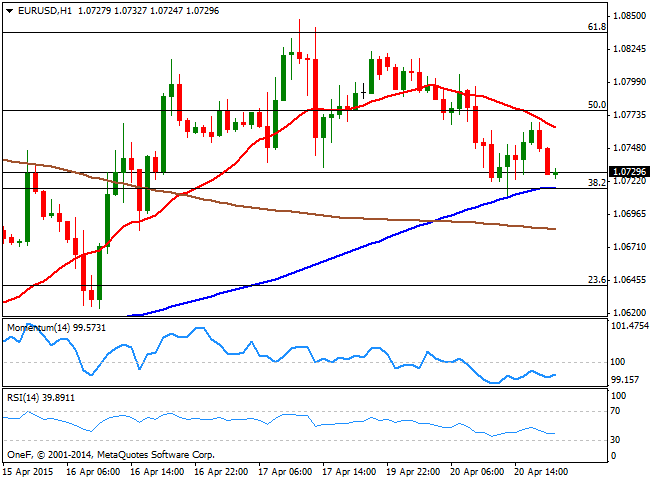

EUR/USD Current price: 1.0729

View Live Chart for the EUR/USD

The EUR/USD pair fell down to 1.0711 this Monday, as the American dollar got boosted by bad news among others major economies. Early in Europe, data coming from the region resulted disappointing, as German PPI fell into negative territory yearly basis in March, down 1.7% compared to a year before. The Euro zone construction output also fell beyond expected, down 1.8% in February, and 3.7% compared to a year earlier. There was no fundamental data in the US, but ECB's Vice President Constancio said in the American afternoon that Greece might not have to leave the euro area even if it defaults on its debt, unless the decision comes from the Greek government itself. Indeed, the Greek woes are the major weigh on the EUR these days, as the rest of the common area members are still demanding a clear list of reforms before releasing more bailout.

Technically, the EUR/USD 1 hour chart shows that the price hovers near the daily low, with the price developing below a bearish 20 SMA and the technical indicators showing no directional strength below their mid-lines. In the same chart, the 100 SMA stands along with the 38.2% retracement of the latest bearish run between 1.1034 and 1.0519 around the mentioned daily low of 1.0710, suggesting that if the level gives up, the risk towards the downside will increase. In the 4 hours chart the price stands below a bullish 20 SMA, whilst the technical indicators maintain a bearish slope above their mid-lines, supporting the shorter term view of further declines needed to confirm a bearish continuation.

Support levels: 1.0710 1.0680 1.0650

Resistance levels: 1.0745 1.0775 1.0820

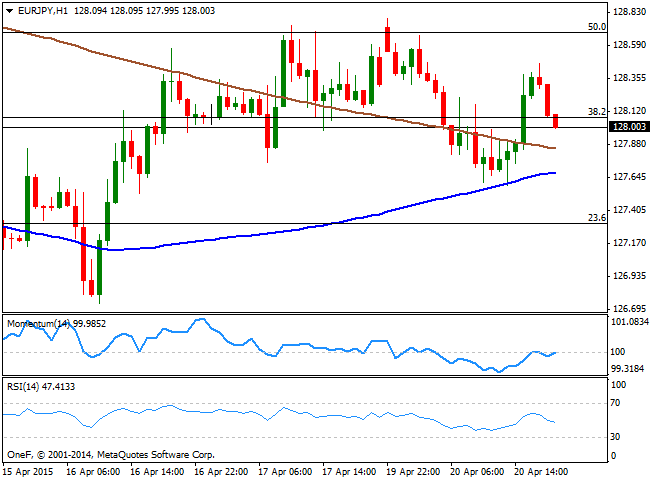

EUR/JPY Current price: 128.00

View Live Chart for the EUR/JPY

The EUR/JPY cross edged lower amid EUR weakness, having set a daily low at 127.58 during the past Asian session. The Japanese yen lost ground as European and American equities posted strong intraday gains, albeit the pair is struggling to hold above the 128.00 level. Technically, the 1 hour chart shows that the Momentum indicator stands flat around the 100 level, while the RSI indicator heads lower around 47. In the same chart, the 200 SMA heads lower around 127.80 whilst the 100 SMA stands at 127.70 offering immediate intraday support as the pair already bounced from this last earlier in the day. In the 4 hours chart the price remained below its moving averages that maintain strong bearish slopes, whilst the technical indicators head lower towards their mid-lines, suggesting some additional declines on a break below the mentioned 127.70 level.

Support levels: 127.70 127.30 126.90

Resistance levels: 128.40 128.80 129.20

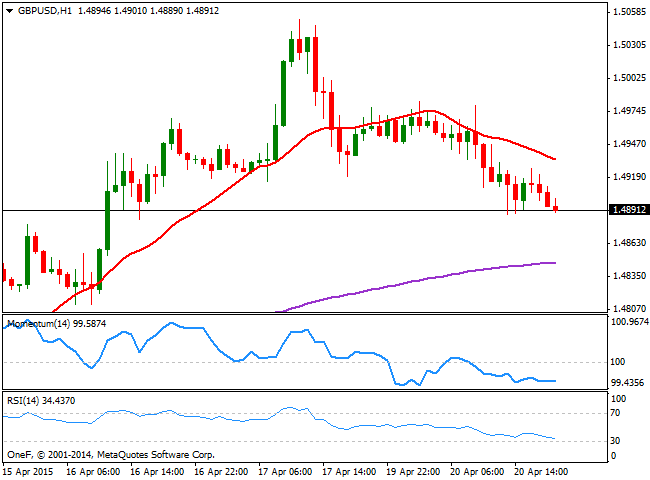

GBP/USD Current price: 1.4891

View Live Chart for the GBP/USD

The British Pound extended its decline sub 1.4900 against its American rival, after failing to sustain gains beyond the 1.5000 figure last Friday. The pair reached a daily low of 1.4887 on the back of dollar's recovery early during the US session, boosted by tepid European data and growing fears of a Grexit. The UK calendar will remain quiet also on Tuesday, with investors therefore focused in the upcoming May elections when trading the pair. On Wednesday, the BOE will release the Minutes of its latest meeting, but it won't be until Thursday, with the release of Retail Sales and Public Sector Borrowing data that there will macro news to guide the Pound. In the meantime, the pair maintains a short term bearish tone, as the 1 hour chart shows that the price develops below a bearish 20 SMA, whilst the technical indicators head lower below their mid-lines. In the 4 hours chart the price broke below its 20 SMA and the 200 EMA, both converging in the 1.4910 region acting now as the immediate intraday resistance, while the technical indicators head lower around their mid-lines, supporting the shorter term view.

Support levels: 1.4870 1.4830 1.4790

Resistance levels: 1.4910 1.4950 1.5000

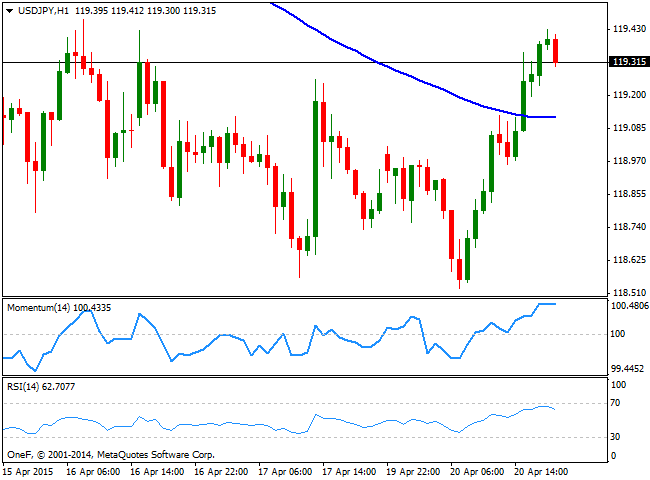

USD/JPY Current price: 119.31

View Live Chart for the USD/JPY

The USD/JPY surged to a daily high of 119.43 during the US session, having posted a fresh 1-month earlier in the day at 118.52. The pair found support in rising US yields as 10Y one surged sharply to 1.90% by the end of the day. Japan will release some confidence data during the upcoming Asian session, albeit the pair will rather continue to trade accordingly to market sentiment than to local data. Short term, the 1 hour chart shows that the pair advanced above its 100 SMA, currently around 119.10, whilst the Momentum indicator heads strongly higher in overbought territory. In the same chart however, the RSI retreats from overbought territory, now heading lower around 60. In the 4 hours chart, the price remains well below its moving averages, whilst the technical indicators present a mild positive tone above their mid-lines. Nevertheless some steady gains beyond the 119.40 region are required to confirm further advances, with a break below 118.90, on the other hand, probably signaling a retest of the mentioned daily low.

Support levels: 118.90 118.50 118.15

Resistance levels: 119.40 119.80 120.10

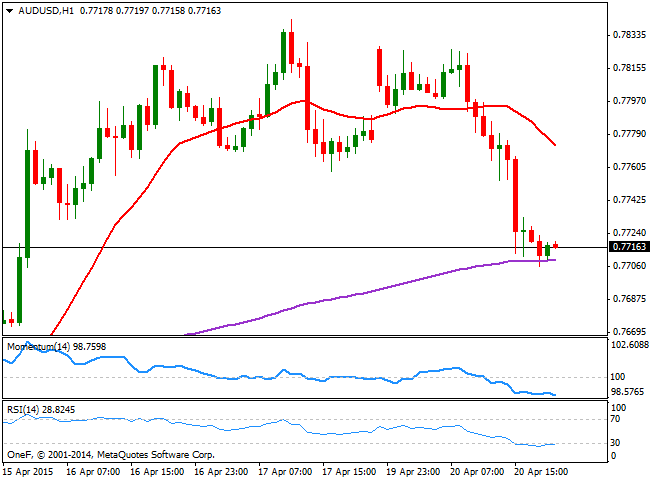

AUD/USD Current price: 0.7715

View Live Chart for the AUD/USD

The Aussie got hit by RBA Governor Glenn Stevens during the American afternoon, as the head of the Central Bank said that rates could be cut again. Speaking at the American Australian Association luncheon hosted by Goldman Sachs, in New York Stevens said rates can be cut again if needed, but is concerned about the impact it may have on house prices, as, despite home building is rising as intended, prices are up at a time when Australians are already highly leveraged. Investors focused on the headline, driving the AUD/USD pair sharply lower to a fresh 3-day low of 0.7706. The short term technical picture maintains a bearish stance, as in the 1 hour chart, the price stands well below its 20 SMA whilst the technical indicators continue to head lower, despite in oversold territory. In the 4 hours chart the price struggles around its 200 EMA, usually a strong dynamic support/resistance level, while the Momentum indicator heads sharply lower below the 100 level and the RSI stands directionless around 46. The downside is favored albeit some follow through below the 0.7685 static support is required to confirm such bearish extension over the upcoming sessions.

Support levels: 0.7685 0.7640 0.7600

Resistance levels: 0.7730 0.7780 0.7810

Recommended Content

Editors’ Picks

USD/JPY holds above 155.50 ahead of BoJ policy announcement

USD/JPY is trading tightly above 155.50, off multi-year highs ahead of the BoJ policy announcement. The Yen draws support from higher Japanese bond yields even as the Tokyo CPI inflation cooled more than expected.

AUD/USD extends gains toward 0.6550 after Australian PPI data

AUD/USD is extending gains toward 0.6550 in Asian trading on Friday. The pair capitalizes on an annual increase in Australian PPI data. Meanwhile, a softer US Dollar and improving market mood also underpin the Aussie ahead of the US PCE inflation data.

Gold price keeps its range around $2,330, awaits US PCE data

Gold price is consolidating Thursday's rebound early Friday. Gold price jumped after US GDP figures for the first quarter of 2024 missed estimates, increasing speculation that the Fed could lower borrowing costs. Focus shifts to US PCE inflation on Friday.

Stripe looks to bring back crypto payments as stablecoin market cap hits all-time high

Stripe announced on Thursday that it would add support for USDC stablecoin, as the stablecoin market exploded in March, according to reports by Cryptocompare.

Bank of Japan expected to keep interest rates on hold after landmark hike

The Bank of Japan is set to leave its short-term rate target unchanged in the range between 0% and 0.1% on Friday, following the conclusion of its two-day monetary policy review meeting for April. The BoJ will announce its decision on Friday at around 3:00 GMT.