JPY pair maintains its neutral stance ahead of the US opening, waiting for the FOMC. Before it, the US will release the Pending Home Sales for June, which may have a limited effect in the market. However, the housing sector has been among the worst performers this month, and another tepid reading may put the greenback under pressure. As for the USD/JPY, the pair continues trading in a well-defined range, with a mild positive short term tone as the 1 hour chart shows that the technical indicators hold above their mid-lines, whilst the price stands now above its 100 SMA. In the 4 hours chart, the price held above its moving averages on an early dip, whilst the technical indicators head north in positive territory. Nevertheless, it's about the FED today, with scope to advance up to 124.45 should the US Central Bank delivers a hawkish statement.

Support levels: 123.30 122.90 122.40

Resistance levels: 124.20 124.45 124.90

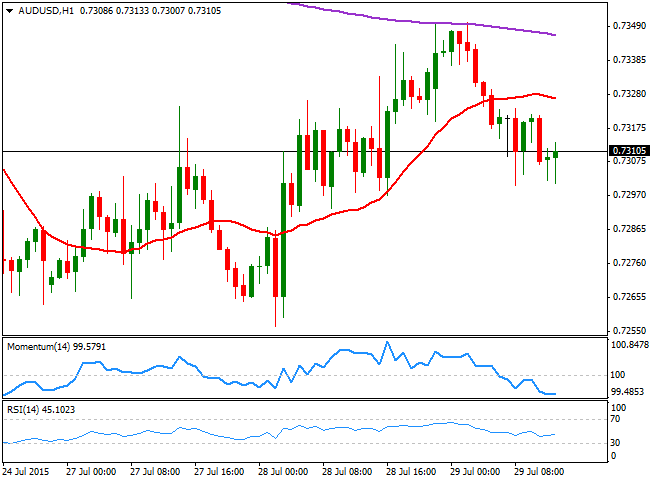

AUD/USD Current price: 0.7311

View Live Chart for the AUD/USD

The Australian dollar faded its latest gains, but trades a handful of pips above the 0.7300 level against the greenback, maintaining a bearish short term tone. There was no data released during the Asian session, and the pair failed to advance despite Chinese stocks recovered over 3.0%, bringing some relied to the region. The pair is technically bearish, with the 1 hour chart showing that the price develops below its 20 SMA whilst the technical indicators stand below their mid-lines, lacking directional strength at the time being. In the 4 hours chart, however, the downside seems limited at the time being, with the price finding intraday support in a horizontal 20 SMA, and the technical indicators bouncing from their mid-lines.

Support levels: 0.7300 0.7260 0.7225

Resistance levels: 0.7350 0.7390 0.7440

Recommended Content

Editors’ Picks

USD/JPY holds near 155.50 after Tokyo CPI inflation eases more than expected

USD/JPY is trading tightly just below the 156.00 handle, hugging multi-year highs as the Yen continues to deflate. The pair is trading into 30-plus year highs, and bullish momentum is targeting all-time record bids beyond 160.00, a price level the pair hasn’t reached since 1990.

AUD/USD stands firm above 0.6500 with markets bracing for Aussie PPI, US inflation

The Aussie Dollar begins Friday’s Asian session on the right foot against the Greenback after posting gains of 0.33% on Thursday. The AUD/USD advance was sponsored by a United States report showing the economy is growing below estimates while inflation picked up.

Gold soars as US economic woes and inflation fears grip investors

Gold prices advanced modestly during Thursday’s North American session, gaining more than 0.5% following the release of crucial economic data from the United States. GDP figures for the first quarter of 2024 missed estimates, increasing speculation that the US Fed could lower borrowing costs.

Ethereum could remain inside key range as Consensys sues SEC over ETH security status

Ethereum appears to have returned to its consolidating move on Thursday, canceling rally expectations. This comes after Consensys filed a lawsuit against the US SEC and insider sources informing Reuters of the unlikelihood of a spot ETH ETF approval in May.

Bank of Japan expected to keep interest rates on hold after landmark hike

The Bank of Japan is set to leave its short-term rate target unchanged in the range between 0% and 0.1% on Friday, following the conclusion of its two-day monetary policy review meeting for April. The BoJ will announce its decision on Friday at around 3:00 GMT.