EUR/USD Current price: 1.1162

View Live Chart for the EUR/USD

The dollar found some limited demand in quite thin trading, higher against most of its rivals in the European morning with London off on holidays. Earlier in the day, European PMIs come out mixed, with German and EU ones beating expectations, but showing an increased slowdown in France, Spain and Greece. Ahead of the US opening, the EUR/USD trades near a daily low set at 1.1122, and the 1 hour chart shows that the price stands below its 20 SMA but bouncing from a bullish 100 SMA, the immediate support around 1.1120. In the same chart, the technical indicators are aiming north well below their mid-lines, and far from suggesting additional gains at the time being. In the 4 hours chart, the pair broke below its 20 SMA, currently around 1.1200, whilst the Momentum indicator heads lower below 100 and the RSI turns flat around 54. The immediate support stands at 1.1120, and the downward risk will remain limited as long as above it, albeit a recovery above 1.1200 is required to see bulls retaking the lead.

Support levels: 1.1120 1.1085 1.1050

Resistance levels: 1.1160 1.1200 1.1245

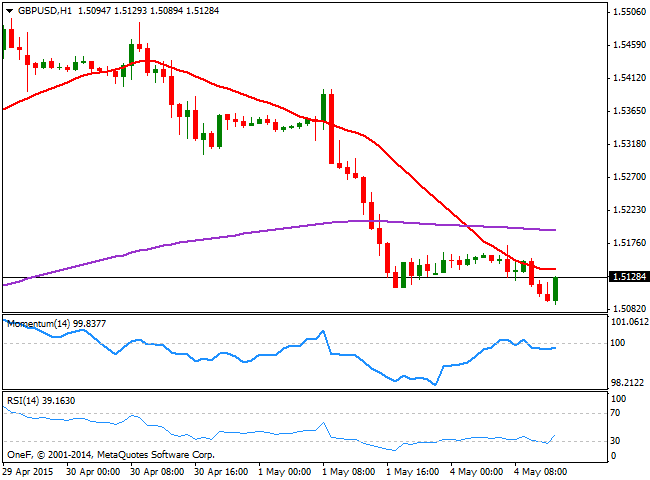

GBP/USD Current price: 1.5128

View Live Chart for the GBP/USD

The GBP/USD pair bounces from 1.5093, its daily low accumulating around 500 pips of steady decline ever since flirting with the 1.5500 level last Thursday. The technical picture continues to favor the downside, despite in the 1 hour chart, the RSI aims higher from oversold territory, as the price stands below its 20 SMA whilst the Momentum indicator heads lower 100. In the 4 hours chart the 20 SMA turned sharply lower well above the current level, whilst the technical indicators are fading its latest upward corrective movement near oversold territory.

Support levels: 1.5060 1.5020 14980

Resistance levels: 1.5130 1.5170 1.5210

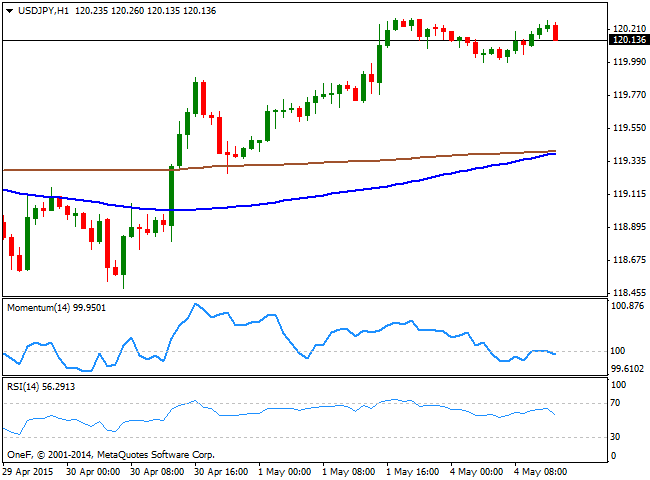

USD/JPY Current price: 120.13

View Live Chart for the USD/JPY

The USD/JPY pair retraces from the highs in the 120.30 price zone, consolidating its recent gains. Having set a daily low at 119.99, the 1 hour chart shows that the technical indicators are turning lower around their mid-lines, whilst the price stands well above its 100 and 200 SMAs, both converging in the 119.40 region. In the 4 hours chart the technical indicators are retracing from overbought territory, but far from suggesting a bearish move, whilst the price holds well above its moving averages, which lack clear directional strength at the time being. The pair needs to break above 120.45 to gain upward momentum, whilst a break below 120.00 should favor additional declines towards the 119.40/60 price zone.

Support levels: 120.00 119.65 119.30

Resistance levels: 120.45 120.85 122.10

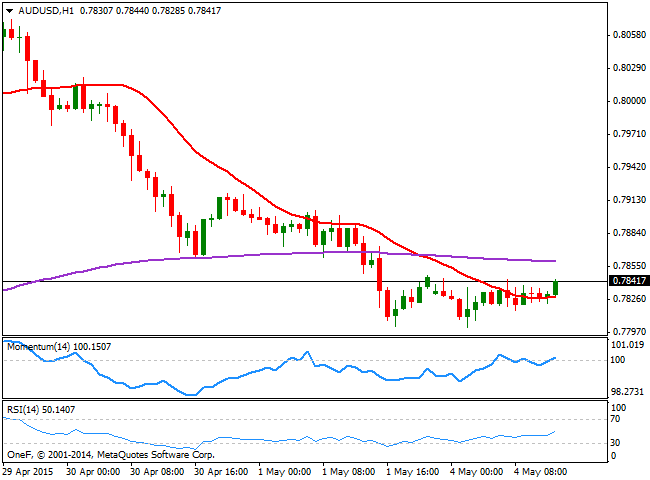

AUD/USD Current price: 0.7804

View Live Chart for the AUD/USD

The AUD/USD pair trades lower in range, consolidating around the 0.7800 figure. The RBA will have its monthly economic policy meeting, and market expects a rate cut coming from Governor Stevens. Technically, the 1 hour chart shows that the technical indicators are aiming higher around their mid-lines, whilst the price stands a few pips above a flat 20 SMA. In the 4 hours chart a mild positive tone comes from the technical indicators that aim higher below their mid-lines, albeit the price stands well below a bearish 20 SMA, currently around the 0.7900 figure.

Support levels: 0.7800 0.7770 70.7730

Resistance levels: 0.7860 0.7900 0.7940

Recommended Content

Editors’ Picks

EUR/USD falls back toward 1.1150 as US Dollar rebounds

EUR/USD is falling back toward 1.1150 in European trading on Friday, reversing early gains. Risk sentiment sours and lifts the haven demand for the US Dollar, fuelling a pullback in the pair. The focus now remains on the Fedspeak for fresh directives.

GBP/USD struggles near 1.3300 amid renewed US Dollar demand

GBP/USD is paring back gains to trade near 1.3300 in the European session. The data from the UK showed that Retail Sales rose at a stronger pace than expected in August, briefly supporting Pound Sterling but the US Dollar comeback checks the pair's upside. Fedspeak eyed.

Gold hits new highs on expectations of global cuts to interest rates

Gold (XAU/USD) breaks to a new record high near $2,610 on Friday on heightened expectations that global central banks will follow the Federal Reserve (Fed) in easing policy and slashing interest rates.

Pepe price forecast: Eyes for 30% rally

Pepe’s price broke and closed above the descending trendline on Thursday, eyeing for a rally. On-chain data hints at a bullish move as PEPE’s dormant wallets are active, and the long-to-short ratio is above one.

Bank of Japan set to keep rates on hold after July’s hike shocked markets

The Bank of Japan is expected to keep its short-term interest rate target between 0.15% and 0.25% on Friday, following the conclusion of its two-day monetary policy review. The decision is set to be announced during the early Asian session.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.