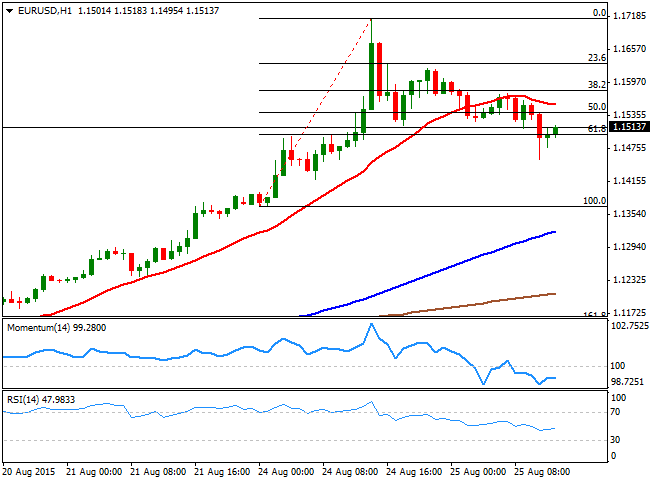

EUR/USD Current price: 1.1512

View Live Chart for the EUR/USD

China's stocks market collapse extended this Tuesday, with the Shanghai Composite closing the day down 7.63%. But the rest of the Asian markets recovered some of their recent losses, whilst European markets also opened with a positive tone that extended after the PBoC announced a 25 bp cut in key rates and a 50 bp cut in reserve requirements, in another desperate move to contain stocks' bleeding and guarantee liquidity. The dollar got benefited with the announcement, extending its recovery across the board. Earlier today, Germany released the final review of the Q2 GDP, in line with market's expectations. Also, the country offered its IFO survey data, showing that local sentiment continues to improve.

The EUR/USD pair fell down to 1.1455 after the latest PBoC rate cut, but bounced back above the 1.1500 level, where it stands ahead of the US opening. The level is the 61.8% retracement of yesterday's advance, which means that if it holds, may see the pair resuming its advance towards fresh lows, being this latest decline merely corrective. Technically, the 1 hour chat shows that the price is below its 20 SMA, whist the Momentum indicator heads lower below the 100 level, although the RSI indicator aims higher, around 48. In the 4 hours chart, the technical indicators have corrected extreme overbought readings and now attempt to recover, not yet confirming additional gains. The price needs now to advance beyond 1.1540, the 50% retracement of the same rally, to confirm additional gains this Tuesday.

Support levels: 1.1500 1.1455 1.1420

Resistance levels: 1.1540 1.1580 1.1630

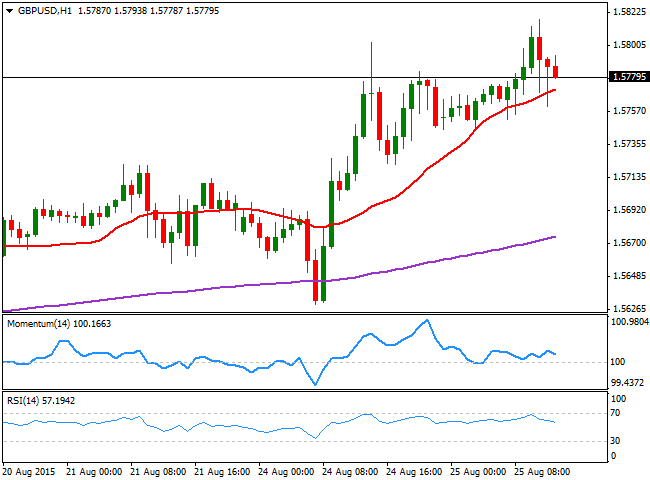

GBP/USD Current price: 1.5778

View Live Chart for the GPB/USD

The GBP/USD pair retreats from a fresh 2-month high set at 1.5817, with dollar buyers surging slowly after China's Central Bank move, and helped by a recovery in local share markets. There were no fundamental releases in the UK, but later today, the US will release housing and employment figures, which may determinate whether the greenback can extend its intraday advance. The short term picture suggests the downside is limited, as in the 1 hour chart, the price is above a bullish 20 SMA that attracted buyers on intraday dips, whilst the technical indicators have turned lower, but remain well above their mid-lines. In the 4 hours chart, the 20 SMA heads sharply higher around 1.5710, whilst the Momentum indicator aims higher well into positive territory and the RSI indicator hovers around 62, lacking upward strength, in line with the shorter term view.

Support levels: 1.5770 1.5735 1.5680

Resistance levels: 1.5815 1.5840 1.5885

USD/JPY Current price: 119.84

View Live Chart for the USD/JPY

Bears still in control, 121.00 a line in the sand. The USD/JPY pair advanced up to 120.34 this Tuesday, with the Japanese yen weakening on Nikkei's recovery and Japan's PM Abe advisor, Hamada said that the country may need to ease further if Q3 GDP fails to grow. The pair however, retreated from its high and remains below the 120.00 figure, with the 1 hour chart showing that the price remains well below the 100 and 200 SMAs that maintain strong bearish slopes, whilst the technical indicators are losing their upward strength near overbought levels. In the 4 hours chart the technical indicators have corrected the extreme oversold readings reached yesterday, but are losing their upward strength well below their mid-lines, limiting chances of a stronger recovery, and maintaining the risk towards the downside. The pair needs to recover above the mentioned daily high to be able to extend its recovery up to 121.00, the 200 DMA, and a line in the sand for the latest bearish trend. Below 119.20 on the other hand, the pair will likely resume its decline, with 118.80 as the immediate support.

Support levels: 119.60 119.20 118.80

Resistance levels: 120.35 120.65 121.00

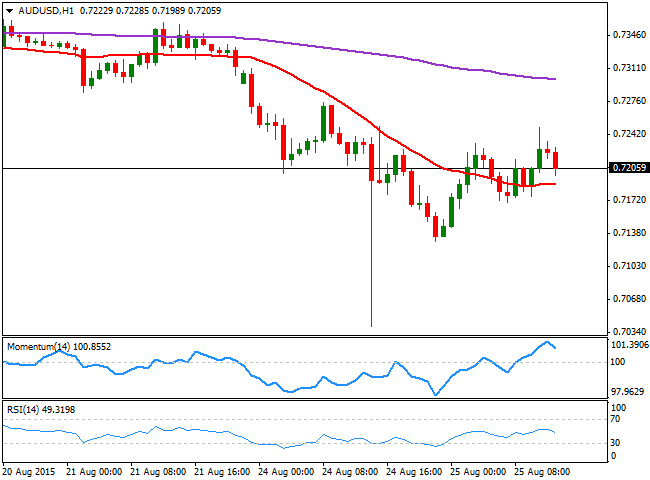

AUD/USD Current price: 0.7205

View Live Chart for the AUD/USD

The AUD/USD pair trades steady around the 0.7200 figure, having recovered ground amid the latest PBoC decision to cut rates. The 1 hour chart shows that the price is holding above a flat 20 SMA, whilst the Momentum indicator retraces alongside with price from a high set at 0.7249, and the RSI turns lower around 50, suggesting the upside remains limited. In the 4 hours chart, the price has stalled well below a strongly bearish 20 SMA, whilst the technical indicators have turned sharply lower after correcting oversold readings, pointing for another leg lower over the upcoming session, particularly if the pair losses again the 0.7200 level.

Support levels: 0.7200 0.7165 0.7120

Resistance levels: 0.7260 0.7300 0.7345

Recommended Content

Editors’ Picks

USD/JPY holds above 155.50 ahead of BoJ policy announcement

USD/JPY is trading tightly above 155.50, off multi-year highs ahead of the BoJ policy announcement. The Yen draws support from higher Japanese bond yields even as the Tokyo CPI inflation cooled more than expected.

AUD/USD extends gains toward 0.6550 after Australian PPI data

AUD/USD is extending gains toward 0.6550 in Asian trading on Friday. The pair capitalizes on an annual increase in Australian PPI data. Meanwhile, a softer US Dollar and improving market mood also underpin the Aussie ahead of the US PCE inflation data.

Gold price keeps its range around $2,330, awaits US PCE data

Gold price is consolidating Thursday's rebound early Friday. Gold price jumped after US GDP figures for the first quarter of 2024 missed estimates, increasing speculation that the Fed could lower borrowing costs. Focus shifts to US PCE inflation on Friday.

Stripe looks to bring back crypto payments as stablecoin market cap hits all-time high

Stripe announced on Thursday that it would add support for USDC stablecoin, as the stablecoin market exploded in March, according to reports by Cryptocompare.

Bank of Japan expected to keep interest rates on hold after landmark hike

The Bank of Japan is set to leave its short-term rate target unchanged in the range between 0% and 0.1% on Friday, following the conclusion of its two-day monetary policy review meeting for April. The BoJ will announce its decision on Friday at around 3:00 GMT.